Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München (OTCPK:MURGY) is an interesting income play over the long term, but its earnings outlook in the short term is not great due to recent catastrophe events in the U.S.

As I’ve covered in a previous article, even though Munich Re’s dividend yield is not among the highest in the reinsurance sector, it’s a good income pick due to a sustainable dividend over the long haul. As I’ve not covered the company for some time, in this article I analyze its most recent financial performance and update its investment case, to see whether it remains a good income pick or not in the reinsurance industry.

Financial Overview

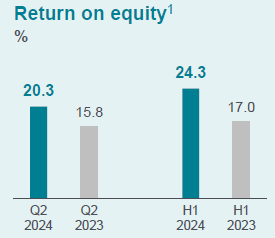

Munich Re released, a couple of months ago, its earnings related to the first half of 2024 (H1 2024), which were above expectations, both at the top and bottom lines. This was supported by improved pricing across the property & casualty (P&C) industry, which was key for strong profitability in its reinsurance segment.

Indeed, strong pricing improvements of past years were maintained in both January and July renewals, as competition from both alternative and traditional players remains subdued, boding well for pricing power from large players in the reinsurance market, such as Munich Re. This was positive both for the company’s price changes in recent renewals and higher volumes, even though the company has recently decided to reduce its exposure to proportional casualty business, leading to lower overall volumes in July renewals.

Moreover, catastrophe losses were below estimates during the first half of 2024, leading to a combined ratio of 79.6% during this period, which is a very positive outcome and leads to a strong underwriting profit in the P&C segment. In other segments, the operating momentum was also positive, both across life reinsurance operations and traditional insurance activities in its ERGO business unit, being supportive of