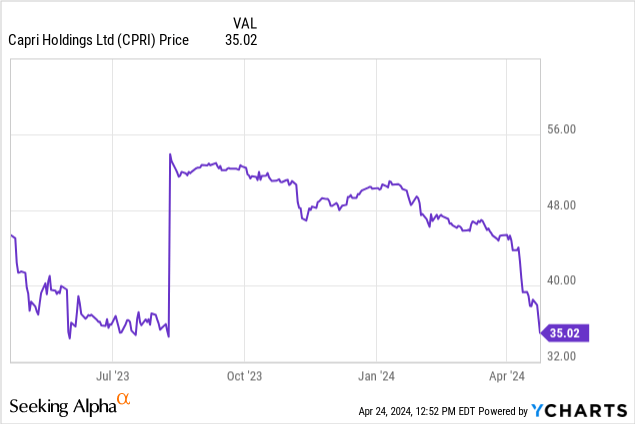

Tapestry announced its intention to acquire Capri Holdings for $57/share on August 10, 2023. The Federal Trade Commission moved to block the deal on April 22, 2024. Tapestry disputes the FTC’s conclusions. As such it’s likely the case will proceed to court and a judge has been assigned.

A Preliminary Valuation

Before the Tapestry offer, Capri was trading at around $35/share compared to a $57/share cash acquisition price. However, Capri’s results have been weak since. Now the shares are back at $35, suggesting the markets see limited prospects of the deal closing. Immediately after the offer, Capri shares touched $53/share.

Background

Anti-trust policy under the Biden administration has been aggressive. A number of cases have been bought to stop transactions that might have previously been approved under a different administration. Tim Wu’s book The Curse of Bigness: Antitrust in the New Gilded Age, though mostly about the tech industry helps explain the administration’s position.

Specifically there is a desire to roll-back the thinking of the Chicago School which has prevailed for decades with more of a focus on price and free market efficiency and re-shape anti-trust policy toward a broader conception of market power and consumer welfare. Wu and others argue that this might be anti-trust returning to its roots, but either way it’s a big shift.

Recently, the administration via the Department of Justice and FTC has bought many anti-trust cases. Often these have not succeeded, but they did receive a favorable ruling blocking JetBlue’s acquisition of Spirit earlier in 2024.

The FTC’s Argument

The FTC’s argument, at least at this stage, has the following elements:

- Michael Kors (one of Capri’s key brands at over 70% of revenue) is a close competitor to Coach and Kate Spade (owned by Tapestry).

- Tapestry would become dominant in the “accessible luxury” handbag market.

- The acquisition may negatively impact a combined 33,000 employees

Tapestry disputes this stating that the markets they compete in are, “intensely competitive and highly fragmented” and that they are “providing industry-leading wages and benefits for our employees.”

What Next?

There is some timeline risk to close the transaction. The merger agreement is set to expire on August 10, 2024, but can be extended in three-month increments due to legal challenges such as this. That may be necessary.

Historically trials have taken roughly 3 to 8 months (looking at Staples, Whole Foods and Sysco cases) from the date of the FTC’s complaint, so legal proceedings may conclude at some point between July and December 2024 barring an unexpectedly slow or fast outcome. It appears unlikely that the deal will fail to close because of the length of the trial.

Handicapping the Trial Outcome

The merger could be blocked on any one of the FTC’s three major issues, or any they add a trial. Let’s assume they have already stated their main arguments. However, there is some suspicion that the FTC may have other “hot docs” or evidence of executives discussing anti-competitive behavior which could help their case.

| Argument | Probability of success | Notes |

| Michael Kors is a close competitor to Tapestry brands | 10% | This appears a stretch, there are many luxury brands with considerable consumer choice and the market appears relatively vibrant and competitive (note 1) |

| Tapestry would become dominant in accessible luxury handbags | 30% | This appears (relatively speaking) the strongest argument that the FTC has, especially if it can land this market definition in the trial, though even here significant consumer choice would remain after the acquisition in a relatively fluid market and the judge must accept that “accessible luxury” handbags is a valid market definition, which he may not (note 2) |

| 33,000 employees would be harmed | 5% | This is a novel argument and doesn’t appear to have much legal precedent. It may be challenging to prove harm here. However, the power of the FTC/DoJ would be increased significantly if this succeeds so it may make sense for them to include it, even with a low chance of success. |

If you believe the probabilities above and that they are independent, you then get a 60% chance that the deal proceeds (i.e. all the arguments fail in court).

(note 1) Luxury brands prevalent in U.S. and Europe – Ted Baker, Burberry, Dior, YSL, Furla, Rebecca Minkoff, Longchamp, Coach, Marc Jacobs, Tory Burch, Kate Spade, Prada, Hermes, Gucci, Chanel, Louis Vuitton, Bottega Veneta etc. (note that several of these brands are owned by LVMH, increasing concentration somewhat)

(note 2) Accessible luxury handbag brands – Burberry, Coach (Tapestry), Michael Kors (Capri), Kate Spade (Tapestry), Tory Burch, Longchamp, Furla, Rebecca Minkoff, Marc Jacobs, Ted Baker, Fossil etc.

The Judge

The judge assigned to the case, John Koeltl, has dismissed an antitrust case in 2019, based on alleged collusion between art museums. Though that decision was more a procedural matter, and this case likely has more merit coming from the FTC.

Implied Value Of Capri

Capri’s results have weakened for the fiscal year ending April 2023 with a 12% decline in segment level operating income and a 25% decline after corporate costs compared to 2022. Hence crudely, if the stock wasn’t trading on the deal probabilities it might be off -18% on weaker profit expectations. That suggest the stock might be trading for $29/share (very approximately) without the prospect of a Tapestry offer.

Resulting Valuation – $43/share

| Scenario | Probability | Share Price |

| Deal Succeeds In Court | 60% | $57 |

| Deal Blocked In Court | 40% | $29 |

Implied ‘expected value’ = (60% x $57) + (40% x $29) = $46/share

Discounted at 6.5% assuming 8 months to close at 10% annual discount rate: $43/share (22% upside from $35)

Conversely with today’s share price of $35, after reflecting the time value of money, the market implies a 29% chance of a legal win on the above framework. (Though of course the market may be factoring in other scenarios too).

Conclusion

Capri holdings appears an interesting, if unspectacular, investment today. A 22% estimated return, given its potential to diversify a portfolio given the risks are likely less correlated with the broader market is somewhat attractive, especially with legal proceeding as an obvious catalyst (though downside risk too). The FTC and DoJ continue to push the envelope on antitrust policy and this is another attempt. It may succeed, but it seems most likely it will not.

Now may be an opportune time to start building a position in Capri, though it may be prudent to leave some ‘space’ with position sizing as newsflow might create a superior opportunity in the coming months assuming the trial proceeds as planned.

Risks

- There is some risk that Tapestry decides to walk away from the deal. That could lead to a loss for Capri investors.

- Of course, it’s quite possible that Tapestry loses in court. A lot will come down to the decision of a single judge and what other evidence emerges, and though the legal system should theoretically be consistent, outcomes are hard to predict.

- Capri’s operating performance may continue to deteriorate leading to increased downside if the deal breaks.

- If the above analysis is correct, there is a 40% chance of a loss for equity holders.

- Tapestry may agree to an out-of-court settlement with the FTC (such as selling certain Capri brands, for example) this may lead to a lower price for Capri shareholders.

- There are other scenarios where the trial does not conclude that are not covered in the table above. Most of these are potentially bad outcome for Capri shareholders.