The UK’s family wealth management sector is undergoing a profound shift as families adapt to digital transformation, changing generational expectations and a historic “great wealth transfer.” What was once the discreet world of trusts and private portfolios is now a dynamic arena where bespoke advice and technology are reshaping strategy and legacy.

Family offices and wealthy families are increasingly moving beyond traditional liquid assets. Many are pursuing direct investments, co-investments with private equity and even establishing in-house fund structures.

Motivations range from gaining greater control to reducing costs and aligning investments with entrepreneurial ambitions and personal values. “The families we work with do not fit a template,” says a spokesperson for Torsio Capital, a London-based multi-family office.

“Our mandate is to harmonise their wealth, governance and purpose so each generation can thrive, guided by values as much as assets,” he added. “Purpose-driven governance is central to effective wealth management.”

With £7 trillion expected to pass between UK generations by 2050 and up to 70 percent of fortunes lost by the next generation, succession is both a technical and cultural challenge. Modern inheritors want wealth to serve their values, careers and impact on the world.

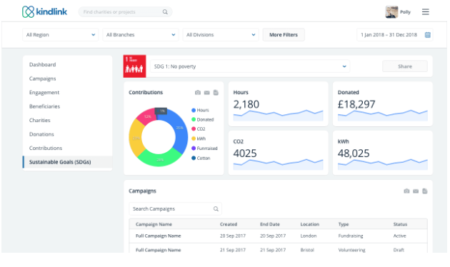

Impact investing, ESG alignment and sector-focused strategies in technology, healthcare and sustainability are moving to the centre of family priorities. Robert Kiyosaki, author and founder of Rich Dad Company, says: “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

UK families are adopting flexible governance frameworks and evolving family constitutions to suit changing priorities. Mentorship models are making next-generation members active decision-makers, not just recipients.

Artificial intelligence is transforming risk management, portfolio design and compliance, freeing advisers to focus on strategic relationships. Yet cybersecurity threats and a shortage of specialist tech talent remain pressing challenges.

Outsourcing, consolidating platforms and targeted recruitment are increasingly used to maintain competitiveness. Transparency and agility are now regarded as essential qualities for modern family offices.

An Ocorian study found that 86 percent of family offices see governance as their biggest challenge, but fewer than one in five feel fully prepared. The absence of UK-specific regulation allows for innovation but brings operational and reputational risks.

Global diversification is also reshaping wealth strategies. A third of family offices now invest outside their home markets, seeking opportunity, stability and growth.

For UK families, this global reach adds tax, legal and compliance complexity but offers access to top-tier expertise. UBS reports that developed-market equities, notably in AI and healthcare, are the top allocation targets for the next few years.

More than 80 percent of family offices expect to increase AI-related investments. Private debt is also expanding as a tool for yield and diversification.

The UK’s family wealth management sector is at a turning point. Old models of passive generational transfer are giving way to entrepreneurial, values-led approaches supported by global outlooks and digital innovation.

As Torsio Capital’s spokesperson notes, the goal is not simply to preserve assets but to embed purpose at the heart of wealth strategies. Families that embrace personalisation and involve the next generation as active partners are best placed to build resilient, lasting legacies.