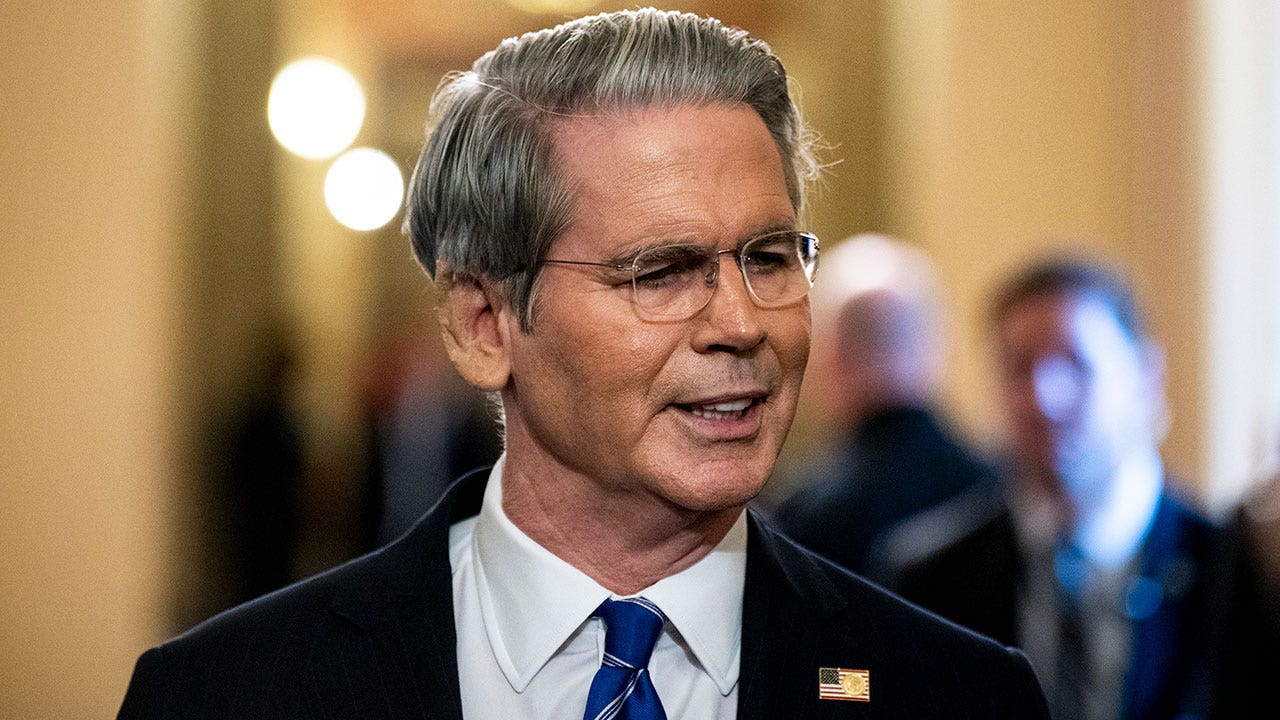

Treasury Secretary Scott Bessent said Tuesday that the Trump administration will begin its interview process for prospective nominees to serve as chair of the Federal Reserve after Labor Day.

Bessent was interviewed on CNBC’s “Squawk Box” and said that there are currently 11 candidates under consideration for the role, including a group of contenders who currently or previously worked at the Fed.

“In terms of the interview process, we’ve announced 11 very strong candidates,” Bessent said. “I’m going to be meeting with them probably right before, right after Labor Day, and to start bringing down the list to present to President Trump.”

He said that it’s “an incredible group” and it’s “people who are at the Fed now, have been at the Fed, and private sector,” adding that “I look forward to meeting them all with a very open mind.”

BESSENT OUTLINES THE QUALITIES HE’S LOOKING FOR AS HE VETS TRUMP’S FED SHORTLIST

Potential contenders for the chairmanship include Fed Governors Michelle Bowman and Christopher Waller, White House National Economic Council Director Kevin Hassett and former Fed Governor Kevin Warsh.

Those four were initially believed to be frontrunners, though the field has since expanded to include Fed Governor Philip Jefferson, Dallas Fed President Lorie Logan, as well as former Fed governor Larry Lindsey and former St. Louis Fed President James Bullard.

Rick Rieder, BlackRock chief investment officer for global fixed income, David Zervos, chief market strategist for Jefferies and Mark Sumerlin, former deputy director of the National Economic Council, are also under consideration.

TRUMP SAYS FED CHAIR SEARCH DOWN TO ‘THREE OR FOUR’ CANDIDATES, WITH ANNOUNCEMENT COMING ‘A LITTLE BIT EARLY’

Fed Chair Jerome Powell’s term as chairman is set to end in May 2026, though the Trump administration may nominate his successor sooner to signal a more dovish monetary policy is on the way.

President Donald Trump and his allies have been lobbying the Fed to cut interest rates in the hopes of spurring economic growth and lowering the cost of servicing the more than $37 trillion national debt.

The treasury secretary warned that the current level of interest rates is creating some issues in the housing market as well as for “low-income households with high credit card debt.”

MARKETS NOW BETTING FED WILL CUT RATES IN SEPTEMBER AFTER DISAPPOINTING JOBS REPORT

“We’re seeing this big capex boom, part of it’s AI, part of it’s the tax bill. So capex is doing well, but households, homebuilding is struggling,” Bessent noted.

Bessent said in the interview that he believes the Fed should cut interest rates by 50-basis-points – which would be larger than the 25-basis-point reduction that the market has anticipated – in an effort to spur the housing industry.

“If we keep constraining home building, then what kind of inflation does that create one or two years out? So a cut here could facilitate a boom or a pickup in home building, which will keep prices down one, two years down the road,” Bessent said.