Cap rates are one of the best indicators of forward returns in REITs. It is not 1 for 1 in the sense that a 5% cap rate does not translate to a 5% forward return, but a higher cap rate at purchase will, all else equal, result in higher forward returns.

Generally speaking, it is a bad time to buy REITs when they are trading at low implied cap rates and a good time to buy when they are trading at high implied cap rates. We will show this has borne out in recent history, but let us first define implied cap rate as this is a term that is rarely used outside of dedicated real estate professionals.

A cap rate is the NOI of a property divided by its price.

The implied cap rate of a publicly traded stock is the NOI of the properties owned by that company divided by the enterprise value (including debt) of the company.

Each individual REIT has its own implied cap rate, but today we will be looking at the median implied cap rates of REITs as an entire sector and then breaking that down to the median cap rates of the individual property subsectors.

Buy high implied cap rates, not low implied cap rates

Recall that REITs, as measured by the Vanguard REIT ETF (VNQ), peaked at the end of 2021 and have had a rather dismal performance since then.

SA

Well, much of the weak performance is related to valuation.

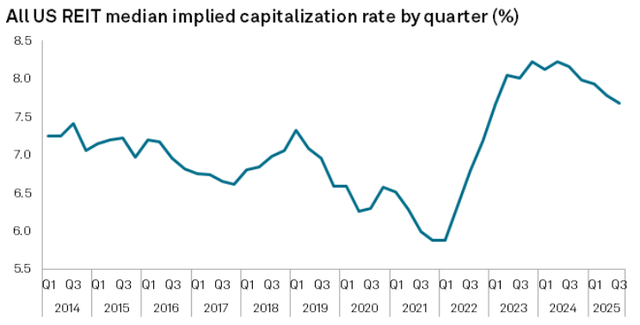

At the end of 2021 REITs were trading at an implied cap rate of about 6%

S&P Global Market Intelligence

That is a low implied cap rate by historical standards.

REIT investors were excited by the prospects of steady contractual revenues in the face of an otherwise 0% interest rate environment.

Hindsight is, of course, 20/20, but it is now clear that people were overpaying for most fixed income investments because that pricing only made sense if interest rates stayed very low.

As it turns out, the 10-year Treasury yield rose from 1% to fluctuating around 4%.

Tradingeconomics

Those real estate investments at a 6% cap rate looked great relative to a 1% treasury yield, but not so great compared to a “risk-free” 4%.

Therefore, the valuation had to correct.

Many people are baffled that I could be bullish on real estate given that the stocks have done so badly for 5 years.

I think the key is understanding why they performed poorly. Underlying real estate fundamentals have generally been solid. It was a valuation issue. Valuation overshot to the upside in the 2021 excitement and now it has overshot to the downside.

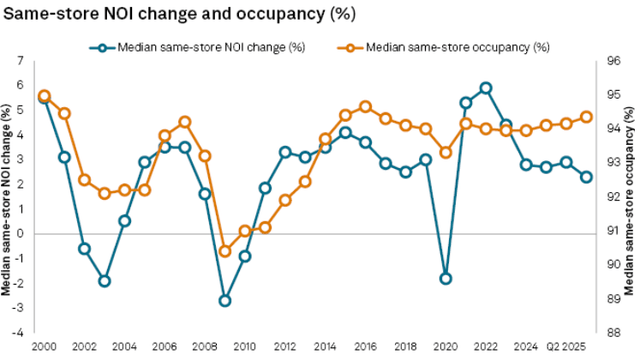

The median REIT implied cap rate now sits at 7.7%, which represents a very healthy spread over the Treasury yield. NOI has been growing nicely, and occupancy is approximately full.

S&P Global Market Intelligence

The 7.7% NOI yield in combination with steady NOI growth implies an above market return for REITs broadly given current valuation.

Within real estate, some areas look much better than others:

- Public better than private

- Retail and industrial better than average

- Self-storage worse than average

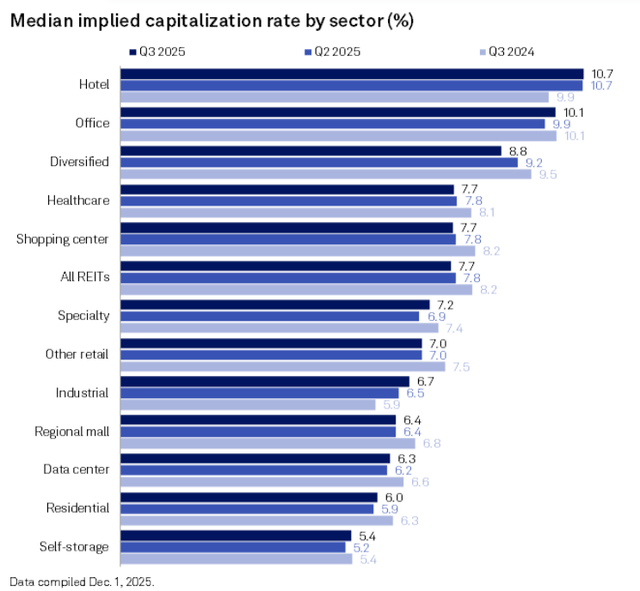

Again, looking at implied cap rates, we can break them down by property type.

S&P Global Market Intelligence

The above cap rates are for the publicly traded REITs. Buying the REITs is functionally buying the underlying real estate at the given implied cap rate.

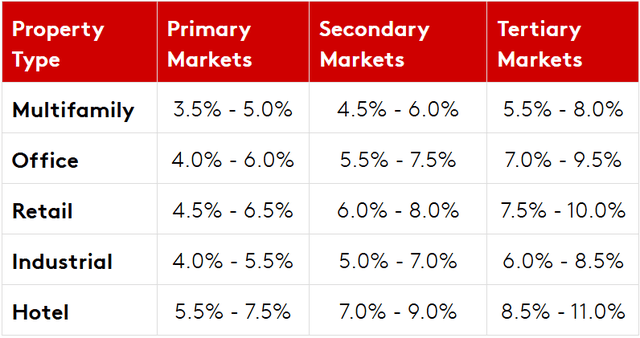

In contrast, private real estate is transacting at much lower cap rates.

Loopnet

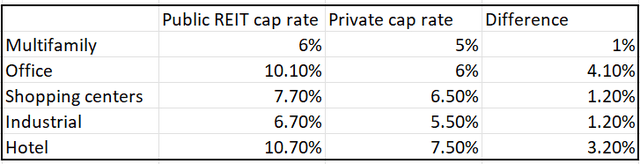

In each sector, the public REITs are trading well below the private value of their underlying real estate (higher cap rate). Note that REITs overwhelmingly operate in primary markets with modest exposure to secondary and just a hint of tertiary. We compare these numbers in the table below:

2MC

When real estate is trading at higher cap rates than REITs, it could make sense to buy real estate directly. If you have the expertise to manage it, one could reasonably get a higher return.

Similarly, when REITs are trading cheaper than real estate, it generally makes more sense to buy the REIT.

At the present valuation, I think public will substantially outperform private going forward.

Property types

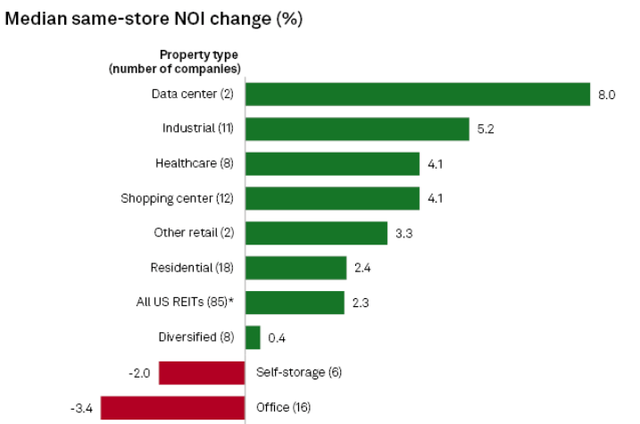

Growth, much like cap rates, also varies by sector.

In a world of proper or efficient pricing, higher growth would map to lower cap rates. Data centers largely make sense as they are trading at among the lower implied cap rates (6.3%) while also having faster NOI growth (8%).

On the other end of the spectrum, office also looks about right with very high cap rates (10.1%) and negative growth (-3.4%).

There are 3 property sectors that stand out as materially mispriced:

- Industrial (high growth and moderate cap rate).

- Shopping center (high growth and above average cap rate).

- Self-storage (negative growth and low cap rate).

S&P Global Market Intelligence

I think the mistake the market is making in pricing industrial REITs is that it is looking at market rental rates which are indeed low growth presently due to the wave of supply. Missing in that calculation is the huge gap between existing lease rates and market rates. Thus, measured NOI which is what is used for cap rates is far below stabilized NOI. As NOI stabilizes, I think it will be clear that industrial was underpriced at this valuation.

Shopping centers are not getting credit for their high pace of NOI growth because it has not yet translated into strong AFFO/share growth. REIT investors are focused on AFFO per share in the same way that broader market investors are focused on earnings per share.

It is a good metric, but it doesn’t tell the whole picture. Retail AFFO/share growth is held back by SNO leasing (leases that are signed but not open). Many of the shopping centers have hundreds of millions of annual base rent currently under contract but not yet commenced. As it contractually commences the AFFO/share growth will arrive and the shopping center REITs will look significantly undervalued.

Finally, self-storage valuations are just crazy right now. The sector is woefully oversupplied. Unlike other property sectors that have secular demand to eventually fill in the supply, self-storage demand is a bit of an unknown. Utilization rates among the general population fluctuate and not in a predictable way.

There is real potential for the sector to be permanently oversupplied so it just seems crazy to value the properties at a 5.4% cap rate. Invest with extreme caution.

Overall, I think REITs are positioned to outperform due to a relatively high implied cap rate coinciding with healthy organic growth. A broad ETF like VNQ should be a reasonably good investment, but I think one can do even better by overweighting the sectors with more favorable combinations of value and growth.

The 2nd Market Capital High Yield Portfolio (2CHYP), with live updates in Portfolio Income Solutions, is significantly overweight industrial and retail while having 0 exposure to self-storage.