Introduction

Valaris Limited (NYSE:VAL) is an offshore drilling company that leases rigs and drillships to energy giants like Shell and Exxon. Its stock trades at a steep discount to its intrinsic value – largely due to the industry’s collapse during COVID, when many drillers went bankrupt and assets were handed to creditors.

Today, Valaris has a stronger balance sheet and one of the youngest, most advanced fleets – positioned to benefit as deepwater drilling regains momentum. With stable oil demand, rising cost competitiveness, limited rig supply, and long newbuild lead times, day rates (daily rental costs of rig operation) are expected to climb.

As of this writing, 8.6% of Valaris’s public float is sold short, and only one out of eight analysts covering the stock has a “Buy” rating. It now trades at a steep discount to both replacement value and future free cash flow potential. With low valuation, new capital structure, rising demand, constrained supply, and improved industry discipline, Valaris could deliver a 3-7x return over the next 3-5 years.

Industry and Company Intro

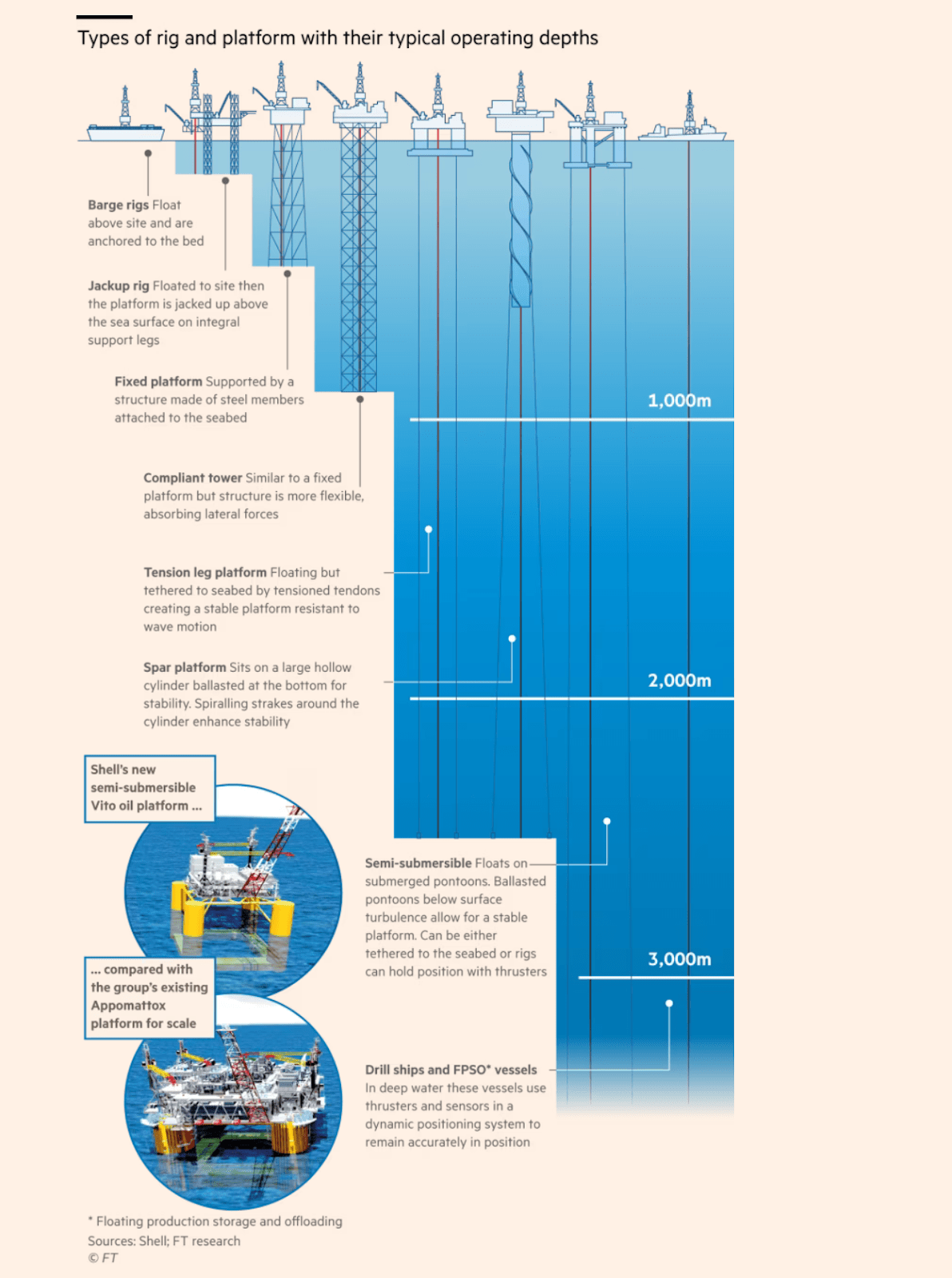

A key factor in understanding why deepwater offshore drilling is growing in importance relates to its cost competitiveness vs. other methods of oil extraction. According to different estimates, the breakeven price has fallen to $30–$43/barrel. This makes deepwater drilling cheaper than U.S. shale. I will also note that offshore drilling is already a vital component of the world’s oil production mix. As of today, it accounts for around 30% of the total amount, of which deepwater drilling accounts for 6-7% of the world’s total supply. Offshore drilling occurs in different depths and environments: shallow (<125m), deep (400–1,500m), and ultra-deepwater (>1,500m) zones.

Source: FT

The depth and the condition of the sea would determine the type of platform being utilized. Industry analysts divide the oil rigs into