Introduction & Investment Thesis

Powell Industries (NASDAQ:POWL) develops, designs, and manufactures custom-engineered equipment for end markets that include Oil & Gas, Petrochemicals, Electric Utility and Commercial. The stock has sizably outperformed the S&P 500 and Nasdaq 100 YTD. It reported its Q3 FY24 earnings, where revenue and diluted earnings per share grew 50% and 149% YoY, respectively, beating estimates by a huge margin.

Although the company is seeing strong bookings across its end markets while it expands its capacity to meet its backlog, the management has not provided any guidance for Q4 FY24 and beyond. Meanwhile, consensus estimates point to a significant slowdown in revenue growth from its current levels in FY25 and beyond, as the company will face tougher comps. Along with that, it is also important to remember that its end markets are highly cyclical in nature and that a macroeconomic slowdown along with AI spend optimization can put downward pressures on its core revenue segments.

Plus, the short float on the stock is 17%, which is quite high in my opinion and may partially explain the magnitude of the post-earnings spike in the stock price. Assessing both the “good” and the “bad,” I believe that the stock is a “sell.” I believe that it is prudent to book some (or all) profits on the stock (depending on the individual’s risk appetite), as the high short float can subject the stock to potential large, volatile swings in either direction.

The good: Strong Revenue growth across all end markets along with growing new orders and steady backlog, Expanding Profitability

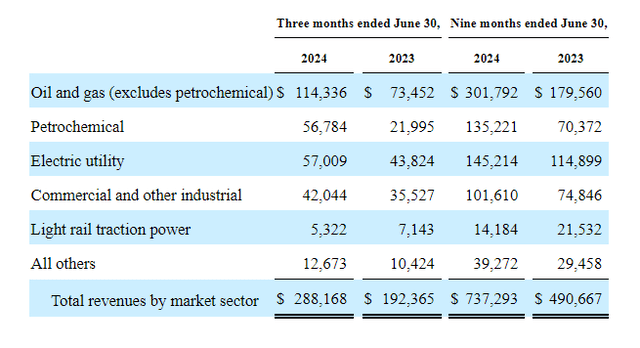

Powell Industries reported its Q3 FY24 earnings, where it generated $288M in revenue, growing 50% YoY, which exceeded analyst expectations by a whopping 22%, driven by strength across all the market sectors they serve, particularly Oil & Gas and Petrochemical markets that contributed 60% of Total Revenue, growing 56% and 158%, respectively, as they benefited from revenues exiting the backlog. During the earnings call, the management discussed that the fundamentals of the US natural gas market remain favorable with conducive price spreads across global markets in order to support US export activity. I believe that the company should see continued strength in this sector in the coming years, especially as it sees tailwinds from increasing global economic activity as well as energy transition projects such as biofuels, carbon capture, and hydrogen.

At the same time, the revenue for its Electric Utility market also grew 30% YoY to $57M and the management is positive about its outlook moving forward, given the company’s leadership in utility distribution substations and the volume of projects that are coming to market. Finally, its Commercial market segment also grew substantially by 18.3% YoY to $42M as it looks to gain market share in the data center segment, especially spending on AI capex by companies, which continues to grow steadily with no signs of slowdown in sight.

Q3 FY24 Press Release: Revenue by end markets

Given the tailwinds across the markets it serves, Powell Industries booked $356M in new orders, which grew 51% from the previous quarter, with the backlog unchanged at $1.3B, while the company continues to expand its capacity initiatives to facilitate their backlog execution along with delivering operational efficiency. In terms of margins, the company generated $82M in gross profit, which grew approximately 90% YoY with a margin expansion of 620 basis points, as they benefited from a higher volume of project closeouts, strong project execution, and unlocking operating leverage, especially in its non-industrial markets, as it became more effective in its manufacturing and delivery processes. Meanwhile, the company generated $57.2M in operating income on a GAAP basis, which also grew 165% YoY with a margin of 19.8% compared to 11.2% a year ago, as overall operating expenses grew at a slower pace than overall revenue growth, despite R&D spending growing 49% as they continued to invest in innovation to develop new technologies and broaden their portfolio.

The bad: Short float of 17% may have contributed to the share price spike. Forward Revenue growth estimates point to a slowdown

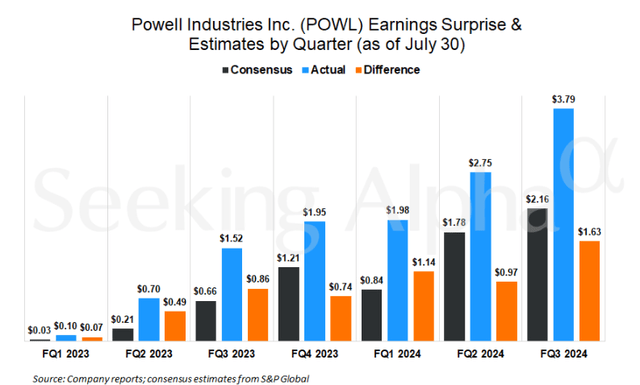

Although the management remains confident that they have the necessary infrastructure and resources to execute their growing backlog while progressing through their plans to expand their capabilities as they position themselves to benefit from the tailwinds that their end markets possess, they did not provide specific guidance for Q4 FY24 and ahead. The consensus estimates for revenue growth for FY24 stand at 29%, while diluted earnings per share are projected to expand 1265% YoY to $9.35. Plus, the company has been consistently beating its earnings estimates over the past four quarters by an average of 130%, which is extremely impressive and also explains the stock price ascent.

S&P Global: Consistently beating earnings estimates

However, I am concerned about the forward growth estimates, where revenue is expected to slow down in the 5% range moving forward, which is at par with nominal GDP growth rates. There is no doubt that the company will be facing tougher comps next year; however, the analyst estimates for a revenue slowdown are quite substantial, in my opinion. I believe this ties to the cyclical nature of the end markets that Powell Industries operates in, where project decisions are tied to factors such as demand and price for oil and the overall macroeconomic environment, which could experience a slowdown. While it has diversified its portfolio beyond core oil, gas and petrochemical end markets towards electric utility and commercial sectors, I believe a lot of the optimism is currently tied to AI capex spending, which I believe can slow down in the coming quarters as companies assess ROI and optimize spend as a result.

It is, however, certainly possible that analyst estimates are too conservative for FY25 and beyond, especially when we look at the rate at which the company has been consistently beating earnings estimates. However, past performance doesn’t drive future performance, and while the company is positioned at the intersection of structural tailwinds in its end markets, I would like to point out that the short float on the stock is close to 17%. This means that there is significant pessimistic sentiment among investors, which could partially explain the stock’s near 40% gain after its Q3 earnings.

Tying it together: It’s time to book your profits

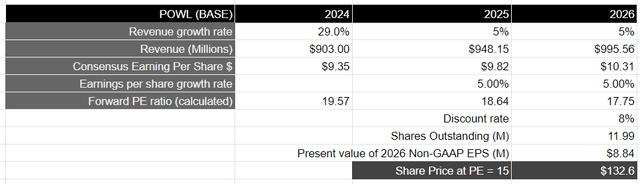

Looking forward, assuming that the company grows its revenues by 29% for FY24 as it benefits from a strong backlog across its end markets and then slows down to growing its revenue at par with nominal GDP at approximately 5% for the following 2 years, it should generate close to $996M in revenue by FY26. I am taking the consensus estimates to build my valuation model, as I believe that the company will face tougher comps moving forward, especially next year. In terms of profitability, assuming that diluted EPS grows in line with revenue growth as it continues to execute projects effectively while expanding capacity in a financially disciplined manner, it should generate $10.31, or the equivalent of a present value of $8.84 when discounted at 8%.

Author’s Valuation Model: Base Case

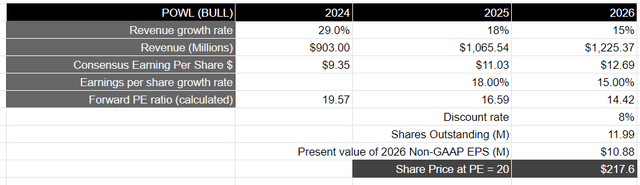

On the other hand, I also have a bullish scenario (although that is not my base case), where the company continues to grow its revenue in the high teens as it benefits from tailwinds in its end markets, with Electric Utility and Commercial markets likely contributing a higher percentage to revenue as it benefits from AI-led data center projects. In this case, the company should generate close to $1.2B in revenue by FY26. Assuming profitability grows in line with revenue growth, it should see a diluted EPS of $12.69, which is equivalent to a present value of $10.88.

Author’s Valuation Model: Bull case

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15–18, I believe that the “base” and the “bull” cases should trade at a PE ratio of 15 and 20, respectively, given the growth rate of its earnings during this period of time. This would translate to a price target of $132 for the “base case” and $217 for the “bull case.” Assuming that there is a 50% probability in either of these scenarios, there will be no net upside for the stock.

My final verdict and conclusions

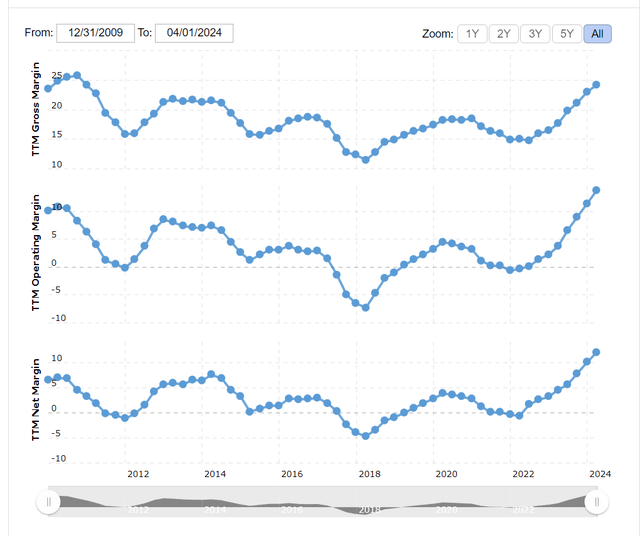

There is no doubt that the company has been performing well since the end of 2022, when revenue and operating margin started to incline upward. Part of that could be a resilient US economy where demand is strong, and the second reason is the company’s focus on gaining market share in the data center segment in its Electric Utility and Commercial market, especially after the launch of ChatGPT in late 2022, which has allowed it to diversify its portfolio while simultaneously driving investor sentiment.

Macrotrends: Trend of revenue and operating profit growth

So far, the pace of new bookings remains strong, and I like how the company has been strategically expanding its capacity to meet its backlog while growing profitability at the same time. While the company has been smashing its analyst estimates for revenue and earnings growth, the lack of clear forward guidance is making it difficult, given the cyclical nature of the end markets the company operates in.

While the consensus estimates point to a significant slowdown in revenue growth, as the company faces tougher comps moving forward, it is also possible that these estimates are too conservative, especially as Powell Industries sits at the intersection of structural tailwinds in all its end markets. In the short term, we might enter a period of macroeconomic slowdown, which can negatively affect the Oil & Gas and Petrochemicals markets. At the same time, optimization in AI capex spend can also depress investor sentiment towards the stock.

Finally, a short float of 17% is quite high, in my opinion, and can subject the stock to volatile swings in either direction. Therefore, assessing both the “good” and the “bad,” I believe it is best to book a portion or all your profits on the stock, while I will wait for a better entry point when it has sufficient upside to justify initiating a long-term position.