“Run Clubs Are the New Dating Apps”

“Speed Dating Is Making a Comeback”

“Upside Down Pineapples to Find Love”

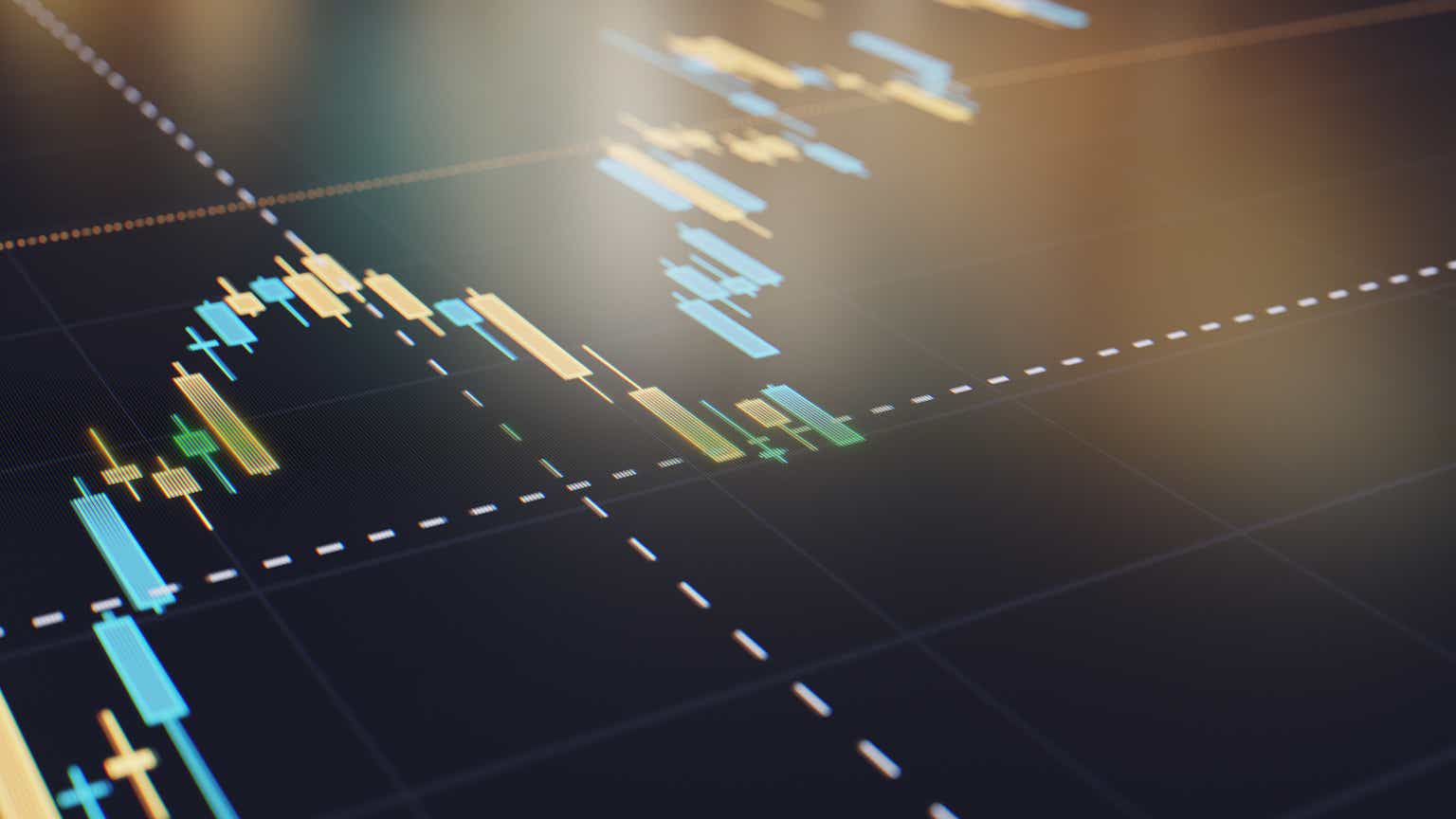

These are all real headlines in 2024 that describe the state of the online dating market but more importantly, investor expectations. Having previously sold our Match Group (MTCH) position during the pandemic craze, when investors had pushed the shares to 70x forward earnings, we have re-entered the segment at less than a tenth of that valuation. Just as analysts had over-extrapolated user growth during the pandemic, we now believe that they are too heavily discounting their long term prospects.

Instead of relying on viral news stories, we thankfully have access to hard data from third party agencies. We will focus on the US as it’s the most important market in terms of revenue for all major dating apps. Although download growth has been negative for the past year and a half(and users and time spent per day have been declining), we believe that this is a temporary headwind primarily caused by the shift in society moving back to in person settings. From a longer term perspective, dating app downloads have actually remained remarkably stable over the past five years at 3.5 million per month. If we remove Grindr (GRND) from the category(as it does not focus on heterosexual relationships), we note that the online dating market is essentially unchanged over the past five years with just Tinder, Bumble (BMBL) and Hinge increasingly dominant.

This type of consistency is not surprising, although there are hundreds of new dating apps that launch each year, virtually none make it beyond their initial marketing push due to the nature of the industry’s network effects. With more than a decade having passed, investors forget that in order to gain scale, Tinder, the first successful mobile dating app, had to subsidize an entire team of women travelling across the country ‘ touring college campuses to advertise the app with pizza parties and free thongs.’ And who headed this viral marketing? Whitney Wolfe Herd, the soon to be founder of Bumble.

Herd left Tinder after two years in 2014 to found Bumble; positioning it as a female friendly alternative to Tinder, with its initial growth hack of only allowing women to initiate the conversation after matching. The company went public in 2021, making Herd the youngest female self-made billionaire in history. It was a feel good story that everyone enjoyed, (except perhaps Tinder owner, Match Group, which had tried to both buy Bumble and also sue it for copying Tinder’s design; the lawsuit has now been settled). Although revenue proceeded to double from its IPO to over a billion dollars today, growth has not lived up to the lofty expectations that pandemic investors expected.

Herd stepped down as CEO in late 2023 and became executive chair as part of a larger senior leadership shakeup. In February 2024, the company took a page from Zuckerberg’s year of efficiency and announced that they were laying off 30% of the workforce, wisely removing management layers to accelerate decision making. However, in order to execute on its long term objectives, Bumble had to get off the Wall Street guidance treadmill and in August slashed its 2024 revenue forecast from 8-11% to 1-2%. The stock, which was already down 89% from its all time high, fell by an additional 40% in the premarket. There is rarely enough liquidity in a small cap to trade premarket in any size, however as a small fund, Tidefall was able to acquire our position.

At the time of our purchase we bought Bumble for ~6x 2024 GAAP earnings or a 16% earnings yield. At that valuation, we didn’t need to know how fast the company would grow but rather how fast earnings would decline. That seemed like a far easier question to answer as we believe growth will actually continue. Bumble has net debt of $332m, with strong 8x interest coverage, allowing for large potential share repurchases when management is confident on their trajectory. Bumble is also trading at a large discount to its dating app peer, Match Group, which trades at 19x 2024 GAAP earnings.

Although industry growth has slowed from its pandemic highs, we believe dating apps are in a far stronger position than the headlines and self reported surveys would suggest. With workplace romances increasingly taboo and Gen Z spending more time online than Millennials, dating apps are likely to adapt and remain the most common way that new relationships are formed.

Trevor Scott

|

This document is intended for informational purposes and should not be construed as an offering or the solicitation of an offer to purchase an interest in Tidefall Capital Management LP (the “Fund”). Past performance should not be mistaken for and should not be construed as an indicator of future performance and there is no assurance that the investment objectives of the Fund will be achieved. An investment in the Fund involves a high degree of risk. The information contained in this document is not, and should not be construed as, legal, accounting, investment or tax advice. The contents of this document are based upon sources of information believed to be reliable but no warranty or representation, expressed or implied, is given as to their accuracy or completeness. All opinions and estimates contained in this report constitute the Manager’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. The Manager asserts that the reader is solely liable for their interpretation and use of any information contained in this document. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.