|

Investment Results |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

YTD 2025 |

Since Inception1 |

|

LVS Growth (net of fees) |

– |

61.9% |

16.1% |

(35.8%) |

7.0% |

36.7% |

15.8% |

104.4% |

|

LVS Event-Driven (net of fees) |

7.0% |

13.2% |

9.1% |

3.8% |

6.2% |

7.5% |

3.6% |

62.2% |

Note: investment performance is presented net of all fees and expenses. Investment results are as of June 30, 2025.

(1) LVS Event-Driven was incepted on January 1, 2019. LVS Growth was incepted on January 1, 2020.

Dear Investors,

For the half of 2025, the LVS Growth Portfolio gained 15.8% and the LVS Event-Driven Portfolio gained 3.6%, net of all fees and expenses. This compares to the S&P 500, which gained 6.2%, and the high-yield bond index, which gained 4.8%, our benchmarks, respectively.

In this letter, I will discuss the Growth Portfolio’s investment in Curtiss-Wright (CW) and the Event-Driven Portfolio’s recent investments in biotech liquidations. For a more detailed discussion of our Curtis-Wright investment, please refer to our investment memo here.

Growth Portfolio: Curtiss-Wright Investment

Curtiss-Wright is an industrial conglomerate serving the aerospace, defense, and nuclear power industries. The company is not a household name, but it probably should be. CW’s history traces back to the invention of flight as its predecessor company was founded by the Wright brothers. The stock went public in 1929 and has remained publicly listed ever since, making it one of the NYSE’s longest continuously listed companies.

Today, Curtiss-Wright owns a collection of high-quality businesses that operate with limited to no competition. CW’s legacy as one of the original defense contractors in the aerospace and naval industries has given it a monopoly position in many critical components including naval propulsion systems and chips that power jet fighters. The Company is also the sole provider of nuclear reactor cores to the key players in the commercial nuclear power sector.

Our Curtiss-Wright investment thesis is two-fold. First, we see several tailwinds continuing to benefit CW’s aerospace and defense markets. Second, we believe the Company’s commercial nuclear power business is under-appreciated due to the expanded opportunity to serve the rising power needs of data centers. We first purchased CW’s stock in September 2023 but recently doubled down on our position in March 2025 after building conviction in the upside case for the stock.

Tailwinds in Aerospace and Defense Markets

Approximately 80% of Curtiss-Wright’s earnings today are tied to aerospace and defense sales. The Company serves an increasingly diverse number of customers and use cases. For example, in commercial and military airplanes, CW supplies electro-mechanical actuation systems, flight controllers, engine sensors, thermal spray coatings, and wheel speed sensors. There are too many components to name here but the key theme is that CW sells small but critical parts. The exception to this rule is in CW’s naval portfolio where the Company is the preferred provider of key components in nuclear propulsion systems used by aircraft carriers and submarines.

Over the past 10 years, Curtiss-Wright has been able to drive organic revenue growth of roughly 5% and EPS growth of roughly 14%. Looking ahead, we believe many of the following growth tailwinds are intact or are accelerating which should continue to propel the CW’s financial results:

1. Rising demand for defense electronics

Curtiss-Wright is the leading supplier of defense electronics. These are chips and other electrical components that go in all types of military hardware. Over time, more electronics have gone into hardware (tanks, missiles, jets, etc.) as the military has gotten more computerized. Embedding artificial intelligence into military hardware platforms will only make defense electronics more critical.

Curtiss-Wright uses commercial-off-the-shelf chips from Nvidia/AMD and customizes them to suit the needs of specific military use cases. As a result, CW has limited R&D or capex requirements. However, Curtiss-Wright’s legacy in this market provides it with substantial incumbency advantages. The Company is deeply embedded into the electronics stack of various hardware programs, making CW virtually impossible to dislodge by competitors. This business is highly diversified across branches of the military and hardware types. The result is that CW has a highly predictable order book that generates meaningful free cash flow with limited capital investment.

2. Secular growth in commercial aviation

Curtiss-Wright benefits from the general uptrend in commercial flights driven by travel demand. The global airplane fleet is expected to double over the next 20 years and is supported by record backlogs at Airbus and Boeing. Curtiss-Wright has content on virtually all Boeing and Airbus models and will benefit from the rising tide.

3. Increased US naval defense spending

Curtiss-Wright has outsized exposure to the US Navy, and the Trump administration just proposed a 40% increase to the naval shipbuilding budget. The US Navy has become a larger priority in recent years due to the need to protect US interests in key waterways including the Persian Gulf and the South China Sea. CW is particularly levered to the Trump administration’s Naval priorities which include expanding the US nuclear submarine fleet.

4. Rising foreign military sales for US defense contractors

Global defense spending has accelerated in recent years due to the high-threat environment. NATO countries have pledged to increase defense spending in the coming years. As the leading provider of defense electronics across over 400 platforms and 3,000 programs, Curtiss-Wright is well-positioned to benefit. For example, CW has content with key US export products including Lockheed Martin’s F-35, Boeing’s Apache helicopters, and Raytheon’s Tomahawk missiles.

Curtiss-Wright has also cultivated direct relationships with foreign defense companies including Germany’s Rheinmetall. CW was recently awarded a contract to supply turret drive aiming and stabilization technology to Rheinmetall for use on the German Army’s Boxer Heavy Weapon Carrier (tank) and Hungarian Ministry of Defense Lynx infantry fighting vehicles (tank).

Naval Defense is another area with strong foreign military demand in the coming decades. The US, UK, and Australia have established a partnership in nuclear submarines called AUKUS. Under this agreement, Australia will purchase 3 to 5 Virginia Class subs, and the three countries have agreed to collaborate on developing a next-generation submarine. As a key supplier for the Virginia class submarine, Curtiss-Wright will sell hundreds of millions of dollars of content to the Australian Navy as part of the deal and will likely have additional content on the next-generation platform as well.

Curtiss-Wright’s Nuclear Power Growth Opportunity

The crux of our investment thesis lies in our belief that Curtiss-Wright’s commercial nuclear business could see earnings grow 5x over the next 5 to 8 years. Commercial nuclear represents 20% of CW’s earnings; therefore, 5x growth in this segment is needle-moving for the company overall.

Having written up Talen Energy (TLN) in our Q2 2024 letter, I won’t reiterate the entire nuclear power thesis here. But to summarize, nuclear power is increasingly an attractive source of electricity because it is reliable and zero-carbon. At a minimum, we believe existing nuclear plants will be maintained beyond their current useful lives, but increasingly we see greenfield nuclear power projects coming into fruition over the next decade as new reactor designs gain traction.

Curtiss-Wright supplies many small but critical components to nuclear power plants including control systems, specialized valves, and the pumps that support the nuclear reactor core. Today, CW’s power business is exclusively a maintenance business where it provides replacement parts to existing power plants. Nuclear maintenance is booming because many plants were scheduled to be decommissioned but are now getting plant life extensions. Over 80% of the existing nuclear plants in North America (94 in US, 19 in Canada) have applied for plant life extensions and 3 previously decommissioned nuclear plants are in the process of turning back on.

It increasingly looks like there will be a significant buildout in greenfield nuclear projects from both Gen 3 large reactors and newer designs for small modular reactors (“SMR”s). This is a controversial view because greenfield nuclear projects have been maligned by critics as uneconomic and otherwise unrealistic due to regulations, NIMBYism, and general apathy after the Fukushima disaster.

However, many interesting trends are aligning for potential nuclear greenfield projects. First, there is an existing commitment in Eastern Europe to build 10 – 15 new AP1000 reactors (Gen 3 nuclear power plants) over the next decade. Second, large US tech companies have been aggressively buying nuclear capacity and committing to Small Modular Reactor projects. Finally, the Trump administration has committed to reducing regulations to allow for nuclear projects to get fast-tracked for approval and construction with less red tape. For all these reasons, we are optimistic that we are at an inflection point for greenfield development in the industry.

Curtiss-Wright is in pole position to capitalize. CW is the exclusive supplier to the leading Gen 3 nuclear design (Westinghouse’s AP1000) and has established agreements to supply most of the leading small modular reactor designs. The table below shows CW’s publicly announced SMR deals.

Curtiss-Wright SMR Announced Deals

|

Partner |

CW Content Per Reactor |

Technology |

|

NuScale |

$40 million |

Pressurized Light Water Reactor (PWR) |

|

X-Energy |

$120 million |

High-Temperature Gas-Cooled Reactor (HTGR) |

|

Westinghouse |

$50 million |

Pressurized Light Water Reactor (PWR) |

|

Rolls Royce |

Deal reached but details not disclosed |

Pressurized Light Water Reactor (PWR) |

|

Terrapower |

Deal reached but details not disclosed |

Sodium-Cooled Fast Reactor (SFR) |

|

GE Hitachi |

Deal reached but details not disclosed |

Boiling Water Reactor (BWR) |

Source: Company filings, LVS Advisory research.

We do not believe Wall Street is correctly modeling Curtiss-Wright’s growth opportunity from greenfield nuclear projects. The company itself doesn’t include nuclear greenfield in its guidance because the projects are inherently unpredictable although management has noted that it does expect significant greenfield order volume to materialize in the coming years.

The investing community is also generally skeptical of anything related to SMRs due to several highly promotional publicly traded SMR companies that will likely end up going bankrupt. However, there is piling evidence that SMRs are going to gain adoption in the coming years. We believe the market has been slow to study the recent deals announced by Google/Kairos, Amazon/X-Energy, and Ontario Power Generation/GE Hitachi, which are paving the way for broader commercial adoption of small modular reactors.

The way Wall Street works is that if management issues conservative guidance, analysts will typically make their own models more conservative as well, providing an opportunity for some investors to make a bet on a growth “call option”. We are willing to underwrite that call option at Curtiss-Wright.

Event-Driven Portfolio: Biotech Liquidations

Occasionally the macro environment creates a thematic event-driven trade with a compelling risk/reward dynamic. In 2020, our thematic trade was to buy SPACs at a discount to NAV and flip them once a deal was secured. At one point in 2020, a majority of our Event-Driven Portfolio consisted of SPACs we purchased at attractive prices. This contributed to 2020 being our strongest year of performance in our track record to date.

I believe biotech liquidations today represent a similar albeit smaller-scale opportunity.

Biotech liquidations refer to early-stage biotech companies liquidating their assets due to a failed clinical trial or an inability to fund future research. To fund drug development, biotech companies raise cash from investors and generally hold the cash in money market accounts while their clinical trials progress. Clinical trials can cost hundreds of millions of dollars and take anywhere from 5 to 10 years to complete. Therefore, biotech companies need to raise a lot of cash upfront to have enough runway to be a going concern.

However, many drug candidates fail, and sometimes drugs fail in the early stages of a clinical trial, leaving the asset owner with a box of cash without a viable drug candidate to spend it on. In these situations, the companies can do one of two things: use the cash to acquire new drug assets or return to cash to investors and liquidate the company. Increasingly, companies are choosing (or being coerced) to liquidate.

The opportunity is that many biotech companies trade at a discount to their net cash value because investors expect the companies to continue spending the money. In fact, the discounts can be as large as 40% to 60% (i.e. a company with $100 million of cash trades for a $40 market cap).

Ironically, to make money in this trade you need to identify and invest in biotech companies with “bad assets” and hope that they choose to give up and send cash back to shareholders. There are signs a trial isn’t going well and it usually pays to wait until the company provides a clear signal that it will strategically move in another direction.

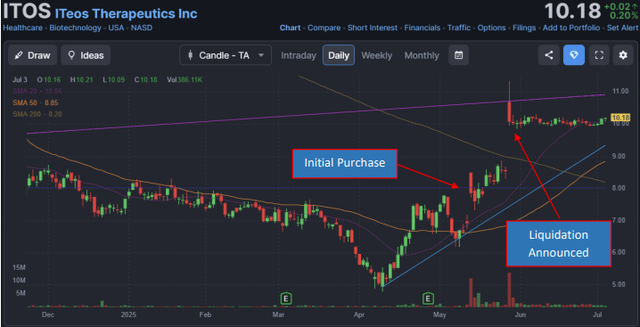

iTeos Therapeutics (ITOS) described below provides a good example but we have participated in several similar situations over the past year.

iTeos Therapeutics Case Study

On May 13, 2025, the ITOS announced poor results from its Clinical Phase 2 study for its leading drug candidate. The Company announced it would terminate the program and initiate a review of “strategic alternatives to maximize shareholder value”. At the time of that announcement, ITOS stock traded for $7.60 per share and had $12 per share of cash on its balance sheet (net of liabilities). On the heels of this news, we purchased shares for ~$7.71 on average.

Just two weeks later, ITOS announced it would liquidate its assets and return all remaining cash to shareholders. The stock popped by 30% to over $10 per share. We continue to hold the stock as we believe there is incremental value to be gained, but expect the situation to be resolved by the end of the year.

Until Next Time

My family was blessed to welcome our second child into the world on April 15. Our “tax day” baby and her mom are both doing well. We’ve enjoyed a quiet spring and summer nursing our young family. Thank you for your continued support and trust in LVS Advisory.

Best regards,

Luis V. Sanchez CFA

|

ABOUT LVS ADVISORY LVS Advisory is a boutique investment firm focused on providing active investment management services for individuals, families, and institutions. The LVS Event-Driven Portfolio is an absolute return strategy focused on capital preservation. The LVS Growth Portfolio is a global equity strategy focused on capital appreciation. Luis V. Sanchez CFA is the Founder and Managing Partner of LVS Advisory. Luis is a licensed Investment Adviser Representative and a CFA Charterholder. LVS Advisory is a Registered Investment Adviser based in Central Florida. LEGAL DISCLAIMER The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, any officer, or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied upon as statements of fact. LVS Advisory LLC is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.