Summary

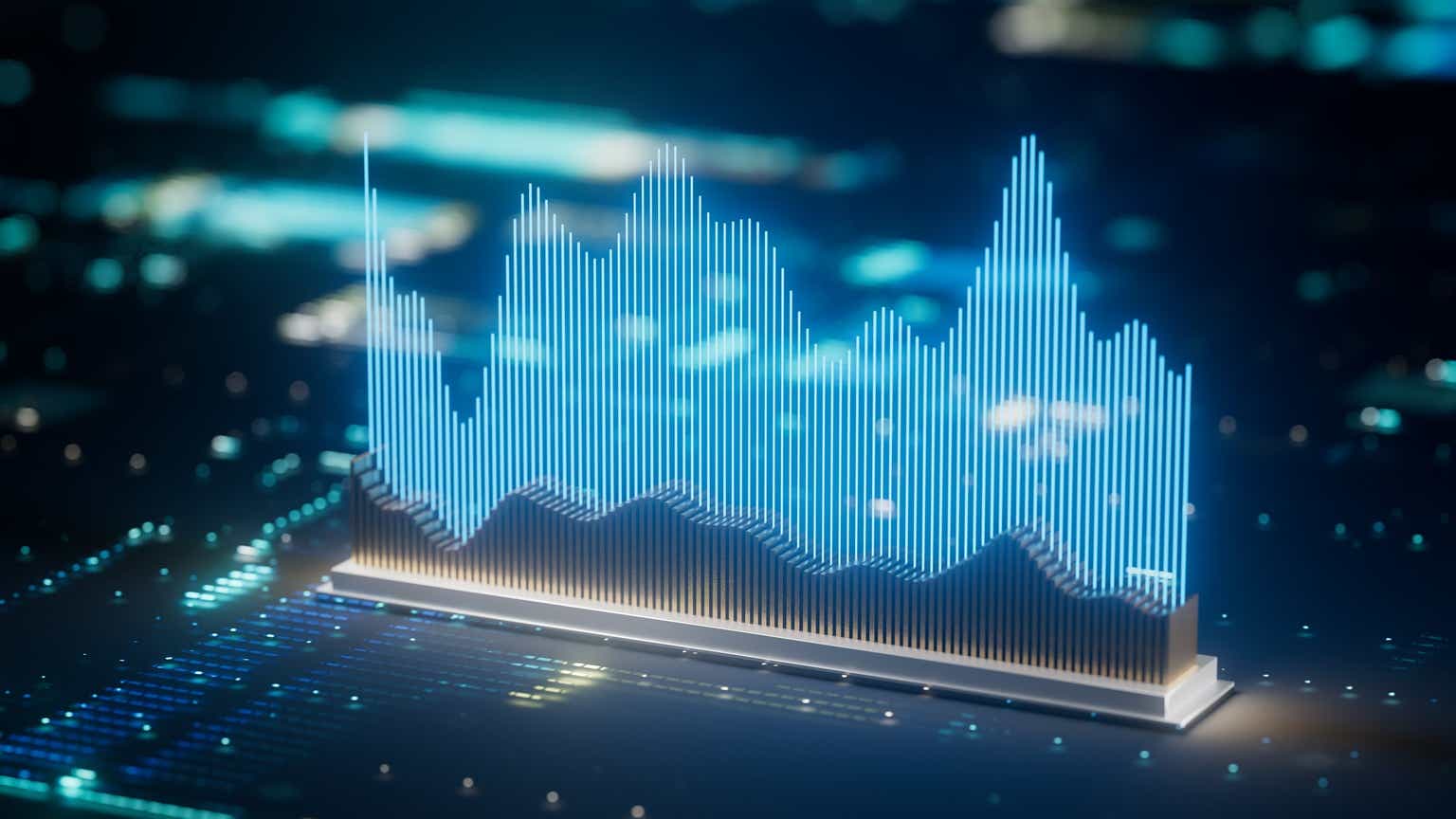

- China’s re-rating this year, driven by stimulus measures and policy reforms, could lead to increased global flows to the country’s equity market.

- Beyond more well-known themes like China Internet, we are seeing significant potential catalysts this year in China’s STAR Market, health care, and clean technology, and, in some cases, these themes are outperforming the broad benchmarks.

- China’s health care market has immense growth potential.

China’s re-rating this year, driven by stimulus measures and policy reforms, could lead to increased global flows to the country’s equity market, the second-largest in the world. Hong Kong’s Hang Seng Index is up +28.91% year-to-date (YTD) as of August 22, 2025, while the Shanghai

Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. KraneShares offers innovative investment solutions tailored to three key pillars: China, Climate, and Uncorrelated Assets. Our team is determined to provide industry-leading, differentiated, and high-conviction investment strategies that offer access to key market trends. Our mission is to empower investors with the knowledge and tools necessary to capture the importance of these themes as an essential element of a well-designed investment portfolio.