Fraudulent schemes in Ukraine’s aviation sector — which during wartime have begun to directly impact our national defense — have already amounted to hundreds of millions of hryvnias. We will break down, year by year, how much Ukraine has lost due to the actions of a so-called top aviation businessman who regularly wins state contracts.

It all started when UNN journalists investigated where MP Ihor Kopytin got his Toyota Land Cruiser and ended up uncovering companies linked to Roman Mileshko. Despite having a charter capital of just 120 000 UAH (2 874 USD), these firms began receiving state contracts worth billions. According to StopCor coverage, the company entrusted with over 2 billion UAH in government contracts has: charter capital: 120,000 UAH (2 874 USD), office: 200 sq. meters, staff: 82 employees — clearly insufficient for the scale of work. This revelation exposed how, during wartime, companies could install equipment on military helicopters that potentially poses risks — including gear originating from the aggressor state. It also came to light that aircraft are still being traded with or leased from Russians. Digging deeper, the activities of these firms should be of interest not only to the Security Service of Ukraine but also to the Bureau of Economic Security. This article expands on a StopCor video, detailing a tax evasion scheme involving these companies.

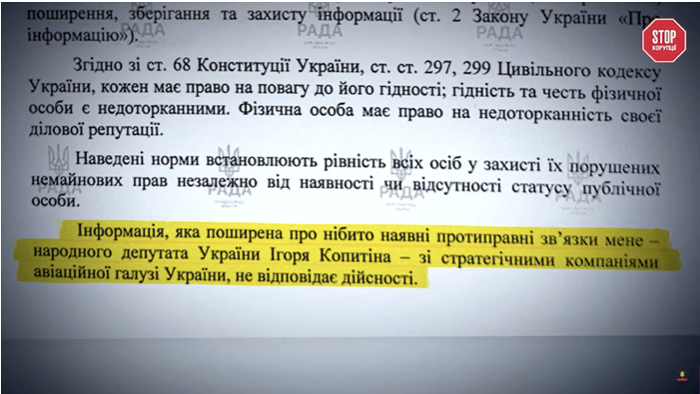

MP Denies Links to Aviation Companies — But the Facts Tell Another Story

Outlets like Ukranews have circulated statements that appear to defend MP Ihor Kopytin, who denies any connection to Roman Mileshko.

However, credible information — including reports from UNN and StopCor — indicates that Roman Mileshko worked for and earned income from a company then owned by Kopytin and his family: Rotor Ukraine LLC. As reported by Chesno.org and as listed in Igor Kopytin’s dossier StopCor, this company trained pilots.

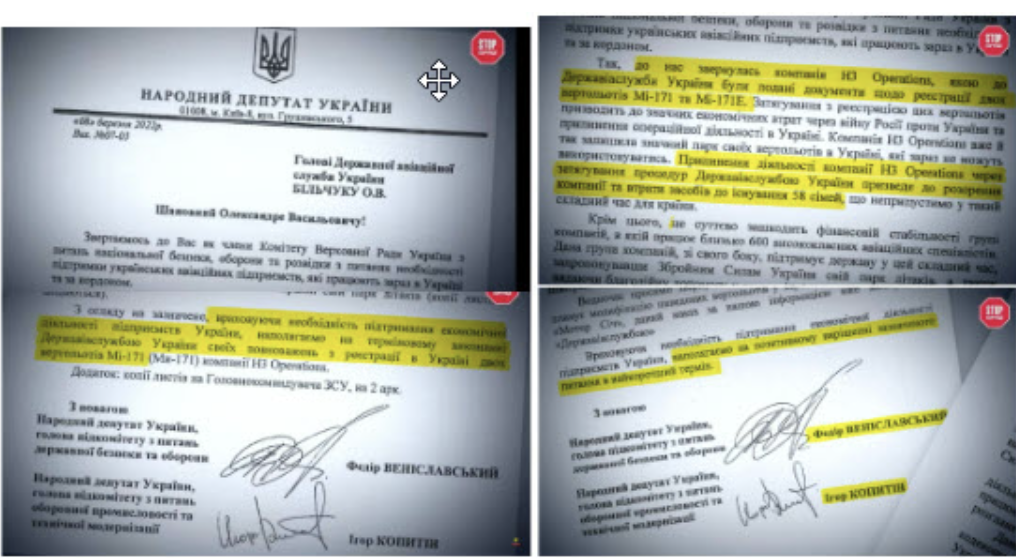

Furthermore, StopCor published two letters dated March 2022 sent to Ukraine’s State Aviation Administration — contradicting Kopytin’s claim that he has no ties to aviation companies.

Think about the timing: at the onset of the full-scale invasion, when Ukraine was fighting for survival and Kyiv was under threat, two members of the Verkhovna Rada’s Security Committee allegedly lobbied for private — not national — interests, specifically those of N3Operations LLC.

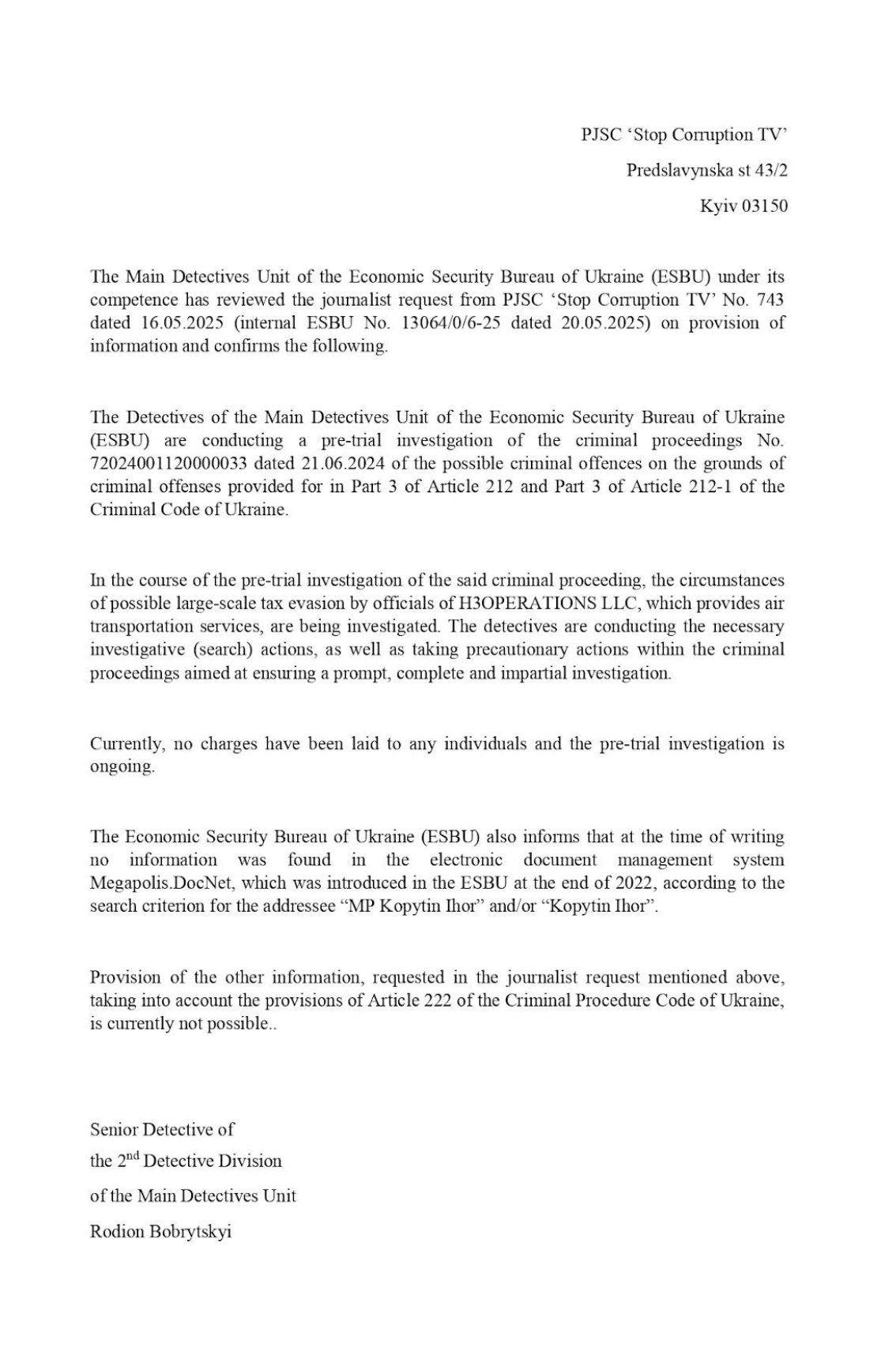

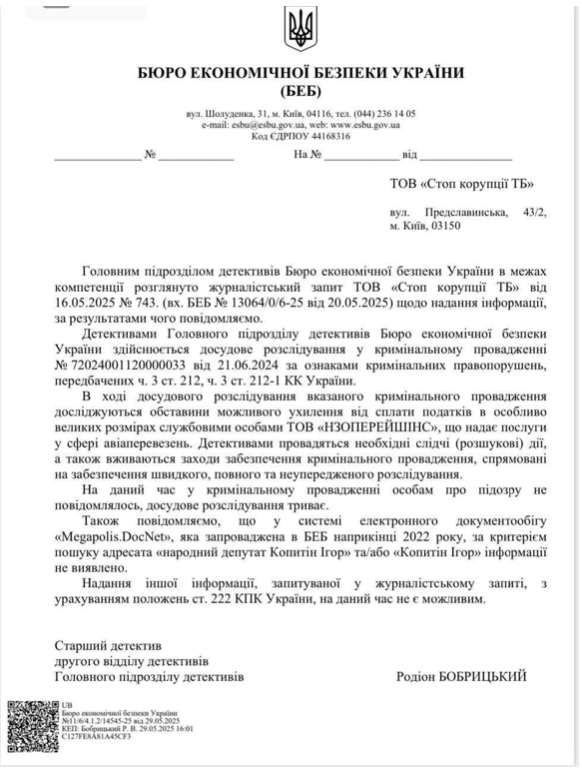

This company reportedly hides its employees’ salaries “in envelopes”, avoiding taxes and depriving a bleeding country of vital revenues. After StopCor released its video, the Bureau of Economic Security confirmed it is investigating the case in an official response to a journalistic inquiry.

*Below you will find a translation of this official letter from the Bureau of Economic Security of Ukraine.

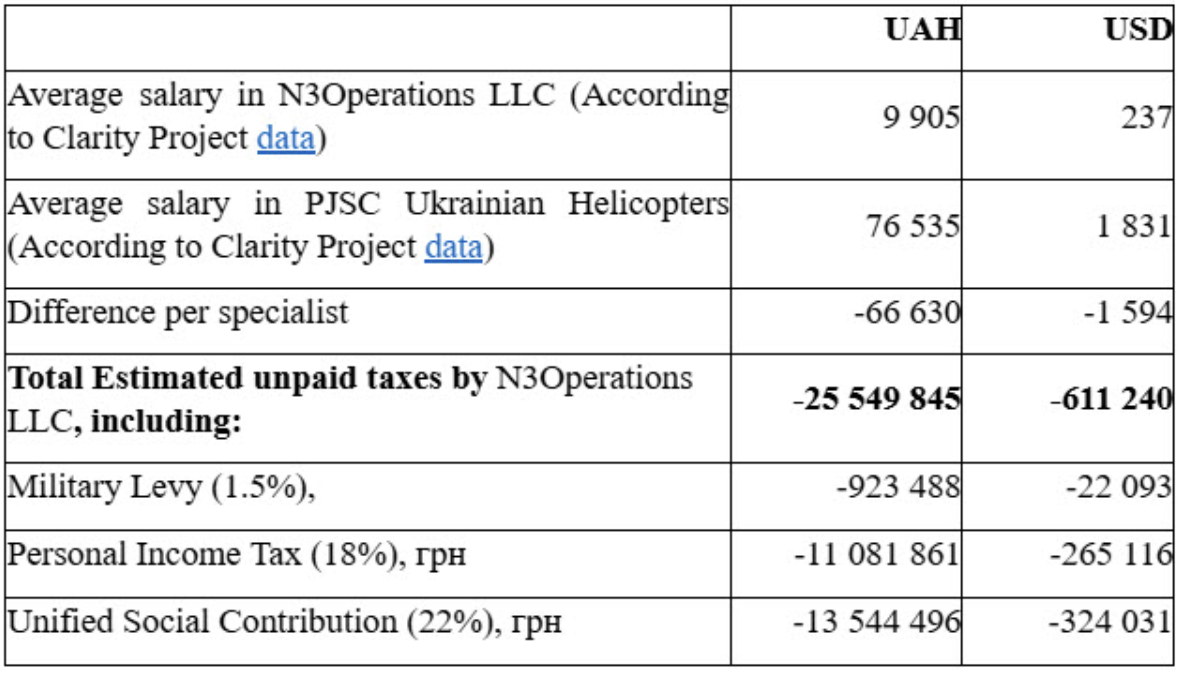

Take a look how much Mileshko and company hid from taxation in 2022.

Both aviation companies operate in the same region and serve the same clients — meaning salaries should be roughly equal.

Surviving or Profiting During Wartime?

We’re investigating two legal entities beneficially owned by Roman Mileshko: Constanta Airlines PJSC and N3Operations LLC. Both list passenger air transport as their core activity. Yet they allegedly pay pilots, flight attendants, and engineers substantially less than their industry peers.

StopCor compared the official salaries at Constanta Airlines PJSC and N3Operations LLC to two top-lead Ukrainian airlines.

That’s an 8-fold difference in salaries. The implication? In addition to questionable links with sanctioned Russians and Georgians, Mileshko’s companies may be using a dual accounting system — and this is evident even in public data.

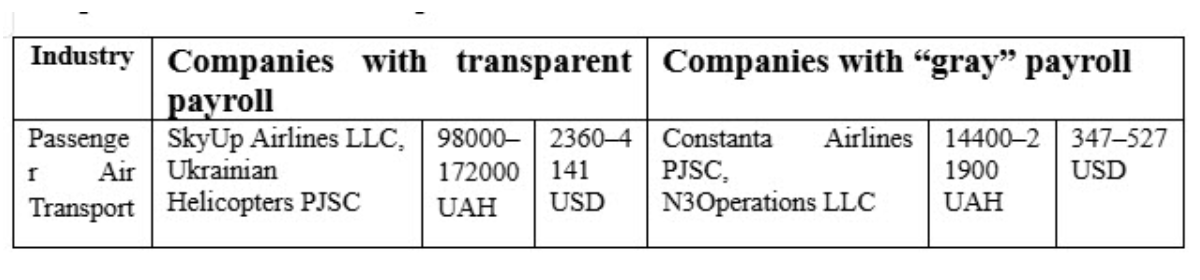

On one side, there’s socially responsible business — like SkyUp and Ukrainian Helicopters — who pay market wages and transparently report to the state. Their crew members earn between 98 000 and 172 000 UAH monthly (between 2 360 and 4 141 USD), comparable to salaries in foreign airlines.

How the “gray” payroll Scheme Works

In 2024, it’s unrealistic for one company to pay 98 000–172 000 UAH (2 360–4 141 USD) and another just 14 400–21 900 UAH (347–527 USD) without foul play. Tax-evading firms may report minimum wage payments to authorities, while paying the remainder in cash or transferring funds to foreign bank accounts, such as in the UAE. This means required contributions to the state budget — calculated from the official salary — are much lower than they should be. This means taxes like PIT, USC, and the military levy are only paid on the reported 14 400 UAH (347 USD) — not on the full salary, not on actual payments like 172 000 UAH (4 141 USD).

Employment contracts often include non-disclosure clauses, preventing workers from revealing their actual pay. This can trap employees in a grey zone, making them unwilling accomplices.

Whether the hidden portion is handed out in envelopes or wired to foreign cards (for example, in the UAE) is less important than the consequences: Ukraine is being deprived of funds for defense (military tax), social programs, reconstruction, and scientific or educational development (USC, PIT). Given the urgent need for equipment — from drone defenses to air defense systems — avoiding the military tax during wartime borders on treason.

How Much Has the State Lost During the War?

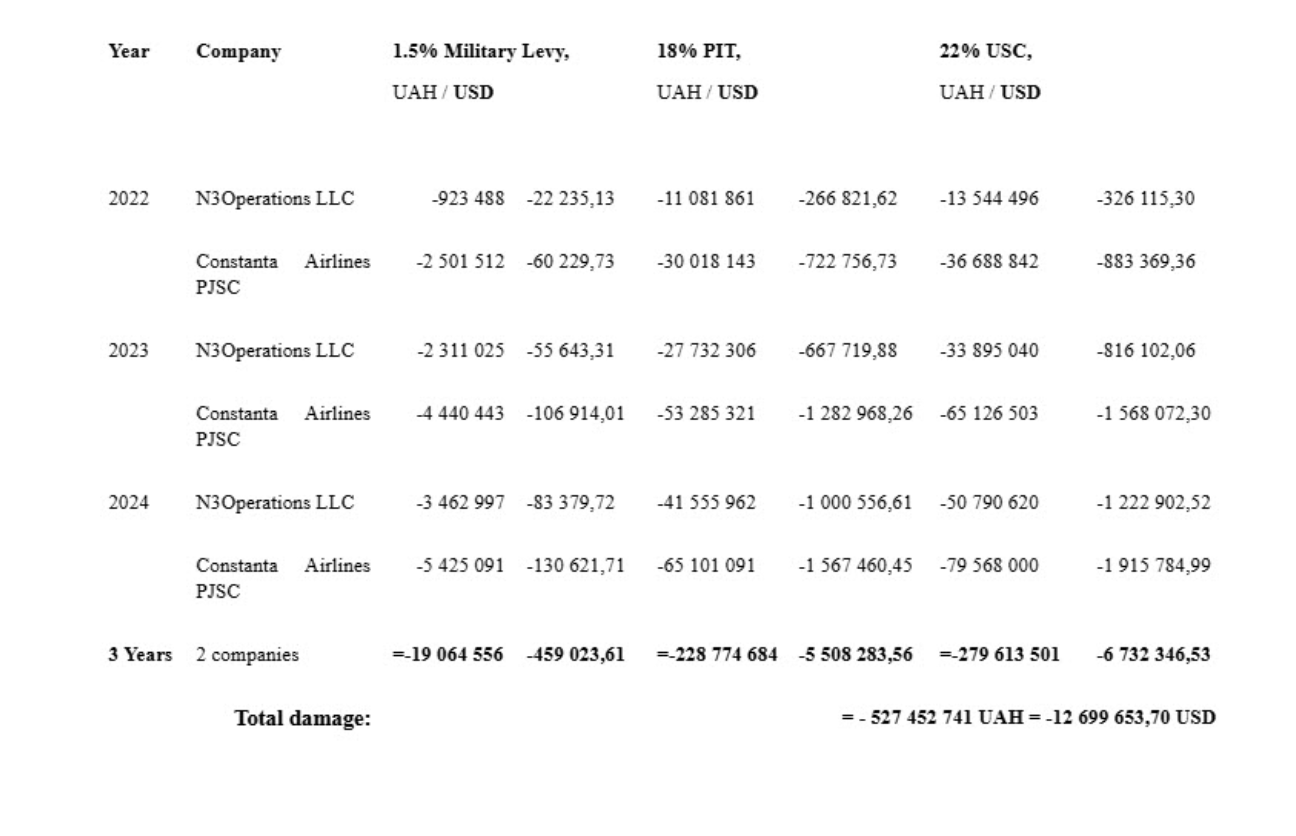

Based on the legal tax rates and the number of employees, and knowing the industry’s market wages, we calculated how much Roman Mileshko’s companies may have cost Ukraine over three years of full-scale war.

That’s 527,4 million UAH (over 12,7 million USD) in losses may be caused by just two companies — N3Operations LLC and Constanta Airlines PJSC during a full-scale war in three years.

How many more years will the state keep turning a blind eye to these salary schemes? How much longer will it fund those who derail defense contracts, maintain links with aggressor states, and dodge taxes?

We await a reaction from law enforcement.