Because our Funds and the market increased in the third quarter of 2024, we thought it was a good time to reach out to shareholders and answer their questions. We were humbled by your overwhelming response. It tells us we should do this more often, but also means we won’t be able to get to all of your questions in this commentary. We will handle the overflow mid-quarter.

We received several questions regarding our non-U.S. investments. Members of our non-U.S. team expect to address these in a separate website article later this quarter. You also provided many helpful suggestions for making shareholder accounts easier to manage, which our operations team will consider as they seek to improve the shareholder experience. Last, there were personal finance and tax questions. Those questions are better suited, however, for the advisors and planners who know more about your individual situation.

Now, let’s get started on the rest.

When will Oakmark offer an ETF?

We currently have a proposal in registration at the SEC for an Oakmark ETF based on our large-cap investment strategy. Until that registration is effective, we are limited as to what we can say. But we are excited to share details with you when we can.

How important is the upcoming election?

After President Biden dropped out, a friend said, “I’m so glad we don’t have to choose between one candidate who frequently stretches the truth and another who might be too old for the office.” I said, “Are you sure?”

Given a dysfunctional political environment, we are fortunate that economic forces are stronger than political forces. Every four years, we are told that this election is the most important ever.

But the stock market goes up under both Republican and Democrat administrations. So, we don’t obsess over it. On the margin, we would expect a change in administration would make ETFs, interest rates, the election and more-what shareholders are asking about business consolidation more likely, which could allow our holdings that have potential acquisitions sitting in limbo to complete them.

How have you kept taxable distributions so low?

First, our long-term investment approach is naturally tax friendly. Long holding periods defer gain recognition and largely avoid higher taxed short-term gains. Additionally, we take steps throughout the year seeking to lower realized capital gains when we believe it is in the best interests of the Fund. For example, we actively harvest tax losses and will utilize redemptions in kind when requested by a redeeming shareholder and when we believe it is in the interest of all of our shareholders. We previously announced that we expect the 2024 capital gains distribution to be zero for all of our domestic funds, and adding activity from the past quarter, we can now say the same for our global funds.

Why bother with an old-fashioned fund like Oakmark Equity and Income?

The perception that this Fund is “your parents’ mutual fund” really bothers me. Reduced-risk equity funds have been one of the most rapid growth areas in the fund industry. Those funds tend to offer somewhat lower returns than the S&P 500 (SP500, SPX) and proportionately lower risk. So, if an investor wanted 30% less risk than the S&P 500, they would achieve that by producing 30% less return. Over its nearly 30-year history, Oakmark Equity and Income (MUTF:OAKBX) has had a standard deviation of roughly 30% less than the S&P 500 yet has delivered 94% of the S&P 500 return. Instead of lowering the return by 30%, it only lowered it by 6%. And looking at the risk metric that we believe is most important-the capital our shareholders lose when the S&P 500 has down years-the Fund’s risk reduction is even more impressive. The S&P 500 declined in six calendar years since the 1995 inception of the Equity and Income Fund, and the Fund had a smaller decline in five of those six years. Further, the median and average declines for the S&P 500 were 15% and 17%, respectively. Equity and Income had a median decline of 5% and an average less than 1%. Using any of those risk measures, the Fund reduced risk meaningfully more than it reduced returns. Additionally, the Fund uses the same tools we use in our other Funds seeking to defer taxable distributions.

Despite delivering returns very close to the S&P 500 with substantially less risk, Equity and Income has experienced persistent redemptions. Like all our Funds, Equity and Income attempts to maximize total return whether through capital appreciation or income. The Fund achieves somewhat higher income than our equity funds due to investing approximately 40% of its portfolio in bonds (which again yield more than stocks and much more than they did several years ago). Unlike many of the more popular funds, we do not engage in transactions that change the character of returns from capital to income. Those transactions might boost their quoted yields, but they are expensive and extremely tax inefficient.

If you require more income, you are better off selling some shares than having us reduce the total return. Additionally, we believe the Fund is more convenient than owning separate bond and stock funds because we manage the rebalancing, so you don’t have to. Hopefully, we can find a better way to communicate these advantages because we believe investors should be more excited about this Fund.

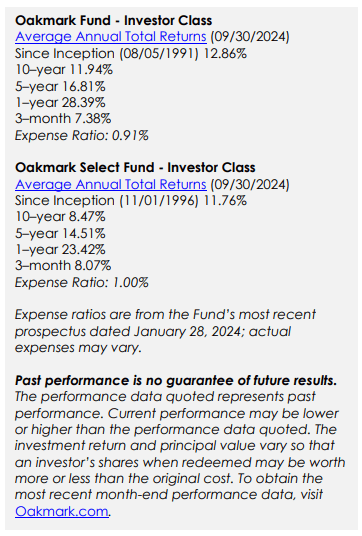

Why does Oakmark Select (OAKLX) keep underperforming the Oakmark Fund (OAKMX)?

I wrote Why We Still Believe in Concentrated Investing for our website last year. Unfortunately, the underperformance of both the value style and Oakmark Select has persisted for another year. We started Oakmark Select in 1996 believing that since our primary skill is stock selection, a fund more concentrated than the Oakmark Fund, essentially owning only our favorite stocks, would offer higher returns over the long run. Since its 1996 inception, Oakmark Select has increased 22-fold compared to 14-fold for the Oakmark Fund. So, over the very long term, it is working. But over the past decade, Select has trailed Oakmark. The biggest reason has been that value investing has been in a very long cycle of underperformance. And when value underperforms, our favorite ideas tend to underperform the rest of the Oakmark portfolio, the stocks Select doesn’t own. Additionally, Oakmark Select has the flexibility to own some smaller companies. While this has proven to be a long-term advantage, the recent poor performance of small-cap stocks has amplified Select’s underperformance. We believe that value investing will stage a comeback, and when it does, we expect Oakmark Select to again outperform the Oakmark Fund.

Why don’t you talk more about your portfolio managers investing in the Funds they manage and how that investment has changed with time?

We want managers of the companies we invest in to be invested side-by-side with us, and we think you should expect the same of your fund managers. One of the reasons we started the Oakmark Funds in 1991 was because we wanted to invest our personal assets the same way we invested for clients. Each year we disclose total employee, family and trustee investment in the Funds, the majority of which are investments by the portfolio managers. In her president’s letter last November, Rana Wright disclosed that these investments exceeded $877 million as of September 30, 2023, compared to just over $200 million as of December 31, 2005. That growth has come primarily from market appreciation and has been supplemented by new investment. Our portfolio managers continue to invest the majority of their assets (apart from their homes) in the Oakmark Funds.

How should an investor respond to interest rates being so much higher than a few years ago?

After an extended period of near zero interest rates, returns on bonds are again higher than inflation, which has been the historic norm. When rates were near zero, the role of bonds in a portfolio was limited to reducing volatility. With real interest rates now positive, returns from bonds can again help investors achieve their financial goals. We believe that the current yield of nearly 5% as of September 30, 2024 on our Oakmark Bond Fund (OANCX) makes it a very attractive investment.

As mentioned earlier, higher rates have also improved the yield for our Oakmark Equity and Income Fund to over 2% as of September 30, 2024.

The effect of higher rates on our equity holdings has been mixed. Our bank stocks tend to benefit from rates being slightly above inflation. So, the current environment is healthy. But the increase from zero to 5% was so rapid that it had a short-term negative impact. We believe that if rates stabilize near current levels, it will be positive for the banks.

For non-financial stocks, higher inflation means expected growth rates have moved up, but so have required returns. (In other words, investors need to earn a higher return on a stock than a bond to justify taking the extra risk.) On balance, we think interest rate changes have done little to change the attractiveness of our equity portfolios.

Why was the holding period so short for some of our higher growth businesses? Did we change our process?

Some higher growth businesses fell dramatically in price in 2022, reaching prices we considered to be bargains. UBER had a double-digit free cash flow yield; Adobe (ADBE) fell to an average P/E ratio; Netflix (NFLX) dropped to a price-to-subscriber that was lower than some cable TV networks; and Amazon (AMZN) hit a level that we thought was fair for either retail or AWS, meaning the other business was effectively free. We bought those stocks anticipating they would be long-term holdings. But we got lucky, and they rose to our fair value estimates very quickly. So, we sold them and used the proceeds to make new bargain purchases. Nothing changed in our process. The market simply corrected these undervaluations much more quickly than it typically does.

If value has finally become attractive, why shouldn’t I just buy some value factor ETF?

Value ETFs do a nice job of providing a very low-cost way to buy a diversified portfolio of low P/E and P/B stocks. But while we believe that many stocks that have low prices compared to earnings or equity are indeed values, we believe they are but a subset of the value universe.

GAAP accounting does a poor job of highlighting the value of what we call income statement investing. By that, we mean investments that bring returns for many years, but because they aren’t tangible assets, they must be expensed immediately, which depresses both earnings and equity. Spending on advertising, customer acquisition, and R&D are all examples of investments that are expensed. If income statement investments are preventing a stock from having a low P/E, that won’t stop us from buying it, but it will stop the value ETFs.

We’ve often said that very low-cost S&P 500 Index funds require active managers to have high active share (the percentage of a portfolio that is different from the S&P 500) to justify their fees. The same is true relative to index funds that replicate a style, like the Russell 1000 Value. The Oakmark Fund has an active share of 91% relative to the S&P 500 and 89% relative to the Russell 1000 Value as of September 30, 2024. Both numbers are very high relative to peers. The way we are investing for Oakmark cannot be easily replicated with an index or factor fund.

Are there enough value investors left for the style to work? Is value investing dead?

In 2000, at the peak of the dot-com bubble, magazine covers proclaimed the death of value investing. I only hope this question proves to be as timely! Early in my career, you could just buy low P/E or P/B stocks, wait patiently, and expect other investors to push up their prices. That hasn’t worked very well lately. Today, when intellectual property is often more valuable than tangible assets, we would be foolish to define value only by low P/E and P/B ratios. If you agree with that broader definition of value, then I’m comfortable saying value investing is alive and well.

It is true that not as many investors today are willing to buy cheap stocks and patiently wait for others to buy them. But this isn’t an insurmountable problem. Companies can take advantage of their shares being undervalued by using the cash they earn to repurchase stock. We invest with management teams that are just as happy to grow EPS by shrinking the share base as by growing net income. Most of our holdings supplement modest net income growth with share repurchase to achieve average growth. And we can buy that form of growth for a much lower P/E ratio. At the extreme, General Motors (GM) is using its earnings to reduce its share count by over 20% this year. If current earnings are close to normal, which we believe they are, and if management doesn’t lose patience, which we hope they don’t, then the business value per share will sharply increase!

Does Oakmark offer environmental, social and governance (‘ESG’) funds?

We do not. We will not prioritize anything above maximizing our expected portfolio returns while limiting our risk to appropriate levels. However, consistent with that goal, we believe it is important to invest in companies that are governed to maximize long-term, per-share value. We also want to avoid valuing a stock based on short-term results, which may include unsustainable levels of costs or revenues. We believe that our long time horizon usually aligns us on the economic issues that are typically important to ESG investors.

Does Oakmark subscribe to diversity, equity and inclusion?

We do. We believe we function best with a workforce that is diversified across many characteristics. We also manage our business as a meritocracy. We don’t believe those two statements are in conflict. We have taken steps to increase the diversity of our pool of job applicants and increased the participation of underrepresented groups in our hiring process to minimize hidden bias. We believe this process leads to hiring employees who are most likely to succeed.

Do you plan on retiring soon?

No. I’m 66 years old, but I can’t think of anything I’d rather do with my time. We have a great team of investment professionals, and we all have a hand in deciding what stocks are owned in our funds. So, we have already moved well down the path toward succession. When my colleagues tell me-or I realize-that I’m losing a step, I’ll retire, and you’ll be in strong hands as you are today. Until then, I enjoy this and think my experience brings a valuable perspective to the team.

Thank you!

In closing, I want to say a special thank you to those who shared their personal experiences of Oakmark helping them exceed their families’ investment goals. Your stories, tying our performance to your financial needs, remind us why we chose this career and why we wake up every morning thinking about the best way to invest your assets. Spending our days in the trenches, we don’t often have the luxury of looking back over the past decades. Your emails show the importance of what we do and motivate us to keep improving. Thank you!

William C. Nygren, CFA, Portfolio Manager

|

The securities mentioned above comprise the following percentages of the Oakmark Fund’s total net assets as of 09/30/2024: Adobe 0%, Amazon 0%, General Motors 2.7%, Netflix 0% and Uber 0%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. As of 09/30/2024, none of the securities mentioned above are held in Oakmark Select Fund. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements. Standard Deviation is a measure of the degree to which a portfolio’s return varies from its previous returns, or from the average of all similar portfolios. The larger the standard deviation, the greater the likelihood (and risk) that a security’s performance will fluctuate from the average return. The standard deviation presented is since the inception of the Fund. The price to earnings ratio (“P/E”) compares a company’s current share price to its per-share earnings. It may also be known as the “price multiple” or “earnings multiple”, and gives a general indication of how expensive or cheap a stock is. Investors should not base investment decisions on any single attribute or characteristic data point. The Price to Book Ratio (“P/B”) is a stock’s capitalization divided by its book value. EPS refers to Earnings Per Share and is calculated by dividing total earnings by the number of shares outstanding. GAAP refers to generally accepted accounting principles. Active Share measures the percentage of an equity portfolio that differs from its benchmark. It is calculated using the sum of the absolute value of the differences between the equity weights of the securities in a portfolio and the weights of securities in the portfolio’s benchmark, divided by two. A portfolio identical to its benchmark would have an active share of 0%, whereas the more the portfolio diverges from its benchmark, the larger the active share (maximum = 100%). The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large- capitalization stocks representing all major industries. It is a widely recognized index of broad, U.S. equity market performance. Returns reflect the reinvestment of dividends. This index is unmanaged and investors cannot invest directly in this index. The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. This index is unmanaged and investors cannot invest directly in this index. The Oakmark Funds’ portfolios tend to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility. Because the Oakmark Select Fund is non-diversified, the performance of each holding will have a greater impact on the Fund’s total return, and may make the Fund’s returns more volatile than a more diversified fund. Oakmark Select Fund: The securities of medium-sized companies tend to be more volatile than those of large companies and have underperformed the stocks of small and large companies during some periods. The Oakmark Equity and Income Fund invests in medium- and lower-quality debt securities that have higher yield potential but present greater investment and credit risk than higher-quality securities. These risks may result in greater share price volatility. An economic downturn could severely disrupt the market in medium or lower grade debt securities and adversely affect the value of outstanding bonds and the ability of the issuers to repay principal and interest. The Oakmark Equity and Income Fund’s portfolio tends to be invested in a relatively small number of stocks. uberAs a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility. Oakmark Equity and Income Fund: The stocks of medium-sized companies tend to be more volatile than those of large companies and have underperformed the stocks of small and large companies during some periods. Investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods. All information provided is as of 09/30/2024 unless otherwise specified. Before investing in any Oakmark Fund, you should carefully consider the Fund’s investment objectives, risks, management fees and other expenses. This and other important information is contained in a Fund’s prospectus and summary prospectus. Please read the prospectus and summary prospectus carefully before investing. For more information, please visit Oakmark.com or call 1-800-OAKMARK (1-800-625-6275). Harris Associates Securities L.P., Distributor, Member FINRA. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.