Fall 2025 Market Commentary

Despite geopolitical upheavals, tariff and trade uncertainties, global equity markets had a very strong third quarter. The US economy and market have been boosted by a pause in punitive tariffs and a robust capital investment boom in Artificial Intelligence (AI). By some measure up to half of the 3.8% gain in GDP was attributable to tech capital spending. A surge in global defense outlays have helped boost the aerospace and defense industry. The weakest dollar since 1973 has aided export heavy US multinationals and our foreign stocks. Cheap gasoline is helping consumers with the lowest price at the pump in five years nearing $3 a gallon. Foreign direct investing into the US is now the highest since 2022. All the major indexes ended the quarter higher with the tech-focused Nasdaq Composite up 11.24%, the S&P 500 gaining 8.12% and the Dow up 5.67%. The equal weight S&P was up 4.84% and the Russell 1000 Value up 5.33%. The passage of favorable tax legislation in July and an interest rate cut in September provided further support for equities, especially smaller stocks. FactSet estimates that S&P 500 companies will report third-quarter earnings growth of more than 10% year-over-year, down from 12.7% in the second quarter. The S&P 500 has a trailing P/E of 30.73 and a forward P/E of 23.38. The dividend yield is 1.15%.

Risks

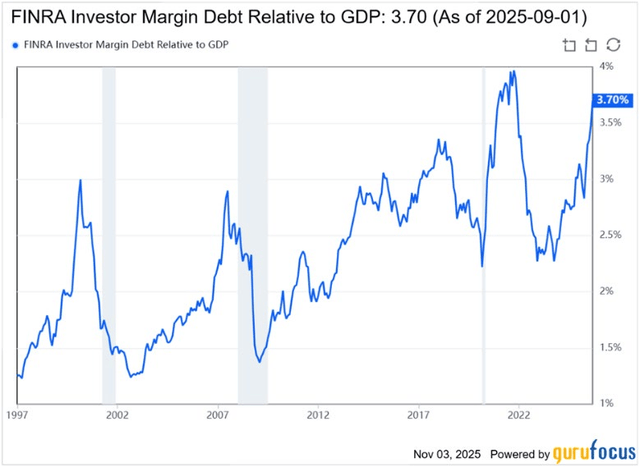

Growing sovereign debt levels together with unregulated borrowing in the “shadow banking” arena are worth monitoring. Non- deposit financial institutions (NDFIs) now account for 50% of all financial services, and 33% of commercial and industrial loans. These loans are lightly regulated and opaque in nature. The recent bankruptcies of NDFIs First Brands and Tricolor led to losses that shocked the lending banks. Another sign of growing excess in lending is the recent $55 billion Electronic Arts (EA) leveraged buyout at 27 times operating cash flow. This is the largest leveraged buyout since Texas Utilities in 2007. That buyout was priced at $45 billion and a price-to-operating cash flow of 8.5 times. It ultimately went bankrupt. In addition, there has been a proliferation of levered exchange-traded funds (ETFs) with the latest being 5x levered. These products can add to volatility, especially on the downside. Another sign of speculation is the zero-revenue story stock like nuclear power startup Oklo (OKLO) which hit a $20 billion valuation with no sales or earnings projected until at least 2027. We saw this take place in 2021 when electric truck maker Nikola (NKLA) came public at $15 billion with no sales or earnings. It failed. Rivian (RIVN), another highly touted EV maker, came public at $100 billion only to ultimately plunge 90%. Over 400 Chinese EV companies failed between 2018 and 2024. In a recent October report Morningstar found that unprofitable stocks in the Russell 2000 were up 55% year- to-date compared with 8% for those with profits. Margin debt as a percentage of US GDP has surpassed the highs of the Dotcom and 2008 financial crises and is near all-time highs. As of September, margin debt is up 38.5% year-over-year to $1.13 trillion.

Global central banks have also been cutting rates with Bank of America reporting a total of 312 cuts so far this year, the second-most in the last 25 years. This together with a weak dollar has boosted foreign equities which are outperforming the US for the first time in several years. While central banks have been lowering rates they have also been aggressively buying gold, contributing to huge gains in the precious metal. In 2022, 2023 and 2024 banks bought just over 1000 tons each year. The previous 10-year average was 400-500 tons. Source: World Gold Council.

Global Tensions Boost Aerospace and Defense Industry

Tensions from long-running conflicts around the world have been a boon for aerospace and defense companies due to a rise in military spending partially driven by President Trump. The United Nations reported that $2.7 trillion was spent on militaries in 2024 and they project that this could grow to $6.6 trillion annually by 2035. All 15 of the world’s largest military spenders increased their budget last year. Aerospace and defense companies are included in the industrials sector of the S&P 500 which has been the third best performing sector year-to-date in the index behind only the communications and technology sectors. The S&P Aerospace & Defense Select Industry Index outperformed all the major stock market benchmarks during the third quarter, up 11.92%. In the US companies like RTX (RTX), Boeing (BA), Parker Hannifin (PH) and Lockheed Martin (LMT) have benefited from this increased global spend and have recently raised their financial guidance for 2025. The US is currently proposing a record budget of $1.01 trillion for 2026.

Third Quarter 2025 Performance Update

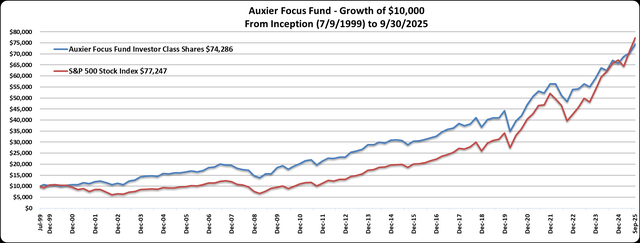

Auxier Focus Fund’s (AUXFX) Investor Class gained 5.35% in the third quarter of 2025. For the same period the S&P 500 cap-weighted index and the equal weight returned 8.12% and 4.84% respectively. The Russell 1000 Value was up 5.33%. Year-to-date equities in the Fund gained 14.31%, while the Fund returned 12.96%, vs 14.83% for the S&P 500. For the quarter, fixed income investments as measured by the S&P US Aggregate Bond Index returned 2.00% and the longer-dated ICE US Treasury 20+ Year Index declined 2.47%. Stocks in the Fund comprised 95.10% of the portfolio. The breakdown was 86.10% domestic and 9.0% foreign, with 4.9% in cash and short-term debt instruments. A hypothetical $10,000 investment in the Fund since inception on July 9, 1999 to September 30, 2025 is now worth $74,286 vs $77,247 for the S&P 500 and $61,839 for the Russell 1000 Value Index. For the same period, equities in the Fund (entire portfolio, not share class specific) have had a gross cumulative return of 1,161.49%. The Fund had an average exposure to the market of 83% over the entire period. Our results are unleveraged.

Auxier Focus Fund – Investor Class Average Annual Total Returns (09/30/2025)

Contributors

The combination of robust capital spending on Artificial Intelligence, incentives for rebuilding the US industrial base, reshoring and increased defense outlays boosted the performance of industrial stocks. Aerospace and defense companies like RTX and General Dynamics (GD) benefited. Corning (GLW) CEO Wendell Weeks has generated terrific returns over the past decade since we bought the stock. The company is enjoying strong demand for their optical communication products that are being used in fiber optic cables and AI data center connectivity. The massive infrastructure buildout that is taking place to expand data center capacity has boosted demand for Caterpillar’s (CAT) traditional machinery as well as their power solutions products like generators. Big bank stocks like Citigroup (C) and Bank of New York (BK) combine solid execution with low valuations versus the industry.

The information technology sector also continues to perform well. Companies like Alphabet (GOOGL), Microsoft (MSFT) and Meta Platforms (META) are putting up exceptional growth in the areas of cloud computing, AI and digital advertising. Alphabet’s Google Search grew 14.5%. YouTube is dominating the media landscape with ad revenue up 15%. Google reported 34% growth in its cloud unit while Microsoft’s Azure revenue saw a remarkable 40% increase since a year ago. Elsewhere, higher margins due to favorable oil prices are boosting refinery stocks. Lower input prices have allowed companies like Valero Energy (VLO) and Phillips 66 (PSX) to expand cash flows as they benefit indirectly from AI infrastructure buildouts that require significant usage of heavy machinery.

Detractors

Consumer-facing businesses have suffered from tariffs and a persistently high inflation rate, up 3% in September–the highest since January. Restaurants and the Food and Beverage industry as a whole have struggled. Alcohol consumption is the lowest in 90 years, impacting Diageo (DEO) and Molson Coors (TAP). Wineries and other farms are getting hit hard. The 20-35 age group is saddled with resumed student loan payments, high housing costs and the dearth of jobs for recent college graduates. Ironically, these businesses tend to be some of the most enduring franchises with high returns on equity, nominal mandatory capital spending and attractive dividend and free cash flow yields. For that reason, as well as the attractive valuations, we anticipate more mergers and acquisitions in the entire staples space.

In Closing

While the major capital investment cycle in AI seems to be dominating the market, it is not the first time we have seen this. We can remember prior booms like the surge of personal computer IPOs in 1983 or the tech-telecom-media binge in 1999; these led to a concentrated buying frenzy followed ultimately by a supply glut and permanent capital loss for investors. Our focus is on compounding returns and knowledge. We are aggressively studying the disruptive impact of AI on businesses and industries as we seek double-play investment opportunities.

We appreciate your trust.

Jeff Auxier

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.