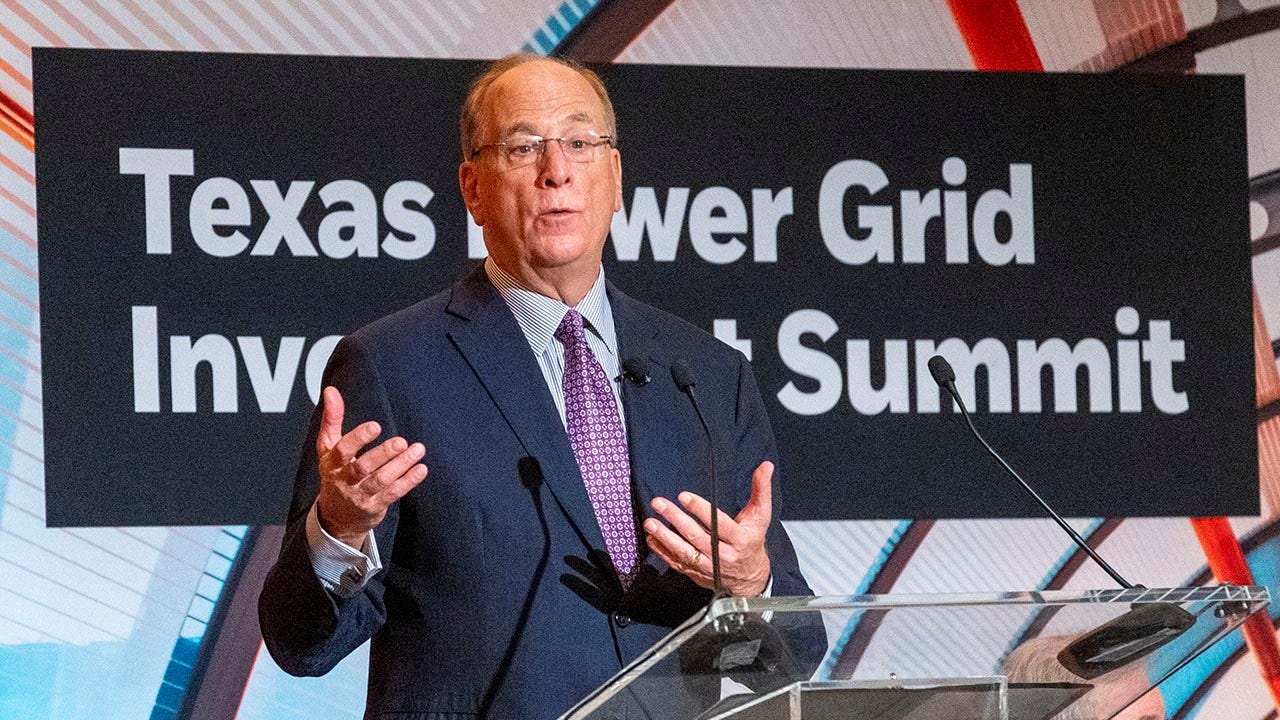

BlackRock CEO Larry Fink said that the U.S. remains the primary destination for investors to put their assets and will continue to be for at least the next year and a half amid economic trends.

Fink was part of a panel moderated by Bloomberg Television at the Future Investment Initiative in Saudi Arabia and noted that earlier this year there was “modest transformation and movement out of the dollar” as investors moved assets to Europe and other regions.

However, he noted that movement came from a “huge overweight in dollar-based assets” and that the trend appears to be reversing with investors moving back into U.S. assets.

“I would say in the last two months we’re seeing that money coming back into the U.S., so I don’t see there’s that much movement. There’s still a deep belief in the opportunity in the U.S.,” Fink said, noting the surge in investment related to AI and other capital projects.

BLACKROCK’S BRAGGING RIGHTS TO FASTEST-GROWING ETFS

“Over 40% of the economic growth in the second quarter was capex for technology, and you don’t see that in other places in the world,” the BlackRock chief said.

“And it’s that capex, whether it’s data centers or finding more power, gas, building gas turbines – you’re seeing all that happening more in the U.S. than in most places in the world today.”

“You’re not seeing that as much in Europe, and this is one of the big reasons for the huge gap between U.S. GDP and European GDP,” he added.

BLACKROCK CEO LARRY FINK’S ANNUAL LETTER TO INVESTORS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,098.05 | +0.05 | +0.00% |

Fink said that while money will continue to move around to different countries and regions of the world, he thinks most global investors will continue to focus on being overweight on their U.S. investments for the next year and a half.

“Money’s going to move around all the time, but I would say most global investors have a very large overweight in the U.S. and I think that’s going to be the best place to have your overweighting for at least the next 18 months,” Fink added.

U.S. markets tumbled earlier this year amid concerns over the impact of the Trump administration’s tariffs on the economy, as well as longstanding fiscal issues.

TRUMP AND XI STRIKE TRADE TRUCE: 5 KEY TAKEAWAYS FROM THE SOUTH KOREA SUMMIT

President Donald Trump’s announcement of his “reciprocal” tariff policy in early April prompted a significant sell-off in the stock market – though the administration later delayed and pared back some of those tariff policies, which reduced investors’ concerns.

Longstanding concerns over the long-term fiscal health of the U.S. have also continued to accumulate as the deficit has surpassed the $37 trillion and $38 trillion thresholds over the course of 2025.

Concerns about the inability of lawmakers to curtail persistent and growing budget deficits prompted Moody’s to become the third major ratings agency to downgrade the U.S. credit rating from its top tier.

Despite those headwinds, the economy has shown resilience and the surge of investment in AI has propelled markets to record highs in recent months, with the S&P 500 index up over 16% year to date.