“The desire to perform all the time is usually a barrier to performing over time.” – Robert Olstein

Artificial Intelligence

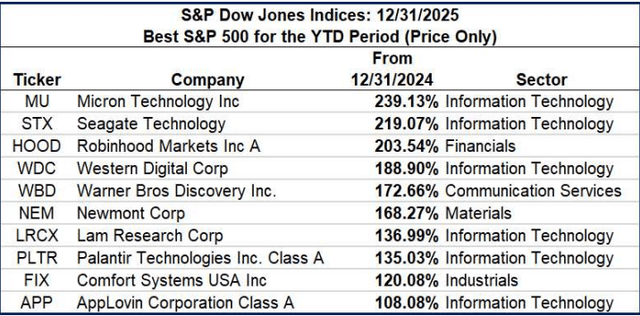

Figure 1: Top 10 S&P 500 Performers for the 2025 Calendar Year

The investment theme of 2025 centered around Artificial Intelligence (A.I.) and the stocks participating in this economic segment. Just as we wrote in our Investor Letter a year ago, the group of stocks with much of the focus were the so-called Magnificent 7 stocks. In 2024, we wrote these seven stocks accounted for over 50% of the return for the S&P 500 Index. In 2025, this same group of seven companies accounted for 42% of the S&P 500 Index return. As reported by S&P Dow Jones Indices, the total return for the S&P 500 Index in 2025 equaled 17.88%, and excluding the Mag 7 stocks, the index’s total return equaled 10.36%. The S&P 500 Index is capitalization weighted, which means the larger companies account for more of the weight in calculating the index’s return. Although the Mag 7 accounted for a large part of the index’s 2025 return, not one of the Mag 7 stocks was in the top 10 for performance. Noteworthy, though, is the amount of technology-related stocks that are represented in the top 10 list, as seen in Figure 1 above.

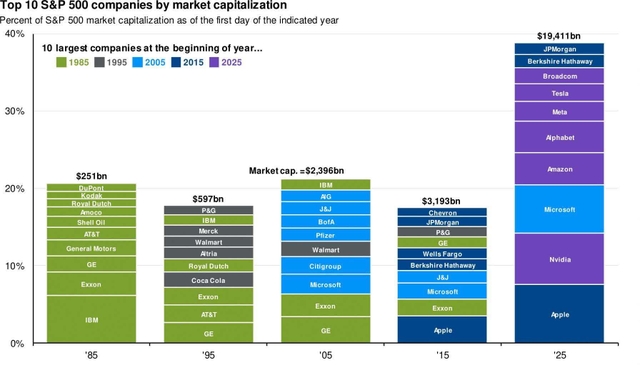

When evaluating the market returns and specifically the S&P 500 Index, it is worth highlighting the concentration of companies in technology-related industries. Of course, the S&P 500 Index includes the Information Technology sector (34.4% of the index), but also the Communication Services sector (10.6% of the index). Included in the Communication Services sector are companies like Alphabet (GOOGL), Meta Platforms (META), and Netflix (NFLX). A number of companies in the Communication Services sector are technology-oriented and are seeking growth through growth in A.I. Over time, history has shown the largest companies in one period or decade tend to lose size status as the economy evolves as seen in Figure 2. With this noted, other market areas and stocks might be attractive return candidates in the coming year.

International Rises to the Top

In reviewing the performance of the equity and bond markets for 2025, the area that rose to the top of performance was international stocks and emerging market bonds. As seen in Figure 3, the iShares MSCI Emerging Markets ETF (EEM) returned 33.7% last year. This compares to the SPDR S&P 500 ETF return of 17.6%. Out of the equity indexes shown on the table, the second and third best performing markets were the iShares MSCI All Country World Index ex U.S. (ACWX), which was up 32.3%, followed by the developed market iShares MSCI EAFE ETF (EFA), returning 31.3%. Contributing to the international returns for U.S. investors was the weak U.S. Dollar, which contributed about one-third of the return. The Dollar declined about 10% in 2025.

The weaker U.S. Dollar could persist in 2026 for a whole host of reasons, with one being the U.S. budget deficit requiring more debt issuance and a Federal Reserve that seems to be on a path to continue its lower interest rate policy. After the last Fed meeting, the Fed seemed to take a more dovish stance with monetary policy, which could lead to more Dollar weakness. A weaker U.S. Dollar is a tailwind for U.S. investor returns in foreign markets.

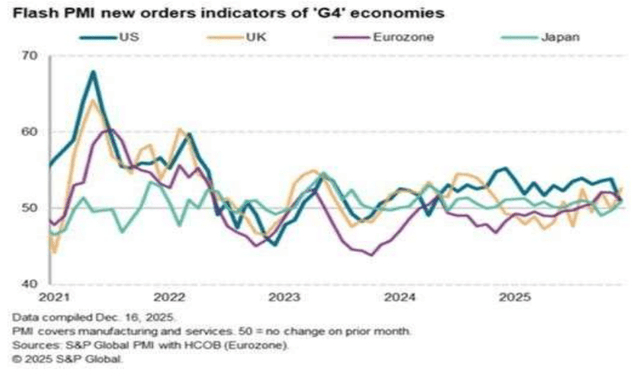

Economic activity outside the U.S. is expanding. Combined Purchasing Manager Indices in countries outside the U.S. are mostly above 50, and this is associated with growing economic activity. Additionally, as seen in Figure 4 and reported by S&P Global, the Flash PMI for new orders reported in mid- December showed “output rising across all four largest developed economies (the “G4”) for an eighth successive month in December.” Noted in S&P’s report is the fact that the U.S. has the weakest new orders PMI.

Source: J.P. Morgan Guide to the Markets

Figure 2: Evolution of the Top 10 S&P 500 Companies by Market Cap (1985–2025)

Figure 3: Comparative Total Returns for Equity and Fixed Income ETFs

Looking Ahead

In the U.S., large company stocks, specifically the S&P 500 Index, have generated strong returns in the three calendar years beginning in 2023. Some investors are concerned this strength foretells a weaker period ahead, sometimes stated as the market reverting to its mean. However, often it is said strengths begets strength, and since 1926, there have been seven other periods where the total return for the S&P 500 was positive in four or more consecutive calendar years. The longest stretch was the period 1991-1999, which was a string of nine consecutive calendar years the S&P 500 Index generated a positive return. So simply because the market has generated strong returns over the past three years, this does not necessarily indicate a down year will follow.

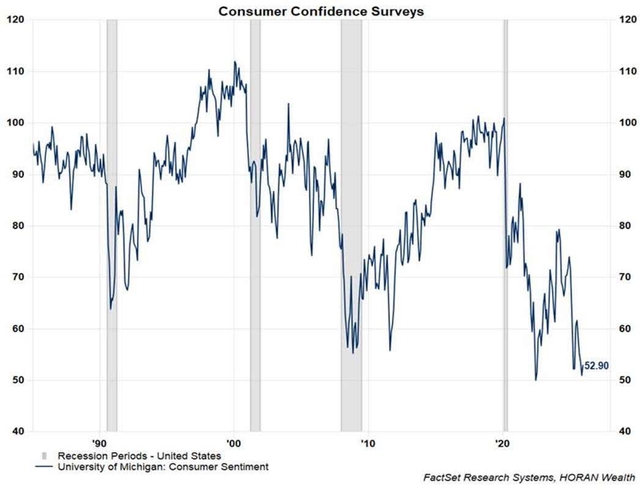

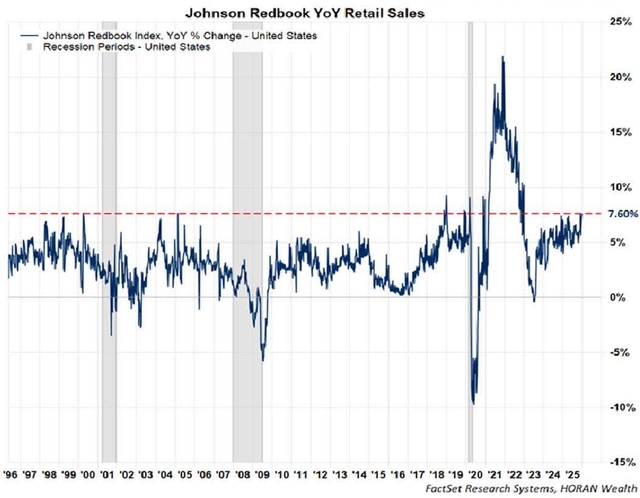

A part of what can contribute to a positive year is a strengthening economy. In the U.S., the consumer accounts for 70% of economic activity. Recent soft news around the consumer suggests a lower level of confidence by the consumer, as noted by the University of Michigan Consumer Sentiment Index. As Figure 5 shows, the index is near its lowest level historically, with a reading of 52.9. Yet, when evaluating the hard data or the actions of consumers, like retail sales, one arrives at a more positive view of the consumer. One data point is the Johnson Redbook Index, which measures year-over-year same store sales growth of U.S. general merchandise retailers. This measure captures approximately 80% of the retail sales data that is also collected by the U.S. Department of Commerce. As Figure 6 shows, the December year-over-year retail sales growth in the Johnson Redbook report equals 7.6%, near a record high going back to the mid-1990s. In short, although the consumer is expressing less optimism, their actions seem to suggest otherwise.

Figure 4: Global Flash PMI New Orders: G4 Economy Demand Comparison

Figure 5: Long-Term Trends in the University of Michigan Consumer Sentiment Index

The consumer strength was validated in the initial estimate of third quarter real Gross Domestic Product (GDP) reported in late December. In the report, GDP increased at an annual rate of 4.3%. Consumer spending was cited as one reason for the strength. Also highlighted in the GDP report by Piper Sandler, “what was really striking was the 8.2% quarter-over-quarter (QoQ) annual rate increase in nominal GDP, with the GDP price deflator up a strong 3.8% QoQ, lifted by the capex, equipment and intellectual property components (i.e., strong A.I. investment).”

Earnings as an Important Driver

One aspect of the equity market (S&P 500 Index) that has evolved over the past number of years is stocks are trading at higher valuations or price earnings multiples (P/Es).

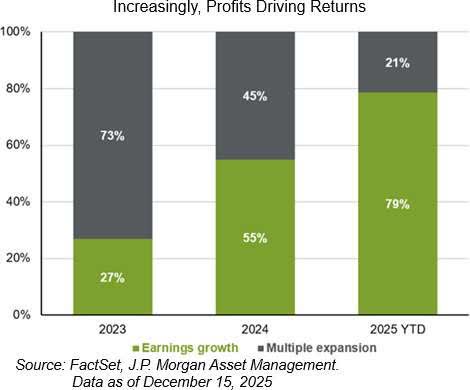

As 2026 unfolds, earnings growth likely becomes an important driver of a positive returning equity market as seen in Figure 7. At the time of writing, analyst expectations are S&P 500 earnings will be up 15.6% in 2026. Assuming fourth quarter meets expectations, 2025 earnings will be up 13.3% after 2024 earnings were up 12.1%. With strong expected earnings growth in the coming year, stock returns could follow a similar path.

Figure 6: U.S. Retail Sales Growth Trends: Johnson Redbook Index (YoY)

Figure 7: Drivers of S&P 500 Returns: The Shift from Multiples to Earnings (2023–2025)

Conclusion

For the past few years, much of the investment conversation has centered around the group of stocks referred to as the Magnificent 7. Importantly, though, and as noted earlier in this Investor Letter, other market areas have performed better than just the Magnificent 7 and the S&P 500 Index for that matter. Broadly, the international markets have led performance with a large percentage of the outperformance coming from the weaker U.S. Dollar. Signs of further broadening in the market are seen with indexes like the S&P 500 Equal Weighted Index. In December and into the first full week of trading this year, the equal-weighted S&P 500 Index has hit new all-time highs. This is partially a sign that smaller-sized companies in the S&P 500 Index are contributing to the index’s performance.

Additionally, there is the potential for investor disappointment and, in turn, volatility. 2025 was a story about two halves when it came to volatility. The first half of the year had a drawdown in the S&P 500 of more than 20%, with the Magnificent 7 correcting even more. The market would then recover its losses within the following 80 trading days. Within the second half of 2025, markets drifted higher with little to no downside volatility. 2026 may experience a similar whiplash and still could end the year with positive returns. As previously mentioned, the current expectation is that net earnings for the S&P 500 will grow 15.6% in 2026, which is above the 25-year average of 10.5%. A revision of these estimates downward would cause a market correction, not too dissimilar to the correction the market experienced in the first half of 2025.

However, there are several economic themes that would suggest a continuation of the current bull market. As further rate cuts are expected from the Federal Reserve in 2026, which is indicative of a more dovish Fed, this action typically is associated with a slow-growth economy or one coming out of recession. In environments like this, typically cyclical stocks and more value-oriented ones lead in performance. With this noted, 2026 might be a year where rotation into these underperforming high-quality stocks occurs. It is not to say the A.I. trade is over, but entering an environment where broader participation is a factor for investors to be mindful of.

Thank you for your continued confidence and support in HORAN Wealth, and we are always available to answer your questions and discuss our outlook further. Please be sure to visit us for company news, reports, and our blog at https://horanwealth.com/insights.

Respectfully,

HORAN Wealth

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.