Dear investors,

I am writing to give you our quarterly update on the War Cap fund.

Please read the disclaimer HERE – nothing here is investment advice.

First performance – the quarter was up healthily at 4.57% over Q2, and YTD performance is now positive at 2.32%, vs 13.96% for the S&P and 4.77% for the REIT index. Since inception we are at 196.66%, still outperforming the S&P and the REIT benchmark of 148.58% & 64.26%, respectively.

It is worth noting that as the year has progressed the REIT index has become a worse benchmark for us as the portfolio has diversified, but I will keep it here for continuity and as for the historical returns it remains a good benchmark.

The reason we are only up a little despite a big win in Plymouth Industrial (PLYM) & a bull market is that I have moved the portfolio to a very defensive positioning, with a large cash balance and significant short positions. The shorts obviously have not taken off yet as the markets continue to notch all time highs.

And the reason I am so defensive is that I believe we have entered a full blown mania stage of the cycle. The evidence for this is everywhere you want to look.

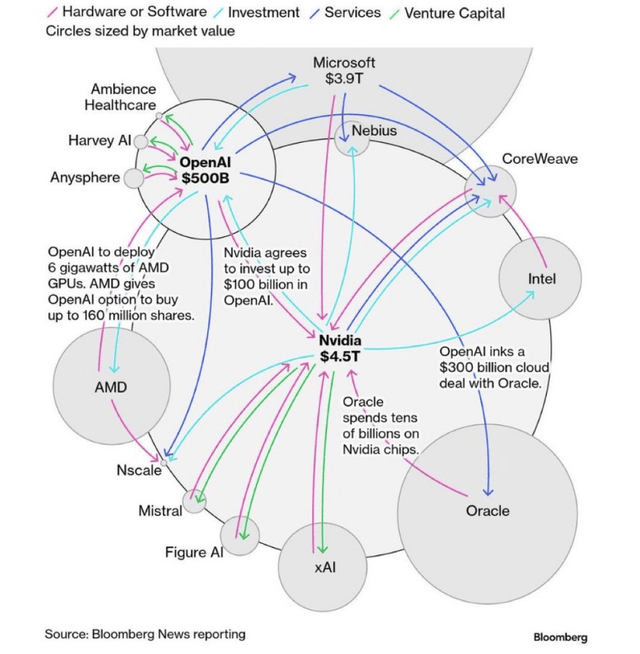

First and at the heart of things is the AI bubble, led by Nvidia (NVDA), Open AI and a web of circular deals announced in the last few months. OAI has committed to spending over 1 trillion dollars over the next several years in various chip and data center deals – an absolutely astronomical sum, especially when you consider that OAI’s revenue is on pace for something like $13 billion if company projections are correct (indeed the commitment is now probably over $1.5 trillion after this mornings Broadcom (AVGO) announcement). This ratio would be wild enough if it were not for the fact that Open AI is losing money hand over first right now – in H1 2025 they apparently made $4.3 billion and had losses of $7.8 billion!1

The only way OAI can come close to meeting these spending announcements is to raise massive amounts of money. Indeed OpenAI itself projects it will need well over $100 billion in cash through 2030 before it begins to make money – just wild, wild projections. $100+ billion even combined with revenues paying for some capex doesn’t get anywhere close to $1 trillion, so OAI’s projections would also require significant investment by other parties.

And yet, the private market may be beginning to get some heartburn over OAI’s funding needs combined with their cash burn, as recently we saw that OAI has turned to its largest supplier, Nvidia, for financing.

Nvidia announced it would invest $100 billion in OAI to fund data center build outs – funds which would primarily be spent on Nvidia chips. We haven’t seen this kind of vendor financing since the dot com boom, and it is a very bad sign in my opinion. And its not just Nvidia and OpenAI, these circular relationships are rife in the AI space.

Simple and clean, right?

Or, in layman’s terms, something like this

Frankly the audacity of this deal surprised me, and it may delay the inevitable reckoning a while longer if Nvidia is willing to wholesale fund the AI capex bubble. Nvidia is seemingly much less concerned about returns than most private investors are, since it will receive most of its investment right back in the form of chip purchases, and thus they may extend the cycle by making investments where other capital otherwise would not.

On Capital Expenditures and Necessary Revenues

I wrote a bit about the needed revenues to make all of this capex work a bit back in February, but it is worth revisiting a bit now over half a year later. AI Capex spending appears to be up to a ~$400B annual run rate. I estimated it was more like 200-250b earlier in the year, and it was already quite substantial in 2024 & even 2023, and will be if anything higher in 2026 if the major players are to be believed (although I personally think it begins to fall off in 26). But if you assume they are right and so we say ‘just’ another ~$400 billion in 2026, we have roughly over $1 trillion in AI capex investment through year end 2026. At a 50% margin2, that needs $2 trillion in cumulative revenues to break even3. This figure of course ratchets up every single year as more capex is spent. But even ignoring that huge issue, simply paying for the current batch of capex will be an absolutely massive mountain to climb, just to break even!

Given the relatively short lifespan of GPUs (although admittedly other parts of the data centers have a longer lifespan, but GPUs appear to be the majority of spend) lets say we have through ~2030 to make this $2 trillion. So 5 years, or $400 billion a year. For comparison the entire US software market is something like $360 billion / year. So the world needs to add another America of software spending, and it needs to do it in the next 12 months. Obviously that isn’t going to happen – perhaps eventually one day it will but the problem is we may have a whole generation (or two !) of GPUs that are a capital loss in the interim.

The AI business itself is on track (or was in July, according to the Information’s reporting) for about $18.5B in revenue at the core large AI startups, with the vast majority of that being OAI and Anthropic. There is a bit of revenue elsewhere – lets generously assume its $25 B total. So we need revenues to 16X just to break even! If these companies want to actually make some money on their capex investment, multiply all these figures by 1.5 to 2x, or 24-32x.

Realistically, the only scenario in which that might happen is if we truly create a general super intelligence, and soon. And based on everything I am seeing, we are just not on track for that. Model improvement has slowed down dramatically recently – scaling began to slow last year, and then reinforcement learning extended the ramp out further into this year. But the latest generation of models simply are not that much better than their predecessors, something most clearly seen in the disappointing GPT 5 release.

Where we are seeing continued good improvement is fields which are amenable to reinforcement learning (most notably coding), video generation4, and also importantly in bringing the lower cost models closer to the performance frontier (this last one bodes very poorly for good returns on said capex). These are all important, and make no mistake generative AI is going to be a big business. But it simply cannot justify the current capex spend, again barring an AGI breakthrough.56

Many people saw the early exponential improvement and extrapolated that out into the future until we hit AGI. The problem is that technological progress is often more like a series of log or sigmoid curves, where we experience rapid advancement in certain areas only to then slow down dramatically, as opposed to progress being one big exponent. A good example of this is the ‘physical sciences’, as a catch all term for tech in the physical world, back in the first half of the 20th century. We went from horse calvary to nuclear energy and landing on the moon in ~50 years, an astounding rate of progress, and so no surprise the 50s and 60s were full of predictions that such progress would continue and by 2020 we’d be a spacefaring civilization with flying cars, colonies on mars, and limitless energy. Sadly these prior exponents did not continue.

All evidence I am seeing thus far is that we seem to be on a similar track for AI. As a little teaser – I am working on an AI product for financial research (who doesn’t have an AI startup these days) with some friends in the tech world. I am very excited to share it soon, and I think we will have something very useful and cool when we launch in hopefully a few months. But as a bonus this gives me a pretty good front line perspective on LLM progress and limitations, which gives me more confidence in these predictions.

Bubbles all around

It is not just AI though, you can see the mania throughout the market. The best example is probably quantum computing stocks (although nuclear stocks are trying to give quantum a run for its money). There are 4 publicly traded quantum computing stocks with a current combined market cap of ~$540 billion (actually even higher today as of this writing somehow), against revenues of ~$100mm, or an insane 600x sales multiple (the firms of course don’t make any money, so the PE is not calculable). Quantum computing has no proven current applications, and the primary usage many believe is possible, factoring very large numbers to break encryption, is many many years out even if technological pace continues at a very rapid pace.7

So we have an industry which may begin to serve a serious use case in 10+ years, trading at a valuation that is arguably higher than even the revenues from that use case could ever support, if said revenues are even ever achieved! Just madness all around. I believe quantum computing represents an excellent shorting opportunity, and have taken out short positions on several of the quantum firms.

There are many more examples – crypto and the proliferation of of crypto treasury companies is another example (although this one is cracking), numerous public companies with huge valuations and no revenue, new memestocks springing to life, hell even Chamath has raised another SPAC!

In my view there is no question we are in a mania today, the only question is how long can it last. I do not know, but if history is any guide at most another year to a year and a half (although it could happen much sooner!). I previously guessed things would begin to unwind Q1 2026 as funding ran out for the AI capex boom, but Nvidia stepping in to fill the void may now push this back several quarters.

Coming Down

A related question is, can the mania unwind without a recession? We just lived through a successful example of this in the 2021 bubble and unwind thereafter, so it is certainly possible. However what frightens me is just how narrow the scope of this bubble is, and how the rest of the economy seems to really be softening. In contrast in 2022 we had the huge upswing of the covid normalization bullwhip, where many real economy sectors such as travel & retail were still recovering in a big way8. Not only that, but the massive increase in construction triggered by low rates and big price increases in 2021 was only just beginning to hit the real economy in 2022. This provided a multiyear stimulus that has only just began to wear off.

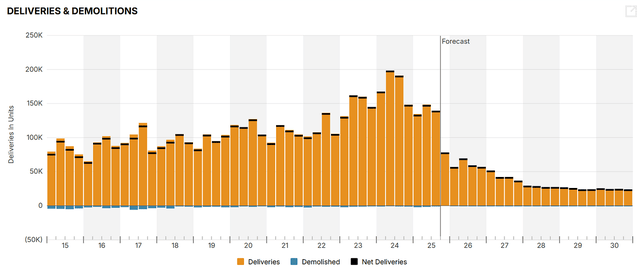

In fact if you look at national multifamily deliveries, we can see that construction is about to fall off a cliff in the next few months. Those workers are going to roll off their current jobs into an economy with extremely limited new construction outside of data centers, and very limited hiring anywhere.

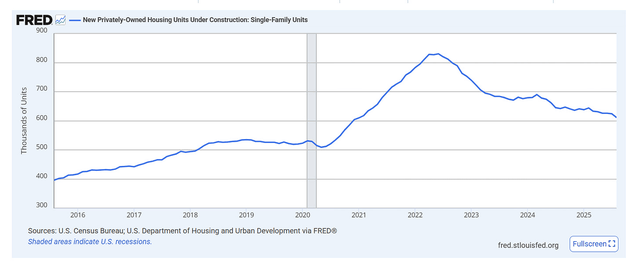

But it is not just multifamily. Single family housing, a huge driver of GDP, is seeing major cracks spread across many of the boom markets.

Single family construction has declined dramatically – here is FRED’s single family units under construction.

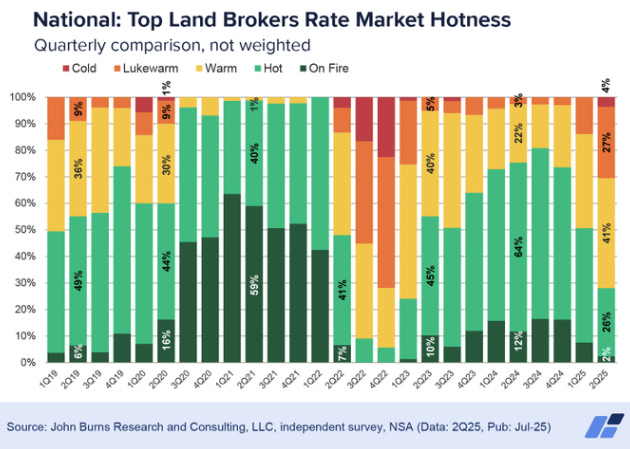

The builders were able to hold out for awhile by slashing their margins (which were historically high), but as I noted in my last letter, single family starts may be about to slow even further as large building supply company BLDR noted demand has fallen further for them recently. This can also be seen in the single family land market, which is beginning to cool off per Burn Consulting.

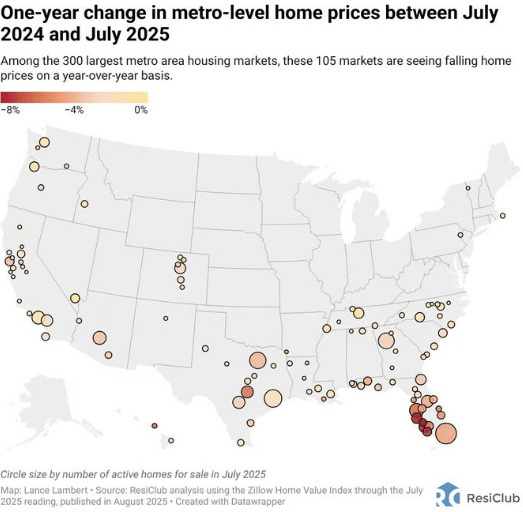

There are problems in housing beyond just construction – home price declines are beginning to spread across the country in the covid boom markets. Here is an analysis by ResiClub of Zillow (Z) home data by metro.

It is worth noting how regional the housing weakness is currently – the northeast and midwest remain fairly healthy. It is easy to forget but recessions were much more regional historically, so perhaps our next downturn will be more regional as well.

The rest of the economy (ex tech), is also showing signs of weakness. Manufacturing is in contraction territory, and has been majorly negatively impacted by Trump’s tariffs. The ISM services index is hovering at 50 (below 50 in contractionary). Hiring has fallen to nearly zero (the latest official data has been delayed due to the government shutdown), with ADP reporting 2 negative quarters for the first time since 2020.

The biggest contra to this weakness in my view is simply the massive deficits we are running at a whopping ~6% of GDP. This deficit spending boosts growth, and may be able to offset the weakness in the ‘real’ economy. We can see this in the jobs data – a huge share of all the jobs being created over the last 6 months are in healthcare. But an economy cannot run on government spending forever.

My fear is that the bubble bursting combined with weakness in the real economy might make for a potentially fairly rough recession. In the dot com era the tech bubble burst but the US consumer & the rest of the economy (particularly housing) was able to power through and keep the downturn fairly mild. Of course there was arguably a price to be paid for this several years later… but regardless this does not seem to be an option for today’s economy.

Now what might be the trigger for the bubble to end? Frankly I have no idea – perhaps it will be Trump trying to increase Chinese tariffs to over 100%. But perhaps it will be something else. My best guess though is it happens sometime in 2026 as the AI capex spending slows down, taking fuel out of the engine.

Interest Rates & Inflation

AI & manias are of course not the only thing happening in the markets – interest rates and inflation remain critical & this corner of the market remains a bit of a tricky situation.

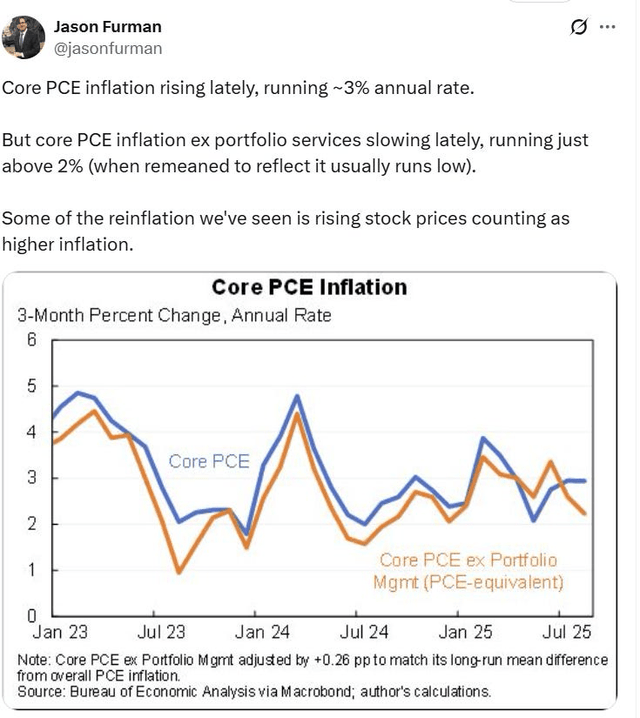

Core PCE has rebounded to the 3% range recently, however much of that is imputed from rising stock prices. Here is economist Jason Furman’s commentary.

Interestingly services inflation has slowed recently, but has been offset by rising goods inflation from tariffs.

Due to all of this plus I’m sure a healthy fear of our massive government spending, bond rates have stayed fairly high and the Fed has been cautious on cuts.

But if the economy slows, and the tariff goods inflation proves to be one time and doesn’t cause a cascade, we could see inflation fall again soon which would clear the way for further Fed cuts in 2026. The Fed is not unaware of the softening labor market, which helped spur their recent cut, and all of this combined gives the markets some confidence in two more projected cuts in 2025.

A bull market thesis might be that the Fed can thread the needle here and cut enough to stimulate enough demand to offset weakening growth, while also not further inflating the bubble we are already in, and we nail the landing. I am doubtful given the delayed effects of monetary policy on the real economy, but it is certainly possible! But even in this scenario I would wager we see a 2022 style bubble cool off – historically the manic phase of a cycle usually lasts only a year or two.9

CRE

Now dear reader, you might be thinking that was a lot of commentary on the economy, and not much on CRE! And you would be correct. But I just published my last CRE notes a month ago, and not a lot has changed. So you’ll have to wait until after Q3 REIT results for more CRE news – apologies to the CRE buffs who have to sit through all my economic thoughts.

Fin

As always, thank you for reading. I am perfectly happy to continue to underperform the market as the mania continues, so as to better preserve capital in what is I believe a likely downturn.

Thanks for reading Warden Capital!

Hawkins Entrekin

|

Footnotes 1 The cash burn rate is lower at the moment as there is a massive stock based comp component here apparently. 2 Much ink could be spilled about an appropriate margin here – it is really hard to forecast. The hyperscalers are around 50% ex depreciation (remember we don’t count depreciation when looking at returns on capex spending). However given the huge competition in the AI space & the ease of substitution it would not surprise me if margins there are much much lower, but lets give them the benefit of the doubt here to illustrate the degree of madness we are looking at. 3 These figures are all extremely rough, and I used round numbers for easy math but given the epic mismatch here even if I’m off a bit the overall picture is very clear. 4 Given movies are simply a series of still images, once you have image generation down video generation becomes as much an engineering challenge as a frontier knowledge one. 5 Most frontier researchers believe that the entire LLM architecture is, at least on its own, a dead end on the search for AGI. And here I don’t mean random employees at OAI, but highly regarded frontier computer scientists and researchers. My personal view is that we may eventually be able to create a series of systems working together, one of which is perhaps an LLM, which could approximate intelligence. But we don’t even really know what the full list of components there even are, let alone how to build them. I don’t mean to say the odds of some breakthrough happening are nil – its certainly possible. But we are really far off. And this is painfully obvious when you try to use an LLM for anything novel or complex – they are great at search of existing knowledge, but very poor at creating anything new (among other shortcomings). Which of course is no surprise if you understand the architecture behind LLMs. 6 A really rough way to think of the value of what is the most monetizable use case for LLMs, which is coding, is as follows. If you assume AI makes coders 25% more productive as an average (studies on this are quite mixed by the way), and that we have ~1.4 million software developers in the US per BLS info, and the average pay is lets say $110k that is roughly $154 billion in total software salaries in the US. 25% of that is $38.5 billion. If you assume the AI providers capture half of that, which is very aggressive given how competitive the space is, that is maybe ~$19 billion in revenue available for the US, max. Add in international and lets say its ~$50 billion. That is for LLM’s biggest use case, max. There are obviously other uses but coding is by far and away where most revenues today are derived. And surplus capture is usually far lower than 50% in tech… think about google. It is literally free. So maybe best case LLMs generate $50 billion in coding related revenues in 5-10 years, and maybe best case we are at $100 billion maximum in end user revenues by 2030, about 25% of what is needed just to break even on our current wave of GPU investment. But frankly it wouldn’t surprise me if it is alot lower. 7 Peter Shor himself, the father of the eponymous algorithm for quantum factoring of integers & arguably the godfather of quantum computing, noted in a recent lecture that there are several theoretical problems quantum computers may be better at, but whenever quantum researchers publish something along those lines a classical computer scientist takes a look at the problem and is able to devise a much cheaper solution on classical computers. This is doubly damning – first obviously it undermines any notion of quantum supremacy for these problems, but secondly and perhaps more critically – the problems were not important enough for anyone to spend any real time on solving them. As the classical computer scientists only decided to take a look at these problems once they saw the quantum papers, as an academic curiosity! 8 For example some hotel REIT’s revenues doubled from 2021 to 2022. 9 The big exception to this seems to have been Japan’s 1980s bubble peak, which really lasted several years. Would love to hear of any other historic mania’s that lasted more than a year or two – bubbles and booms of course go much longer but the truly manic phase, which I think we are clearly in now, is usually much shorter. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.