Dear Friends & Partners,

Our investment returns are summarized in the table below:

| Month | YTD | 12 Months | 24 Months | 36 Months | Inception | |

|---|---|---|---|---|---|---|

| LRT Global Opportunities | -8.00% | -0.17% | -1.83% | +11.71% | +11.71% | +18.59% |

| Results as of 9/30/2025. Periods longer than one year are annualized. All results are net of all fees and expenses. Past returns are no guarantee of future results. Please see the end of this letter for additional disclosures. |

LRT Global Opportunities is a systematic long/short strategy that seeks to generate positive returns while controlling downside risks and maintaining low net exposure to the equity markets.

During the month of September, the LRT Global Opportunities strategy returned -8.00% net of fees. Year- to-date, the strategy has returned -0.17%. As of October 1st, our estimated beta is 0.3236. See the Appendix for detailed return attribution.

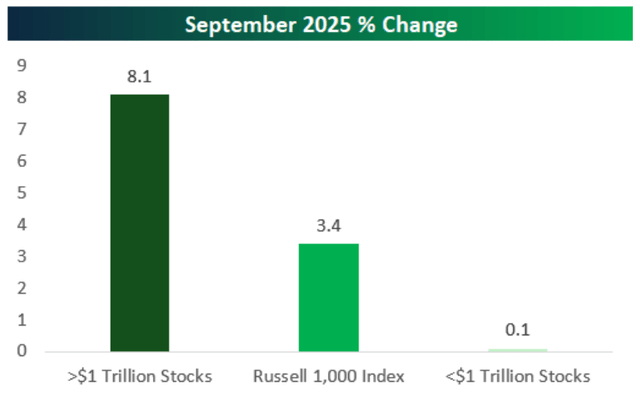

September was a tough month for our investment strategy, with broad market indexes rising driven by a select few, highly overvalued mega-cap stocks, while the rest of the market languished. Our strategy is long a diversifiedbasket of high-quality companies and short broad market indexes. I view this month as an aberration and only a temporary setback. We continue to invest in high quality companies that are growing their value per share, and Iremain confident in the future performance of our strategy. While the “quality” factor has struggled over the past year, it is periods like this that presentthe greatest opportunity for future investment. I believe right now is a perfect time to add to your investment in our strategy, given its muted returns as of late.

Market valuations are currently at extreme levels – something that has historically led to poor forward returns for broad market indexes. Currently, the trailing market P/E ratio is at over 30x (99% percentile), the P/B ratio is over 5.6x (highest ever), and P/S 3.38x (highest ever). Finally, the cyclical P/E (Shiller PE) is at over 40x (it has only been higher in the period between 1999-2000. At the end of the day, I believe that stock prices represent a share of earnings in enterprises and stocks can only deliver returns if the underlying companies deliver goods and services value to their customers, and ultimately profits to shareholders. The higher the starting valuation, the worse the future returns – therefore I believe that investors / gamblers in today’s frothy markets are in for a rude awakening when the economy slows down and markets finally wobble.

Cyclically Adjusted PE Ratio (Shiller PE)

We remain steadfast in our pursuit of portfolio performance and continue to maintain low-risk exposure. I believe this discipline, and risk averse approach will be rewarded in the months ahead.

I take seriously the responsibility and the trust that you have given me as a steward for a part of your savings. As always, if you have any questions, please don’t hesitate to contact me. I appreciate all your ongoing support.

Lukasz Tomicki, Portfolio Manager, LRT Capital

Attributions and Holdings as of 10/1/2025

| LRT Global Opportunities | Return Attribution | ||

|---|---|---|---|

| Top Twenty Holdings (%) – As of 10/1/2025 | Return Attribution (%) – September 2025 | ||

| StoneX Group Inc. (SNEX) | 3.36 | Long Equity | -1.88 |

| Simpson Manufacturing Co., Inc. (SSD) | 3.22 | Hedges | -0.99 |

| Asbury Automotive Group, Inc. (ABG) | 3.04 | Unlevered Gross Return | -2.88 |

| Chemed Corp. (CHE) | 2.99 | Leveraged Gross Return | -7.91 |

| The Toronto-Dominion Bank (TD) | 2.87 | Net Return | 8.00 |

| RLI Corp. (RLI) | 2.70 | ||

| Toro Co. (TTC) | 2.51 | Beta contribution | 1.16 |

| Crown Castle International Corp. (CCI) | 2.46 | Alpha contribution | -9.15 |

| Corporación América Airports S.A. (CAAP) | 2.30 | Net Return | 8.00 |

| Colliers International Group Inc. (CIGI) | 2.26 | ||

| The Travelers Companies, Inc. (TRV) | 2.23 | Top Contributors – September 2025 | |

| Petróleo Brasileiro S.A. – Petrobras (PBR-A) | 2.07 | Integrated Electrical Services, Inc. (IESC) | |

| Fabrinet (FN) | 2.04 | UnitedHealth Group Incorporated (UNH) | |

| UnitedHealth Group Incorporated (UNH) | 2.00 | Valero Energy Corporation (VLO) | |

| Charter Communications, Inc. (CHTR) | 1.96 | Fabrinet (FN) | |

| Group 1 Automotive Inc. (GPI) | 1.94 | Google Inc. (GOOGL) | |

| Exxon Mobil Corp (XOM) | 1.93 | The Toronto-Dominion Bank (TD) | |

| Integrated Electrical Services, Inc. (IESC) | 1.81 | AAON Inc. (AAON) | |

| Darden Restaurants, Inc. (DRI) | 1.79 | Lockheed Martin Corporation (LMT) | |

| Canadian Imperial Bank of Commerce (CM) | 1.77 | ||

| Top Detractors – September 2025 | |||

| Top Holdings Total (% of total long exposure) | 47.25 | iShares Russell 2000 (IWM) | |

| Total Long Holdings | 82 | Corporación América Airports S.A. (CAAP) | |

| Simpson Manufacturing Co., Inc. (SSD) | |||

| iShares Core S&P Small-Cap (IJR) | |||

| Hedges (%) – As of 10/1/2025 | Texas Instruments Inc. (TXN) | ||

| SPDR S&P MidCap 400 ETF (MDY) | -9.04 | Darden Restaurants, Inc. (DRI) | |

| iShares Core S&P Mid-Cap (IJH) | -9.05 | CSW Industrials Inc (CSW) | |

| iShares Russell 2000 (IWM) | -27.11 | Toro Co. (TTC) | |

| iShares Core S&P Small-Cap (IJR) | -28.11 | ||

| Overall Net Exposure (%) | 80.08 | ||

| Beta-adjusted Net Exposure (%) | 32.36 | ||

|

Source: Bloomberg. |

|||

| Numbers may not add up due to rounding. Net returns are net of a hypothetical 1% annual management fee (charged quarterly) and 20% annual performance fee. Individual account results may vary due to the timing of investments and fee structure. Please consult your statements for exact results. Please see the end of this letter for additional disclosures. |

StoneX Group Inc. (SNEX)

StoneX Group Inc. operates as a diversified and globally- focused financial services network, providing a critical suite of products that connect clients to the world’s markets. The company delivers execution, clearing, payment, and advisory services across a broad range of asset classes, including commodities, foreign exchange, and securities. While the financial services industry is intensely competitive, StoneX has carved out a formidable position by focusing on underserved client segments and providing high-touch expertise in complex, niche markets. This has established the firm as an indispensable partner for its clients and a durable, compounding enterprise.

The company’s competitive advantage is built on a foundation of deep institutional knowledge, comprehensive service offerings, and a robust global infrastructure. StoneX acts as a vital intermediary for thousands of commercial, institutional, and retail clients who rely on its platform to manage risk and transact efficiently. In the physical and financial commodity markets, for example, the company provides not just execution but also vital market intelligence and logistical support, a level of service that larger, more transactional-focused institutions often neglect. This high-touch, value-added approach fosters deep, long- standing client relationships characterized by high switching costs.

StoneX’s growth strategy is a disciplined combination of organic expansion and strategic acquisitions. The company has a long history of successfully acquiring and integrating businesses that add new capabilities, expand its geographic footprint, and broaden its client base. The transformational acquisition of GAIN Capital, for instance, significantly scaled its retail foreign exchange and CFD business, creating new avenues for growth and cross-selling opportunities across the entire StoneX network. Management has proven adept at identifying complementary businesses and leveraging the firm’s existing infrastructure to unlock synergies and enhance profitability.

This acquisitive growth is supported by a strong and consistent focus on organic investment in technology and talent. The firm continuously enhances its proprietary platforms to provide clients with more efficient execution and better access to market data and insights. This commitment to technological leadership, combined with a culture that attracts and retains top talent with specialized market expertise, creates a powerful and self-reinforcing business model. Management’s disciplined approach to risk management and capital allocation ensures that growth is pursued prudently, with a clear focus on generating sustainable, long-term shareholder value. In a complex and often opaque financial world, StoneX provides clarity, access, and expertise, making it a critical part of the global financial ecosystem.

Simpson Manufacturing Co., Inc. (SSD)

Simpson Manufacturing Co., Inc. represents a category-defining enterprise and the undisputed leader in the North American market for engineered structural connectors. Through its iconic Simpson Strong-Tie brand, the company provides essential, high- performance products that are critical to the structural integrity and safety of residential and commercial buildings. The company’s deep competitive moat, rooted in decades of innovation, exceptional service, and unparalleled brand equity, have solidified its position as a mission-critical partner to the construction industry, making it a truly high- quality, compounding enterprise.

The cornerstone of Simpson’s durable competitive advantage is its products being specified directly into building codes. Architects, engineers, and builders do not simply choose Simpson products; they are often required to use them to meet stringent local and national safety standards for seismic activity, high winds, and general structural load. This creates immense switching costs, as deviating from the specified product would require costly and time-consuming engineering re-evaluations. The brand itself has become synonymous with trust and reliability, a reputation earned through a relentless focus on product quality, rigorous testing, and engineering excellence. This trust is a powerful, intangible asset that is nearly impossible for a competitor to replicate.

Furthermore, Simpson has cultivated an unmatched distribution network and service model. Its products are ubiquitously available through a vast network of home centers, lumberyards, and contractor suppliers, ensuring that builders have immediate access to the necessary components. This physical availability is augmented by best-in-class technical support and field service for engineers and contractors, reinforcing its role as an indispensable partner rather than a mere product supplier. This holistic approach-from code specification to engineering support to on-site availability-cements Simpson’s dominant market position.

The company’s growth is propelled by durable, secular tailwinds. The persistent need for new housing construction and the consistent, non-discretionary nature of the repair and remodel market provide a stable foundation for demand. Moreover, the increasing frequency of extreme weather events and a growing focus on building resiliency are driving stricter building codes, which in turn increases the content and value of Simpson’s products per structure. Management has a long and proven track record of operational excellence and disciplined capital allocation. The company consistently generates strong free cash flow, which it prudently reinvests in product innovation and strategically returns to shareholders through consistent dividends and opportunistic share repurchases.

In essence, Simpson Manufacturing is not just a building products company; it is a critical component of the construction safety ecosystem. Its entrenched position in building codes, trusted brand, and comprehensive service model create a formidable competitive fortress. This allows the company to capitalize on the enduring need for safer, more resilient buildings, ensuring a long runway for continued growth and value creation.

Asbury Automotive Group, Inc. (ABG)

Asbury Automotive Group, Inc. stands as a premier operator and strategic consolidator within the vast U.S. automotive retail landscape. The company manages a geographically diverse and growing portfolio of dealerships, providing a comprehensive suite of offerings that includes new and used vehicles, financing and insurance products, and, most critically, parts and service operations. While the automotive retail sector is often characterized as fragmented and cyclical, Asbury’s disciplined operational methodology, clear strategic focus, and shareholder-friendly capital allocation have established it as a category leader with a durable model for long-term, profitable growth.

The fundamental competitive advantage of Asbury is rooted in the resilience of its business model, particularly its high-margin parts and service segment. This division generates a consistent, annuity-like revenue stream that provides significant profit stability throughout economic cycles. As vehicles become increasingly complex and technologically advanced, the specialized expertise and equipment housed within a franchised dealer’s service bay become ever more essential, deepening this protective moat against independent competition. This operational backbone is complemented by the company’s strategic focus on owning dealerships with desirable import and luxury brands situated in attractive, high-growth metropolitan areas. This brand mix not only ensures access to a strong and resilient customer base but also drives higher- margin service work and greater customer loyalty over the lifetime of the vehicle.

Management has cultivated a well-defined, dual-pronged strategy for growth that demonstrates both discipline and ambition. First, Asbury has proven itself to be a highly effective and shrewd consolidator in an industry with a long runway for consolidation. Its ability to execute large-scale, strategic acquisitions was best demonstrated by the transformational purchase of Larry H. Miller Dealerships, a move that significantly expanded the company’s operational footprint and earnings power. This transaction, the second-largest of its kind in the industry’s history, underscored management’s capability to identify, integrate, and extract value from major acquisitions, fundamentally reshaping the company’s scale and competitive posture.

Second, this acquisitive growth is balanced with a deep commitment to organic improvement and digital innovation. The company’s proprietary “Clicklane” platform provides a seamless, end-to-end digital retailing tool, fully integrating the online and in-store guest experience. This omnichannel approach is more than a convenience; it is a significant competitive advantage that addresses the evolving preferences of the modern consumer while driving operational efficiencies and enhancing customer loyalty. By creating a frictionless, transparent process, Asbury captures and retains customers more effectively than smaller competitors who lack the scale to invest in such a sophisticated platform.

This synthesis of a robust and stable service business, a proven M&A engine, and a forward-looking digital strategy is underpinned by a disciplined capital allocation framework. Management has consistently demonstrated a commitment to creating shareholder value, opportunistically repurchasing shares and prudently managing its balance sheet to maintain financial flexibility for future growth. Asbury is not merely participating in its industry; it is actively shaping it, creating a platform designed to compound shareholder value for the long term.

Chemed Corp. (CHE)

Chemed Corp. represents a unique and highly successful holding company, operating two distinct, market-leading businesses in entirely non-correlated sectors: VITAS Healthcare, the nation’s largest provider of end-of-life hospice care, and Roto-Rooter, the premier provider of plumbing and drain cleaning services in North America. This unconventional structure is masterfully managed with a disciplined focus on operational excellence and shareholder-friendly capital allocation, creating a remarkably resilient and durable compounding enterprise.

The cornerstone of the Chemed portfolio is VITAS Healthcare. As a category-defining leader in hospice care, VITAS benefits from one of the most powerful and predictable secular tailwinds: the aging of the U.S. population. The demand for high-quality, compassionate end-of-life care is set for a multi-decade expansion, and VITAS is uniquely positioned to meet this need. Its competitive moat is built on its immense scale, its clinical expertise in managing complex patient needs, and its deep, long-standing relationships with referral sources within the healthcare community. The business operates under the stable and predictable reimbursement framework of the Medicare hospice benefit, which provides excellent revenue visibility.

Complementing this is Roto-Rooter, an iconic brand with unparalleled recognition in its industry. Roto- Rooter operates in the highly fragmented and essential plumbing and drain cleaning market. Its services are non-discretionary and recession-resistant; a clogged drain or a burst pipe requires immediate attention regardless of the broader economic climate. The company’s primary competitive advantage is its brand, a powerful intangible asset cultivated over nearly a century of reliable service and effective marketing. This allows it to command premium pricing and generate consistent demand from both residential and commercial customers. This brand strength, combined with a flexible operating model of company-owned branches and independent franchisees, allows for deep market penetration and efficient service delivery.

The genius of the Chemed model lies in its corporate strategy. The parent company acts as an expert capital allocator, allowing the individual business units to focus entirely on their operational execution. The robust and steady cash flows generated by these two best-in-class businesses are then prudently deployed by management. Chemed has a long and consistent history of returning significant capital to shareholders through a growing dividend and opportunistic share repurchases. By combining two market leaders with completely different demand drivers-one driven by demographics, the other by necessity-Chemed has constructed a uniquely durable enterprise built to create shareholder value for the long term.

The Toronto-Dominion Bank (TD)

The Toronto-Dominion Bank, commonly known as TD, stands as one of North America’s premier financial institutions. Headquartered in Toronto, it is a pillar of the TD highly stable Canadian banking oligopoly, a market structure that provides significant and durable competitive advantages. While deeply rooted in its home country, TD has successfully executed a long-term growth strategy focused on establishing a substantial and growing presence in the attractive U.S. retail banking market. The bank’s core philosophy is anchored in a conservative risk culture and a primary focus on traditional retail and commercial banking, which generates consistent and predictable earnings throughout economic cycles.

TD operates through three main segments. The largest and most mature is Canadian Retail, which serves millions of customers across Canada. This segment encompasses a complete suite of financial products and services, including personal and commercial banking, credit cards, wealth management, and insurance. TD’s extensive network of branches and automated banking machines, combined with a leading digital platform, has solidified its powerful brand recognition and a top-tier market share in nearly every product category. The stability of this segment provides a low-cost funding base and a reliable foundation of earnings that supports the company’s strategic initiatives.

The second key segment is U.S. Retail, which has been the company’s primary growth engine. Operating under the brand “America’s Most Convenient Bank,” TD has built a significant presence along the U.S. East Coast, from Maine to Florida. The strategy is centered on providing superior customer service, longer branch hours, and a user-friendly banking experience to attract and retain a loyal customer base. This U.S. franchise has been built through a combination of organic growth and disciplined, strategic acquisitions. Furthermore, the bank’s substantial ownership stake in Charles Schwab provides significant exposure to the U.S. brokerage and asset management industry, adding a high-quality source of equity income.

The third segment, Wholesale Banking, operates under the TD Securities brand. This division provides a range of capital markets, investment banking, and corporate banking services to corporate, government, and institutional clients. Importantly, the wholesale business is managed to complement the broader enterprise and is not the primary driver of risk or profitability. Management maintains a disciplined approach, avoiding the excessive risk-taking that can be characteristic of stand-alone investment banks. This ensures that the stability of the core retail operations is not jeopardized by volatility in the capital markets.

TD’s enduring competitive advantage, or moat, is derived from its immense scale, the entrenched customer relationships inherent in retail banking, and its conservative management culture. In Canada, the oligopolistic market structure creates formidable barriers to entry for new competitors. Customers face high switching costs when moving their primary banking relationship, leading to a sticky and low-cost deposit base that is difficult to replicate. This stable funding source allows the bank to lend profitably and consistently. The bank’s management team has a long track record of prudent capital allocation, disciplined underwriting, and a focus on long-term shareholder value creation. This approach has allowed TD to navigate periods of economic stress with resilience while continuing to invest for future growth.

RLI Corp. (RLI)

RLI Corp. stands as a premier specialty insurance company, a category-defining enterprise that has distinguished itself through a culture of exceptional underwriting discipline. For decades, the company has successfully navigated the complexities of the property and casualty market by adhering to a simple, yet powerful, philosophy: consistently generate an underwriting profit. This unwavering focus, a true rarity in the insurance industry, has allowed RLI to build a formidable competitive moat and a remarkable track record of compounding shareholder value.

The cornerstone of RLI’s success is its deep-seated expertise in niche, underserved markets. The company deliberately avoids commoditized insurance lines where competition is based primarily on price. Instead, it seeks out complex and specialized risks where its superior underwriting knowledge allows it to accurately price policies and earn an attractive return. This strategy is executed by a highly experienced and empowered team of underwriters who are incentivized to prioritize profitability over top-line growth. This disciplined approach means RLI is willing to shrink its business in certain areas when pricing becomes inadequate, a testament to its long-term perspective.

This outstanding underwriting culture is reinforced by significant employee ownership, which creates a powerful alignment of interests between the company’s employees and its shareholders. When employees think and act like owners, the focus naturally shifts to long-term, sustainable value creation rather than short-term gains. This unique cultural advantage permeates the entire organization and is a key driver of its consistent, best-in-class performance.

Furthermore, RLI’s management team has demonstrated an exemplary commitment to prudent and shareholder-friendly capital allocation. The company’s consistent underwriting profitability generates significant free cash flow. Management has established an unparalleled legacy of returning this excess capital to its owners, evidenced by a multi-decade history of raising its regular dividend, supplemented by the frequent payment of large special dividends. This demonstrates a clear understanding that the company’s capital belongs to its shareholders and should be returned when it cannot be redeployed at highly attractive rates of return. By combining a superior, disciplined underwriting model with a deeply ingrained ownership culture and a shareholder-focused capital allocation strategy, RLI has solidified its position as a truly elite operator in the specialty insurance industry.

The Toro Company (TTC)

The Toro Company stands as a premier, category-defining enterprise in the design, manufacture, and marketing of solutions for the turf, landscape, and construction markets. Through its portfolio of iconic brands, including Toro, Exmark, and Ditch Witch, the company has cultivated an unparalleled reputation for quality, innovation, and reliability. This has established Toro not merely as a product manufacturer, but as an indispensable partner to its professional and residential customers, creating a durable competitive moat and a long-term compounding enterprise.

The foundation of Toro’s competitive advantage is its powerful brand equity and its unmatched global distribution network. The Toro brand is synonymous with performance and durability, particularly among high-end professional users such as golf course superintendents, groundskeepers for sports fields, and landscape contractors who rely on the equipment for their livelihoods. This brand loyalty is reinforced by a culture of continuous innovation, which has consistently delivered solutions that enhance productivity and efficiency. This brand strength is amplified by a vast, independent network of dealers and distributors, a critical asset that is nearly impossible to replicate. This network provides not only sales but also expert service, parts, and support, fostering deep, long-standing customer relationships and creating significant switching costs.

Management has executed a disciplined and highly effective growth strategy, balancing organic innovation with strategic, value-enhancing acquisitions. The company has a long history of successfully identifying and integrating businesses that expand its technological capabilities or provide entry into attractive, adjacent markets. The transformational acquisition of The Charles Machine Works, the parent company of Ditch Witch, is a prime example of this strategy. This move significantly expanded Toro’s presence in the high- growth underground construction market, capitalizing on secular tailwinds such as the buildout of fiber optic networks and the modernization of aging infrastructure.

This strategic growth is underpinned by a culture of operational excellence and a prudent, shareholder- friendly approach to capital allocation. The company consistently generates strong free cash flow, which management thoughtfully reinvests in research and development to maintain its product leadership. Furthermore, Toro has an exceptional, multi-decade track record of consistently paying and growing its dividend, demonstrating a clear and unwavering commitment to returning capital to its shareholders. By combining its portfolio of trusted brands, its dominant distribution network, and a disciplined management team, The Toro Company has solidified its position as a best-in-class operator poised for continued, durable growth.

Crown Castle International Corp. (CCI)

Crown Castle International Corp. stands as a category-defining enterprise, owning and operating the largest portfolio of shared communications infrastructure in the United States. The company provides the mission- critical assets-primarily macro cell towers-that form the backbone of the nation’s wireless networks. By leasing space on its strategically located infrastructure to the largest wireless carriers under long-term contracts, Crown Castle has established itself as an indispensable partner in the digital economy. This unique position, protected by immense barriers to entry, has allowed the company to build a durable, compounding enterprise that is foundational to modern communication.

The company’s formidable competitive advantage is rooted in the irreplaceability of its asset base. Securing suitable locations and navigating the complex, lengthy zoning and permitting processes required for new tower construction creates a significant moat that deters new competition. The location of Crown Castle’s towers, concentrated in the top U.S. markets, represents prime real estate for wireless communication, making access to its network essential for carriers seeking to provide reliable coverage. The business model is further fortified by long-term, non-cancellable lease agreements, which typically include contractual rent escalators, providing a highly predictable, recurring, and growing stream of high-margin revenue.

Crown Castle’s growth is propelled by powerful and enduring secular tailwinds. The exponential increase in mobile data consumption, driven by video streaming, cloud computing, and the proliferation of connected devices, creates a continuous need for wireless carriers to invest in densifying and enhancing their networks. The nationwide rollout of 5G technology acts as a significant accelerant to this trend, requiring more equipment on existing towers to deliver the promised advancements in speed and capacity.

In a decisive move to enhance shareholder value and sharpen its strategic focus, management is executing on a plan to divest its fiber and small cell businesses. This will transform Crown Castle into the only publicly-traded, pure-play U.S. tower company. This strategic repositioning is a clear example of disciplined capital allocation, simplifying the business model to concentrate on its highest-margin, most defensible assets. The proceeds are expected to be used to strengthen the balance sheet and return capital to shareholders, underscoring a commitment to financial prudence and value creation. By focusing exclusively on its core tower portfolio, Crown Castle is ideally positioned to capitalize on the multi-decade investment cycle in wireless infrastructure, solidifying its role as a critical enabler of the nation’s digital future.

Corporación América Airports S.A. (CAAP)

Corporación América Airports (CAAP) is a leading private-sector airport concession operator on a global scale. The company’s extensive portfolio encompasses 53 airports across six countries in Latin America and Europe, including Argentina, Brazil, Uruguay, Ecuador, Armenia, and Italy. This geographic diversification provides exposure to a range of macroeconomic environments and travel markets. CAAP’s origins trace back to 1998 with the acquisition of a major concession in Argentina, and it has since expanded its footprint to become a key player in the international airport management industry.

CAAP’s revenue is derived from two primary sources: aeronautical and commercial activities. Aeronautical revenue is generated from fees paid by airlines for the use of airport facilities, including landing and parking fees, as well as passenger usage fees. Commercial revenue, a key area of growth for the company, is generated from a variety of non-aeronautical sources. These include retail and duty-free stores, food and beverage outlets, car parking, and advertising within the airport terminals. The company’s strategy focuses on enhancing the passenger experience to drive growth in commercial revenue, which typically offers higher margins than aeronautical services.

The company’s airport portfolio includes some of the most important and strategic air travel hubs in its countries of operation. For example, CAAP operates Ezeiza International Airport in Buenos Aires, a key gateway to South America, and Brasília Airport, a major domestic hub in Brazil. The portfolio also includes airports in popular tourist destinations, such as the Galapagos Ecological Airport in Ecuador. This mix of international hubs, domestic airports, and tourist-focused facilities provides a balanced exposure to different segments of the air travel market.

CAAP has a demonstrated track record of investing in its airport infrastructure to improve operational efficiency, expand capacity, and enhance the passenger experience. These investments not only support traffic growth but also create new opportunities for commercial revenue generation. The company’s management team possesses extensive experience in the airport and infrastructure sectors, with a deep understanding of the complexities of operating in its various markets.

The company’s growth is closely tied to the long-term trends in global and regional air travel. As passenger traffic recovers and grows, CAAP is well-positioned to benefit from increased aeronautical and commercial activity. The company continues to explore opportunities to expand its portfolio through new concessions and strategic acquisitions, leveraging its operational expertise to create value in new and existing markets. With a resilient business model and a strategic focus on operational excellence and passenger-centric services, Corporación América Airports S.A. represents a significant player in the global transportation infrastructure landscape.

Colliers International Group Inc. (CIGI)

Colliers International Group Inc. stands as a premier global leader in commercial real estate services and investment management, distinguished by a unique and deeply Colliers ingrained entrepreneurial culture. While many of its competitors operate under a more centralized corporate structure, Colliers has built a durable competitive moat through its decentralized model, which empowers local leaders and fosters a powerful sense of ownership throughout the organization. This approach, combined with a disciplined strategy of growth and significant insider ownership, has established Colliers as a best-in-class compounding enterprise.

The foundation of the company’s success is its enterprising culture. Colliers operates as a partnership of professionals, guided by a management team with a substantial equity stake, ensuring a profound alignment of interests with long-term shareholders. This ownership mindset permeates the firm, attracting and retaining top-tier talent that thrives on autonomy and is incentivized to drive profitable growth in their local markets. The company’s global brand provides the scale, resources, and reputation necessary to compete for major mandates, while the decentralized structure allows for the agility and customized service of a boutique firm. This “best of both worlds” model is a key differentiator and a formidable competitive advantage.

Colliers’ growth strategy is a masterclass in disciplined execution. The company pursues a balanced approach, combining steady organic growth with a programmatic and accretive acquisition strategy. Management has a long and successful history of acquiring well-run, entrepreneurial firms that enhance its service capabilities or expand its geographic reach. These acquisitions are carefully integrated to preserve their unique cultural strengths while leveraging the benefits of the broader Colliers platform.

Crucially, the company is strategically focused on expanding its most durable and highest-margin business lines: Investment Management and Outsourcing & Advisory. These segments generate stable, recurring revenue streams that are less susceptible to the cyclicality of transactional capital markets business. By deliberately growing these annuity-like revenue sources, management is progressively increasing the quality and predictability of the company’s earnings profile. This disciplined capital allocation, which prioritizes long-term stability and profitability over short-term transactional volume, is a hallmark of a truly elite operator. By combining its unique ownership culture with a proven and intelligent growth strategy, Colliers is well-positioned to continue compounding value for many years to come.

The Travelers Companies, Inc. (TRV)

The Travelers Companies, Inc. is a leading provider of property and casualty (P&C) insurance for auto, home, and business. With a history stretching back over 160 years, the company has established itself as one of the largest and most respected commercial P&C insurers in the United States. Operating under its iconic red umbrella symbol, Travelers has built a durable franchise based on disciplined underwriting, extensive data advantages, and an unparalleled distribution network. The company’s operations are organized into three primary segments: Business Insurance, Bond & Specialty Insurance, and Personal Insurance.

Business Insurance is the company’s largest segment, offering a comprehensive suite of P&C insurance products and services to businesses of all sizes, from small enterprises to large corporations. Its core offerings include workers’ compensation, commercial automobile, commercial property, and general liability insurance. The cornerstone of this segment’s success is its deep, long-standing relationships with a vast network of independent agents and brokers across the country. This distribution system provides a significant competitive advantage, creating a wide moat that is difficult for competitors to replicate. Agents act as trusted advisors to their clients, and their preference for Travelers is built on the company’s reliable service, financial strength, and claims-handling expertise.

The Bond & Specialty Insurance segment is a high-margin business where Travelers holds a commanding market-leading position. This segment provides surety bonds, which guarantee the performance of contractual obligations, as well as fidelity, management liability, and professional liability insurance. The surety business, in particular, requires specialized underwriting expertise and a fortress-like balance sheet, as it often involves guaranteeing large-scale, multi-year construction and commercial projects. The company’s reputation and financial stability are paramount, making its brand a critical asset. This segment is less commoditized than other insurance lines and benefits from the deep industry knowledge and risk- assessment capabilities that Travelers has cultivated over many decades.

The Personal Insurance segment provides homeowners and automobile insurance to individuals. This division leverages sophisticated pricing models and a multi-channel distribution strategy that includes independent agents as well as direct-to-consumer options. While operating in a highly competitive market, Travelers focuses on attracting and retaining responsible customers by offering tailored products and excellent claims service.

The enduring competitive advantages of Travelers are rooted in its scale and data. As one of the nation’s largest insurers, the company possesses an enormous reserve of historical claims data. This information provides an analytical edge, allowing its underwriters to more accurately price risk and adapt to changing market conditions. This discipline is the foundation of long-term profitability in the insurance industry. The company’s financial strength allows it to manage the inherent risks of the P&C industry, including exposure to catastrophic events and the cyclical nature of insurance pricing. Management has consistently demonstrated a commitment to shareholder value through prudent capital management while maintaining a strong balance sheet capable of meeting its promises to policyholders.

Petróleo Brasileiro S.A. – Petrobras (PBR-A)

Petróleo Brasileiro S.A., or Petrobras, stands as one of the largest integrated energy producers in the world, anchored BR PETROBRAS by a world-class portfolio of oil and gas assets. The company’s unique position is defined by its control over the vast and highly productive pre-salt reserves located deep offshore Brazil. This geological endowment, combined with decades of accumulated technological expertise, establishes Petrobras as a critical player in the global energy market with a formidable and durable production base.

The core of Petrobras’s competitive advantage lies in the sheer scale and low lifting cost of its pre-salt fields. These massive reservoirs contain high-quality light crude oil and are among the most significant petroleum discoveries of the 21st century. The company has developed unparalleled technological capabilities in deepwater exploration and production, allowing it to efficiently extract resources from these challenging environments. This operational expertise, honed over years of pioneering efforts, creates a significant barrier to entry and solidifies its position as the natural operator of these unique assets. The integrated nature of its operations, which includes a substantial refining and logistics network within Brazil, further supports its production activities and provides a degree of stability.

In recent years, the company has undergone a significant strategic transformation, shifting its focus toward maximizing value from its most profitable exploration and production activities. Management has pursued a disciplined strategy of divesting non-core assets, such as onshore fields and certain midstream and downstream assets, to concentrate capital and resources on the development of its high-return pre-salt projects. This sharpened focus has been instrumental in strengthening the company’s balance sheet and enhancing its cash flow generation capabilities.

It is essential to recognize that the Brazilian government is the controlling shareholder of Petrobras. This relationship is a fundamental aspect of the company’s identity, influencing its strategic direction, governance, and capital allocation policies. While this introduces a layer of complexity not present in its privately-owned peers, the underlying quality of Petrobras’s asset base remains undeniable. The company’s ability to generate significant value is intrinsically linked to its operational execution in the pre-salt basins, which continues to be the primary driver of its performance. By focusing on its core geological strengths, Petrobras has solidified its position as a globally significant energy producer.

Fabrinet (FN)

Fabrinet stands as a premier and highly specialized provider of advanced optical packaging and precision manufacturing services. The company has carved out a unique and defensible niche by focusing exclusively on the most complex and technologically demanding manufacturing challenges for the world’s leading original equipment manufacturers (OEMs). This singular focus has established Fabrinet not as a commoditized contract manufacturer, but as a critical, deeply integrated partner in the optical communications, industrial laser, and automotive industries, creating a durable enterprise with a long runway for growth.

The cornerstone of Fabrinet’s competitive advantage is its profound and difficult-to-replicate engineering expertise. The company excels in high-mix, low-volume production of sophisticated optical and electro- mechanical components that require extreme precision and pristine manufacturing environments. This is a capability that most OEMs have chosen to outsource due to the immense capital investment and specialized talent required. By becoming the trusted manufacturing arm for its clients, Fabrinet creates exceptionally high switching costs. Its engineers work collaboratively with customers from the initial design and prototyping phases all the way through to volume production, deeply embedding Fabrinet’s processes and intellectual property into the final product. This level of integration makes it practically and economically infeasible for a customer to move its business to a less capable competitor.

The company’s business model is further fortified by its strategic focus on the optical communications market. Fabrinet is a key enabler of the technologies that power the internet, data centers, and telecommunications networks. It benefits directly from powerful secular tailwinds, including the exponential growth in data traffic, the global buildout of 5G infrastructure, and the immense computational demands of artificial intelligence, all of which require faster and more powerful optical components. While its customer base is concentrated, this is a reflection of the depth and strategic importance of its partnerships with the undisputed leaders in the optical components industry.

Management has demonstrated a long-standing commitment to operational excellence and disciplined growth. The company operates state-of-the-art facilities, primarily in Thailand, which provide a significant cost advantage without compromising on quality or intellectual property protection. This operational discipline consistently generates strong free cash flow, which is managed with a prudent, shareholder- focused approach. By serving as the indispensable manufacturing expert for the most complex optical technologies, Fabrinet has solidified its position as a critical enabler of the digital age and a high-quality compounding enterprise.

UnitedHealth Group Incorporated (UNH)

UnitedHealth Group Incorporated stands as the premier, category-defining enterprise in the United States healthcare sector. The company has built an unparalleled competitive moat by uniquely combining a dominant health benefits platform, UnitedHealthcare, with a rapidly growing and diversified health services business, Optum. This integrated model creates a powerful, self- reinforcing ecosystem that is fundamentally reshaping the delivery and management of healthcare, establishing UnitedHealth as a truly elite and durable compounding enterprise.

The foundation of the company’s strength begins with UnitedHealthcare, the nation’s largest private health insurer. Its immense scale provides significant and sustainable cost advantages, affording it superior negotiating power with healthcare providers and the ability to spread administrative costs over a massive membership base. This allows the company to offer competitive and attractive benefit plans while generating consistent, predictable cash flows. This benefits business serves as both a stable foundation and a vast data-gathering engine for the entire enterprise.

The true genius of the UnitedHealth model, however, lies in its Optum segment. Optum is a collection of high-growth businesses focused on pharmacy benefit management (Optum Rx), data analytics and technology (Optum Insight), and direct patient care delivery (Optum Health). Optum is not merely an adjunct to the insurance business; it is a synergistic partner that leverages the data from UnitedHealthcare to lower healthcare costs and improve patient outcomes. Optum Health’s network of clinics and physician groups allows the company to directly manage patient care, while Optum Insight’s technology provides the analytical tools to identify efficiencies and best practices. This virtuous cycle-where data from the insurance side informs care delivery on the services side, which in turn leads to better outcomes and lower costs for the insurance members-is a formidable competitive advantage that is nearly impossible for a pure-play insurer to replicate.

Management has demonstrated a clear and disciplined strategy focused on expanding this integrated model. The company continuously invests in its technological capabilities and strategically acquires assets that enhance the Optum platform, further widening its competitive gap. This growth is supported by a shareholder-friendly capital allocation policy, where the company’s substantial free cash flow is consistently returned to shareholders through a growing dividend and significant share repurchase programs. By fundamentally aligning the incentives of a payer and a provider under one roof, UnitedHealth has built a superior and more efficient healthcare system at scale, positioning it for a long runway of continued growth and value creation.

Charter Communications, Inc. (CHTR)

Charter Communications, Inc. is one of the largest and most influential connectivity companies in the United States, providing a comprehensive suite of broadband, video, mobile, and voice services under its Spectrum brand. The company’s business model is built upon its vast and robust hybrid fiber-coaxial network infrastructure, which serves as the foundation for its entire product portfolio and creates a significant competitive moat. This extensive network passes more than 57 million homes and businesses across 41 states, giving Charter immense scale and a durable position in the American telecommunications landscape.

The cornerstone of Charter’s strategy is its high-speed broadband service. This product is the primary driver of customer relationships and serves as the anchor for the company’s bundled offerings. Recognizing the critical importance of network superiority, Charter is executing a multi-year, multi-billion-dollar network evolution initiative. This plan involves upgrading its infrastructure to DOCSIS 4.0 technology, which will enable the delivery of multi-gigabit symmetrical speeds across its footprint. This proactive investment ensures Charter can effectively compete with fiber-to-the-home providers and meet the ever-increasing bandwidth demands of its residential and commercial customers.

A key pillar of the company’s growth strategy is the convergence of its services, most notably through the success of Spectrum Mobile. By operating as a mobile virtual network operator (MVNO), Charter leverages its existing broadband customer base to offer high-quality mobile services without incurring the immense capital cost of building and maintaining a nationwide wireless network. This approach creates a powerful and sticky consumer bundle, increasing customer lifetime value and reducing churn. The company’s ability to offer attractively priced mobile service as part of a converged package represents a significant and sustainable growth vector.

While navigating the secular decline of traditional video, Charter is adapting its offerings to better align with modern consumption habits. Furthermore, the company is aggressively pursuing growth through the expansion of its network into unserved and underserved rural territories. Supported by public-private partnerships, this rural construction initiative is systematically expanding Charter’s addressable market, bringing high-speed connectivity to areas with limited competition and creating a long runway for future customer growth. Through disciplined capital allocation, a focus on operational excellence, and a clear strategy centered on its superior network asset, Charter is positioned to remain a leader in the U.S. connectivity market.

Group 1 Automotive, Inc. (GPI)

Group 1 Automotive, Inc. operates as a premier, internationally diversified automotive retailer, with a significant presence in both the United States and the United Kingdom. The company has distinguished itself through a disciplined growth strategy and a focus on operational excellence, managing a portfolio of dealerships that represent many of the world’s leading automotive brands. By adhering to a rigorous framework of strategic acquisitions, prudent capital management, and superior customer service, Group 1 has built a resilient and compounding enterprise in a highly fragmented industry.

The company’s competitive strength is derived from several key pillars. First, its international diversification provides a natural hedge against regional economic fluctuations and allows management to deploy capital in the most attractive markets. The U.K. operations, in particular, represent a significant and profitable segment that differentiates Group 1 from its purely domestic peers. Second, the company maintains a strong focus on luxury and import brands, which typically attract a more affluent and resilient customer demographic and generate higher-margin service business. This parts and service segment is the operational cornerstone of the company, providing a stable, high-margin, annuity-like revenue stream that performs well throughout economic cycles and is less susceptible to the cyclicality of new vehicle sales.

Group 1’s growth model is defined by a methodical and disciplined approach to consolidation. Management has a long and successful track record of acquiring well-run dealerships and dealership groups at sensible prices, then leveraging the company’s scale and operational expertise to enhance their performance and profitability. This strategy is not centered on growth for its own sake, but on the intelligent expansion of the company’s footprint in a way that is immediately accretive to shareholder value. This acquisitive growth is complemented by a commitment to enhancing the customer experience through digital innovation. The company’s AcceleRide platform provides a comprehensive digital retailing solution, allowing customers to complete the entire vehicle transaction online, a critical capability in the modern retail environment.

This disciplined approach to both external growth and internal improvement is a testament to an experienced management team with a deep understanding of the industry. The company’s focus on maintaining a strong balance sheet provides the financial flexibility to act opportunistically on acquisitions while consistently returning capital to shareholders. By combining geographic diversification, a favorable brand mix, a resilient high-margin service business, and a proven consolidation strategy, Group 1 Automotive has built a best-in-class platform poised for continued, durable growth.

Exxon Mobil Corp (XOM)

Exxon Mobil Corporation stands as one of the world’s preeminent integrated energy and ExxonMobil chemical manufacturers, with a history of operational excellence and technological innovation that has shaped the global energy landscape. The company’s business model is built upon a vast, vertically integrated structure that spans the entire value chain, from the exploration and production of crude oil and natural gas to the manufacturing of high-value fuels, lubricants, and petrochemicals. This integration provides significant operational synergies and a resilient financial profile capable of navigating the inherent cyclicality of commodity markets.

The core of Exxon Mobil’s earnings power resides in its Upstream portfolio, which is increasingly concentrated in highly advantaged, low-cost-of-supply assets. Strategic developments in areas such as the Permian Basin in the United States and the prolific Stabroek Block offshore Guyana are central to the company’s production growth and long-term cash flow generation. These world-class assets are characterized by their scale and low breakeven costs, enabling profitable production even in lower price environments and positioning the company to efficiently meet global energy demand.

Complementing its Upstream strength is the Product Solutions business, which combines the company’s Downstream and Chemical operations. This segment captures value by upgrading crude oil and natural gas into a suite of essential products, from transportation fuels to the building blocks for plastics and other advanced materials. The scale and integration of these facilities allow for significant cost efficiencies and the flexibility to optimize output based on market conditions, providing a valuable hedge against volatility in crude oil prices.

A hallmark of Exxon Mobil’s corporate strategy is its unwavering commitment to capital discipline and shareholder returns. The company prioritizes investments in high-return, low-risk projects while aggressively pursuing structural cost reductions across its operations. This disciplined approach has consistently generated strong free cash flow, which is strategically deployed to fund growth, strengthen the balance sheet, and deliver substantial cash returns to shareholders through a reliable and growing dividend alongside significant share repurchase programs.

While maintaining its focus on its core oil and gas business, Exxon Mobil is also pragmatically navigating the global energy transition. The company is leveraging its extensive technical expertise and project management capabilities to build a commercially viable Low Carbon Solutions business. Strategic investments are being directed toward technologies like carbon capture and storage, hydrogen, and advanced biofuels. This approach is not a departure from its core competencies but rather an extension of them, aimed at reducing emissions in hard-to-decarbonize sectors and establishing a durable, value- accretive business for the future. Through this dual strategy, Exxon Mobil is positioned to remain an essential provider of energy and chemical products for decades to come, while simultaneously building the industrial solutions required for a lower-carbon economy.

Integrated Electrical Services, Inc. (IESC)

Integrated Electrical Services, Inc. (IESC) is a diversified provider of essential electrical and technology infrastructure services across the United States. The company operates through four distinct segments-Communications, Infrastructure Solutions, Commercial & Industrial, and Residential-allowing it to serve a wide array of end markets and mitigate the risks of cyclicality in any single sector. This structure has enabled IESC to establish a durable foundation while strategically capitalizing on high-growth secular trends, particularly the build-out of the nation’s digital infrastructure.

The company’s Communications and Infrastructure Solutions segments are its primary growth engines, positioned at the forefront of the digital revolution. The Communications segment provides critical network infrastructure for data centers, technology corporations, and other high-tech facilities. The Infrastructure Solutions segment delivers custom-engineered electro-mechanical products, such as power distribution systems and generator enclosures, that are vital for the uninterrupted operation of these same data centers and other industrial clients. Together, these segments address the surging demand for data processing, storage, and connectivity driven by artificial intelligence, cloud computing, and e-commerce.

The Commercial & Industrial and Residential segments provide a broad and stable base of operations. The Commercial & Industrial segment offers electrical and mechanical services for a variety of facilities, including educational and healthcare institutions, while the Residential segment serves as a one-stop shop for electrical, plumbing, and HVAC needs for both single-family and multi-family housing. While exposed to the housing market, the Residential segment benefits from long-term demographic trends and provides consistent operational scale.

IESC’s competitive advantage stems from its technical expertise, its ability to manage large and complex projects, and its disciplined strategy of pursuing growth through both organic expansion and strategic bolt- on acquisitions. By providing a comprehensive suite of services from design and installation to maintenance, the company embeds itself as a critical partner to its clients. Its strong balance sheet and prudent capital allocation strategy provide the financial flexibility to invest in expanding capacity and to acquire companies that enhance its service offerings and geographic reach, ensuring it can continue to meet the evolving needs of its diverse customer base.

Darden Restaurants, Inc. (DRI)

Darden Restaurants, Inc. stands as the preeminent operator in the full-service dining industry, managing a portfolio of some of the most recognizable and successful brands in American casual and fine dining. The company’s collection of differentiated restaurant concepts, led by the iconic Olive Garden, has established Darden as a category-defining enterprise. Through a disciplined focus on operational excellence, leveraging immense scale, and a prudent capital allocation strategy, Darden has built a formidable competitive moat and a durable platform for compounding shareholder value.

The cornerstone of Darden’s competitive advantage is its unmatched scale. As one of the world’s largest full-service restaurant companies, it possesses significant cost advantages across its supply chain, enabling it to procure high-quality ingredients at costs that smaller competitors and independent restaurants cannot match. This scale also provides substantial leverage in marketing, real estate, and technology, allowing for sophisticated data analytics that inform everything from menu optimization to site selection. This data- driven approach results in a superior guest experience and operational efficiencies that consistently drive industry-leading performance. The strength of its individual brands, particularly the cash-flow-generating powerhouse Olive Garden, provides a stable foundation that funds investment across the entire portfolio.

Management’s strategy is rooted in a relentless focus on the fundamentals of restaurant operations. The company’s “back-to-basics” operating philosophy emphasizes culinary innovation, attentive service, and an inviting atmosphere, ensuring a consistent and high-quality guest experience across its thousands of locations. This operational rigor is complemented by a disciplined approach to growth. Darden prioritizes strengthening its core brands while selectively pursuing strategic, tuck-in acquisitions that add new dimensions to its portfolio, such as the recent addition of the Ruth’s Chris Steak House brand. This demonstrates a commitment to expanding its market leadership in a measured and value-enhancing manner.

The company’s approach to capital allocation is both prudent and shareholder-friendly. Darden consistently generates strong free cash flow, which management deploys thoughtfully between reinvesting in its existing restaurants to maintain their appeal, funding new unit growth, and returning a significant amount of capital to shareholders through a reliable dividend and opportunistic share repurchases. This balanced strategy ensures the long-term health and competitiveness of its brands while providing direct returns to its owners. By combining a portfolio of iconic brands with significant scale advantages and a disciplined management team, Darden has solidified its position as a best-in-class operator poised for continued, steady growth.

Canadian Imperial Bank of Commerce (CM)

Canadian Imperial Bank of Commerce (CIBC) is one of Canada’s largest and most established financial institutions, with a diversified business model built to serve clients across Canada and in select global markets. The bank’s operations are organized into four main segments: Canadian Personal and Business Banking, Canadian Commercial Banking and Wealth Management, U.S. Commercial Banking and Wealth Management, and Capital Markets. This structure allows CIBC to leverage its foundational strength in its domestic market to pursue strategic growth in higher-value segments, particularly in wealth management and cross-border banking.

The bedrock of CIBC’s franchise is its Canadian Personal and Business Banking division, which commands a significant share of the mature and stable Canadian banking sector. This segment provides a full suite of financial products and services to millions of retail and business clients across the country. The stability and scale of these operations generate consistent earnings and a low-cost deposit base, which provides the critical funding for the bank’s other strategic initiatives and its overall financial strength.

A central pillar of CIBC’s long-term strategy is the focused expansion of its wealth management and U.S. commercial banking platforms. The bank is deliberately shifting its business mix toward these less capital- intensive, higher-return businesses to drive growth and diversify its earnings base beyond Canadian retail banking. In Canada, CIBC is focused on deepening its relationships with mass affluent and high-net-worth clients. The most significant element of this strategy has been its expansion into the United States, anchored by the acquisition of The PrivateBancorp. Now operating as CIBC Bank USA, this platform provides a strong foothold to offer commercial banking and private wealth services to middle-market companies, entrepreneurs, and affluent individuals in key U.S. markets.

The Capital Markets segment complements the bank’s other businesses by providing integrated financial solutions, including advisory and financing services, to corporate, government, and institutional clients. This division enhances connectivity across the bank, allowing CIBC to offer a full spectrum of products to its commercial and wealth management clients in both Canada and the U.S.

In essence, CIBC’s strategy is one of focused evolution. The bank is leveraging its deeply entrenched and profitable Canadian retail franchise as a stable foundation to fund a disciplined expansion into the more dynamic and relationship-oriented areas of wealth management and U.S. commercial banking. By investing in its digital capabilities and emphasizing a client-centric approach, CIBC is positioning itself to build deeper relationships and capture profitable growth on both sides of the border.

Appendix I: Portfolio Construction Software Overview

LRT separates the discretionary and qualitative process of selecting the equity holdings from the portfolio construction process which is systematic and quantitative.

Process Example: Portfolio Optimizer

Our quantitative process considers each position’s contribution to portfolio volatility, contribution of idiosyncratic vs. systematic risk and portfolio factor (size, value, quality, momentum, vol, etc.) exposures.

The system outputs target portfolio weighs for each position. We trade mechanically to rebalance the portfolio each month to the targeted exposures. This eliminates emotions, human biases, and overconfidence risk. Visit LRT Capital – Risk Management System to learn more. Visit: https://hubs.ly/Q02kfbbK0 to see more examples.

Example system output:

Image

|

Disclaimer and Contact Information LRT Capital Management, LLC is an Exempt Reporting Adviser with the Texas State Securities Board, CRD #290260. Past returns are no guarantee of future results. Results are net of a hypothetical 1% annual management fee (charged quarterly) and 20% annual performance fee. Individual account returns may vary based on the timing of investments and individual fee structure. This memorandum and the information included herein is confidential and is intended solely for the information and exclusive use of the person to whom it has been provided. It is not to be reproduced or transmitted, in whole or in part, to any other person. Each recipient of this memorandum agrees to treat the memorandum and the information included herein as confidential and further agrees not to transmit, reproduce, or make available to anyone, in whole or in part, any of the information included herein. Each person who receives a copy of this memorandum is deemed to have agreed to return this memorandum to the General Partner upon request. Investment in the Fund involves significant risks, including but not limited to the risks that the indices within the Fund perform unfavorably, there are disruption of the orderly markets of the securities traded in the Fund, trading errors occur, and the computer software and hardware on which the General Partner relies experiences technical issues. All investing involves risk of loss, including the possible loss of all amounts invested. Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly herein will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk-all investing involves risk-and may experience positive or negative growth. Nothing herein should be construed as guaranteeing any investment performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. For a more detailed explanation of risks relating to an investment, please review the Fund’s Private Placement Memorandum, Limited Partnership Agreement, and Subscription Documents (Offering Documents). Indices are unmanaged, include the reinvestment of dividends and do not reflect transaction costs or any performance fees. Unlike indices, the Fund will be actively managed and may include substantially fewer and different securities than those comprising each index. Results for the Fund as compared to the performance of the Standard & Poor’s 500 Index (the “S&P 500”), for informational purposes only. The S&P 500 is an unmanaged market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The investment program does not mirror this index and the volatility may be materially different than the volatility of the S&P 500. This report is for informational purposes only and does not constitute an offer to sell, solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. Any offer to sell is done exclusively through the Fund’s Private Placement Memorandum. All persons interested in subscribing to the Fund should first review the Fund’s Offering Documents, copies of which are available upon request. The information contained herein has been prepared by the General Partner and is current as of the date of transmission. Such information is subject to change. Any statements or facts contained herein derived from third-party sources are believed to be reliable but are not guaranteed as to their accuracy or completeness. Investment in the Fund is permitted only by “accredited investors” as defined in the Securities Act of 1933, as amended. These requirements are set forth in detail in the Offering Documents. LRT Capital Management, LLC 108 Wild Basin Road, Suite 250 Austin, TX 78746 Office: +1 512 320 9085 LRT Capital Management, LLC | LRT Capital Management, LLC is an independent investment advisor. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.