Overview

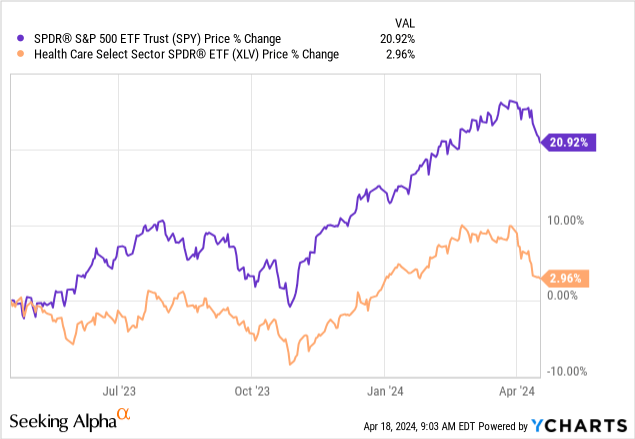

The healthcare sector (XLV) has lagged behind the S&P500 (SPY) for the past year and I believe this opens the door to an opportunity to capitalize on this difference. The factors contributing to the sector’s underperformance can be a wide range of things including the end of Covid, patent expiries, higher interest rates leading to increased debt burdens, and tightening consumer spend just to name a few. I have always felt that it’s much easier to hold positions through downturns and shaky market cycles when you are receiving high distributions from your position. Dividend income makes the price and volatility of the market matter a lot less.

This is where the abrdn Healthcare Opportunities Fund (NYSE:THQ) comes in. THQ operates as a Closed End Fund [“CEF”] that offers investors a way to collect a double digit yield and get exposure to some of the best healthcare companies in the world. The current dividend yield is 11.3% and distributions are paid out on a monthly basis. I previously covered THQ’s sister fund, abrdn World Healthcare Fund (THW), which has more global exposure but comes with a lower yield. THQ has outperformed THW in total return which makes it more of an attractive choice. I will compare the two funds later on.

THQ is appealing for me because of the exposure across different sub sectors of healthcare. This incudes biotech, managed care, healthcare REITs, and life sciences just to name a few. This adds a layer of diverse exposure across the fund. Studies indicate that humans are living longer than ever, no matter where they are located. I think that a result of this longevity is increased healthcare spending for a longer period of time. This longevity of humans may also result in brand new innovations and products being developed which can lead to increased value in the sector as a whole. THQ is a way to get exposure to this potential and collect a high dividend yield while we wait for those things to play out.

Strategy & Holdings

THQ’s stated objective is to first seek current income and then long term capital appreciation. THQ has an expense ratio totaling 1.44%. As of the September 2023 annual report, we can see that THQ is diversified across 11 different sub sectors of healthcare. Pharmaceuticals make up the large majority of the fund, accounting for 37.5% of the exposure. This is closely followed by healthcare providers & services at 28.1% and biotechnology at 19.1%. Something that I like is also the small exposure to equity real estate and this makes the fund special and gives the potential to reap benefits from tenant income as well.

THQ Annual Report

The fund is diverse in sector allocation but THQ is also diverse in the sources it can obtain income. THQ can benefit from the natural earnings growth of their holdings but they also capture income from dividends received, fixed income coupons, REIT distributions, and equity covered call writing premiums. That’s right, THQ implements an option strategy to help fuel the high distribution. THQ has the ability to sell or write calls against a portion of their assets in order to generate additional income.

The portion of their assets overwritten by these options usually stay less than 20% of the total value of managed assets. While this option writing strategy helps produce more income, it can also limit the upside potential of the price. This is why we’ve seen the price stay within the same trading range for a very long time. The fund usually holds the majority of their assets in equities though. Here are the top ten holdings of THQ, broken down by sector and by percentage of net assets.

| Company | Sector | % of Net Assets |

|---|---|---|

| UnitedHealth Group (UNH) | Health Care Providers & Services | 10.6% |

| Johnson & Johnson (JNJ) | Pharmaceuticals | 8.7% |

| Eli Lilly & Co. (LLY) | Pharmaceuticals | 8.2% |

| AbbVie, Inc. (ABBV) | Biotechnology | 7.0% |

| Merck & Co., Inc. (MRK) | Pharmaceuticals | 6.9% |

| Elevance Health (ELV) | Health Care Providers & Services | 5.3% |

| Thermo Fisher Scientific (TMO) | Life Sciences Tools & Services | 5.2% |

| Abbott Laboratories (ABT) | Health Care Equipment & Supplies | 4.5% |

| Pfizer, Inc. (PFE) | Pharmaceuticals | 4.1% |

| Danaher Corp (DHR) | Medical Devices and Diagnostics | 3.4% |

| Gilead Sciences (GILD) | Biotechnology | 3.1% |

| Bristol-Myers Squibb Co. (BMY) | Pharmaceuticals | 3.0% |

| Amgen, Inc. (AMGN) | Biotechnology | 2.6% |

| Boston Scientific (BSX) | Medical Devices and Diagnostics | 2.5% |

| The Cigna Group (CI) | Health Care Providers & Services | 2.2% |

| Humana (HUM) | Health Care Providers & Services | 2.1% |

| Medtronic plc (MDT) | Health Care Equipment & Supplies | 2.0% |

| CVS Health Corp (CVS) | Health Care Providers & Services | 1.9% |

| Stryker Corp. (SYK) | Health Care Equipment & Supplies | 1.8% |

| Vertex Pharmaceuticals (VRTX) | Biotechnology | 1.7% |

Taking a look at some of these top holdings, we can see some huge upside gains in price. Specifically, Eli Lilly (LLY) has appreciated by nearly 300% in price upside over the last 3 year period. Merck (MRK) has risen nearly 70% and AbbVie (ABBV) has grown about 53%. These price gains have contributed to the price stability of THQ and helped the fund lock in additional capital gains alongside the income generated from its option strategy.

The strengths that all of these three companies have in common is that they have successfully build a portfolio of diverse products and services and took advantage of incremental price increases every year. In addition, they have strong earnings histories. For example, LLY beat earnings expectations with a 28% YoY increase in revenue for Q4. As another example, Merck generated greater than expected revenue gains due to the growth Keytruda. Lastly, AbbVie has a great dividend increase streak with a recent raise of over 4% that contributes to 13 years of consecutive raises and a solid dividend growth rate.

However, there are some weaknesses here. For example, Johnson & Johnson (JNJ) has been really suppressed by ongoing litigations and law suites that stall progress. The price is down for the year and continues to lag other peers. In addition, there is also a weakness with Pfizer (PFE) where the price has now reached decade lows. PFE has seen some major patient expiries that leave investors scratching their heads on where the next major revenue sources will come from. PFE has seen decreased revenue levels due to the low demand of Covid vaccines as well. I point these out because the obvious downside to holding a diversified fund is that you are likely to have exposure to some companies who aren’t performing so hot and drags performance of the whole fund down.

Valuation

Since THQ operates as a closed end fund, we can determine the valuation based on where the price trades in relation to the NAV (net asset value) of the fund. Historically, the fund has frequently traded in the discount territory. We can see that dating back to 2015, the price hovered around that -10% discount all the way through 2020 until the drop in the market caused by Covid. We briefly saw the price trade spike above premium territory at the tail end of 2021 before falling back to a discount.

At the moment, the price currently trades at a -8.17% discount to NAV. For reference, the average discount over the last three year period has been -7.96%. This means the price sits below the average discount to NAV, making it an attractive entry point. Fair value seems to be closer to $20 per share since that is where the premium will start to align with the three year average. While it would’ve been more ideal to initiate a position last October when the discount reached nearly -20%, here still serves as a solid entry for some high yielding income and a steady price range.

CEF Data

The value here comes from the income received. If you look at the max duration price chart available, you will see that THQ is only down in price by -2%. This means that over a decade, your returns have come from distributions while the price has stayed in the same predictable range. This means that you can really take advantage and max out your returns by entering THQ during price falls, like the one we saw in October of 2023, where the price dipped below $16 per share.

Holders of THQ are likely here to prioritize consistent income generation. Having a monthly distribution gives you options that some other quarterly paying funds cannot. We can see how the total return of THQ falls behind that of the overall healthcare sector (XLV) However, total return isn’t necessarily the goal here. Investors nearing retirement usually are about one thing: income.

Dividend & Risk

With the income in mind, lets focus on the current dividend yield and how it’s held up over time. The most recently declared monthly distribution of $0.18 per share, brings the current yield up to 11.3%. This is following a huge dividend raise announced in February, of 60%. While this raise was very well-received, it did bring into question the sustainability of it.

Looking at the 2023 annual report, we can see that the fund hasn’t really been pulling in high levels of NII (net investment income) since 2019. The reported NII for 2023 was actually negative at ($0.06) per share. I’m thinking that the huge gains captured from some stocks like LLY, previously mentioned was the source for the high capital gains to help make up the difference in coverage.

THQ Annual Report

It looks like most of the distribution is coming from the net realized gains from positions within the portfolio, due to capital gains from the sales of positions. For the full year of 2023, THQ earned $1.28 from investment operations but distributed out ($1.35). So I gather that the fund hasn’t actually earned enough to fully cover the distribution since 2021, where they earned a record $4.71 from investment operations. This can be damaging in the long run as that means a portion of the return could potentially be coming from ROC (return of capital). While this isn’t explicitly stated in the reporting, I have seen it implemented with the sister fund, THW.

The ROC classification usually refers to when a fund fails to out earn the distribution, so they rely on return investor’s capital back to help make up the difference. This can be harmful over an extended period of time as it can erode NAV and cause the price to crumble along with it. So far this has not been the case but I do remain curious how this will play out with the new distribution raise of 60%. Furthermore, what even drove the raise to happen in the first place if THQ wasn’t able to out earn the distribution in 2022? We will have to wait until the end of September to see an updated annual report but this is something I plan to monitor over time.

THQ Annual Report

In addition, investors should be aware that the income received from THQ is not the most tax friendly. This can be neglected if shares are held in a tax-advantaged account but the distributions are typically either classified as ordinary income or long term capital gains. While not the most tax efficient, the high distribution is especially useful for investors that depend on the income produced from their portfolio. The distribution total has never been cut in its entire history since inception in 2016, which makes this CEF one of the most reliable in terms of consistent income provided.

Peer Comparison

I previously covered another healthcare focused CEF with a high distribution, BlackRock’s Health Sciences Trust (BME). The dividend yield is about half of that of THQ, coming in at 6.35%. Comparing THQ against THW and BME, we can see that THQ has outperformed this peer group in total return. BME has seen periods where the total return was a bit higher than THQ but ultimately, THQ’s high distributions have contributed to being able to outperform BME. Similar to THQ, BME also deploys an option writing strategy to help generate additional income. We can see THW severely underperforming the pack due to its global exposure, making the fund less focused in nature.

THQ looks the most attractive from a dividend yield perspective since it mains a higher distribution. THW’s distribution matches THQ but the total return potential hasn’t been able to keep up. I believe that the global exposure definitely offers a better risk profile in terms of diversity, but it simultaneously makes the fund less focused so it doesn’t capitalize on the upside rallies as well as THQ.

- THQ: 11.3% Dividend yield.

- THW:11.3% Dividend Yield.

- BME: 6.5% Dividend yield.

Similarly to THQ, all of these funds have not been able to fully out earn their distribution. Perhaps the implementation of ROC is something that is expected here. Taking a look at BME reporting, we can see tat the majority of the distribution was paid out as ROC, about 94% for the entire fiscal year. Similarly, THW has also implemented ROC as a way to help cover the distribution. Even with ROC, the NAV has been able to increase over time for BME, THW, and THQ.

BME Section 19 File

THQ looks to be the best healthcare focused CEF out of the three. THQ has the highest yield, a monthly distribution, and so far has maintained the highest total return profile of the three. Now, this might change when the market environment improves for healthcare since the upside potential can be capped by the option plays.

To get an idea of the valuation for these peers, here are where prices trade in relation to their NAV. Starting with THW, they also have the same expense ratio of 1.44%. THW trades at a current premium to NAV of 6.2%. THW’s price crossed into the premium price territory at the start of the new year in January but over the last three year period, the price traded at an average premium to NAV of 6.7%.

However, BME sits at a much more attractive valuation because the price trades at an historically high discount to NAV. The price currently trades at a discount to NAV of -8%. The price hasn’t traded at this much of a discount in 10 years. When the market dropped in 2020, the discount to NAV for BME was only 6.8% so the price sits at a really attractive entry level. While BME does have a lower expense ratio of 1.10%, the yield is also much lower so it is not as appealing as an income investment.

Outlook

The healthcare sector is projected to see a huge rise in medical spending. As I previously mentioned, data also supports that people are living longer than we previously have. The longevity of humans means that we will have a longer timeline of spending money in our old age on wellness care. This means that more money will likely be pumped into preventative care measures and new innovations to help life in old age become easier. I think this will be a huge catalyst at the turn of generations when there are more living millennials than Gen X.

PwC

In combination, the price of newly marketed medicines are rising over time. We can see that the median cost as of 2022 was $222,000. When I am able to locate a more updated researched study, I will gladly update my outlook in the numbers change. This makes a ton of sense if you think about the new innovations and advances that are being made in medicine. The price of such incredible progress within medicine usually comes at a cost until a generic version is created.

BME is the perfect way to get exposure to this potential growth while also collecting a high stream of income. The diverse portfolio gives you exposure to all sub sectors of healthcare that can capture on this increased medical spending. In time, I can even see the fund’s distribution getting raised if total investment income starts to grow at large levels of time. In fact, there is also data that supports the idea of health spending increasing by 5% through 2024.

Takeaway

abrdn Healthcare Opportunities Fund (THQ) offers exceptional value by delivering instant diversity across various subsectors of the healthcare indsutry. The current dividend yield is at 11.3% and offers the ability to collect a high yield while we await market conditions to improve for the sector. Distributions are paid out on a monthly basis which makes this a great choice for the investor that depends on the income produced from their portfolio. You can fuel your retirement with the THQ distributions, or snowball them into other areas of your portfolio to let your passive income growth. In addition, THQ trades at an attractive discount to NAV at the moment which makes it an ideal time for entry. THQ continues to outperform its peers such as THW and BME in total return due to its much more focused set of holdings.