Dear Partners & Friends:

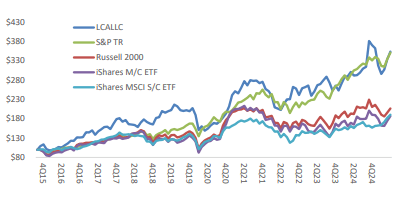

For the 2Q25 quarter (ended June 30, 2025), cumulative net returns improved 19%. Year to date cumulative net returns through quarter end remain negative however, down 4%. Since inception in November 2015 through quarter end, LCA has returned a cumulative 253% net of fees, or 14% CAGR. As a backdrop to returns, on a cumulative net basis since inception, we comfortably exceed three widely used representative indices for passive small company investing: The Russell 2000 Index, the iShares US MicroCap ETF and the iShares SmallCap EAFE (ex-N. Am) ETF. Cumulative net returns since inception are roughly in line with the S&P. Past performance is no guarantee of future results. Individual account returns may vary. 1

| Net returns | Long Cast | R2000 | IWC | SCZ | S&P TR |

| 2015 (2-mos) | 14% | -5% | -5% | 1% | -2% |

| 2016 | 15% | 21% | 21% | 3% | 12% |

| 2017 | 36% | 15% | 13% | 33% | 22% |

| 2018 | -8% | -11% | -13% | -18% | -4% |

| 2019 | 21% | 25% | 22% | 25% | 31% |

| 2020 | -3% | 20% | 21% | 12% | 18% |

| 2021 | 42% | 15% | 19% | 10% | 29% |

| 2022 | -12% | -20% | -22% | -21% | -18% |

| 2023 | 10% | 17% | 9% | 13% | 26% |

| 2024 | 39% | 12% | 14% | 2% | 25% |

| 1Q25 | -20% | -9% | -15% | 5% | -4% |

| 2Q25 | 19% | 8% | 15% | 16% | 11% |

| Cumulative | 253% | 107% | 87% | 90% | 251% |

| CAGR | 14% | 8% | 7% | 7% | 14% |

| YTD | -4% | -2% | -2% | 21% | 6% |

| LTM | 21% | 8% | 13% | 22% | 15% |

Portfolio Update

CCRD, PESI and MAMA were the largest contributors in the quarter slightly offset by declines in RELL, QRHC and PDEX. At quarter end, the top-five positions represented roughly 65% of the portfolio while cash represented roughly 10%.

As discussed in my client email from early July, we have added a number of new smaller positions to the portfolio and we are holding more cash than usual. This administration uses uncertainty as a cudgel to shape policy, and though the market has grown inured to the surrounding dynamics, as evidenced by major indices making new highs, I see significant vulnerabilities and imbalances – notably demand destruction – that could be exposed in short time. Thus, I am cautious about putting money to work and believe cash is a good hedge. I’ll discuss my thinking on this in a bit more detail in the concluding section of this short letter.

In my July email, I called out two stocks – CCRD and QRHC – and both have had substantive news worth updating. At the end of July, CCRD announced its intention to sell itself to Euronet Worldwide (EEFT) in an all-stock deal valued at $30 / share. Our returns were substantially enhanced by doubling the size of the position when the stock declined in late ’23 and early ’24.

As I wrote back in July, I had anticipated a sale before year-end, and although this isn’t the one I’d hoped for, it solves multiple problems for both companies. CCRD gains a haven where it can rebuild revenues in a post-Apple Card world (this deal wouldn’t happen if the company believed it would keep processing the Apple Card), CCRD shareholders have an offramp for their stock if they want and EEFT adds a substantial and well-tested digital payments platform to its legacy ATM networks, prepaid mobile cards and money transfer business.

Like CCRD, EEFT is founder led and run by an idiosyncratic thinker. The legacy business is mostly ex-US merchant acquiring, which is the financial services equivalent of trench warfare; salespeople go door to door trying to compel retailers to rent its point of sale device for processing card transactions or to devote a few square feet of their store to an ATM (with outrageous fees).

A smaller part of the business is processing debit card transactions for banks, but this business faces competition from lower-cost real time payment platforms and regulated caps on transaction fees. In their effort to grow profits, banks are therefore turning to credit cards, which have lower adoption rates outside the US, and are more profitable. This is where CoreCard fits into EEFT’s strategy.

Given CCRD’s small size it is not expected to be meaningful to earnings in the near term. But if EEFT can sell CoreCard’s credit card issuing services through its existing bank customer base, it should do well over the next few years. Given its mid-single digit valuation, mid-teen margins and strong cash flow, I expect we’ll continue to own some EEFT but it will be a much smaller position than 25% of the portfolio, which is where CCRD had grown to prior to 2Q’s close.

Also subsequent to the quarter, QRHC reported meaningful cash flow generation for the first time in two years. As I wrote in my July email, I would love to put the proceeds from CCRD into QRHC, a long- time position that has more than halved (twice) since September, but I am hesitant until I see the effect of recent managerial changes on operations. Cash flow generation is one of those small but important indicators. We have been selectively adding.

However, I continue to think the Board is missing an opportunity to improve as well. Out of the six remaining Board members, three of them – our Chairman Dan Frieberg, plus Stephen Nolan and Audrey Dunning – have a web of interconnects as investors and Board members in what I call “perpetual microcaps”. The only reason to own microcaps is for the expectation that it grows … beyond … so it’s never a confidence builder to see a Board with such heavy microcap-only experience.

As I wrote in my July email, I have long had a highly experienced and extremely knowledgeable industry source who has been a helpful and thoughtful resource in understanding the business – this source could see the managerial and technical deficits at our company as far back as 2017 even as our Board couldn’t see it through last year – and everything he’s ever told me about our company and its managers has proved accurate. He has offered to make himself available to the Board for help. I firmly believe his participation would build confidence for shareholders and help elevate the rest of our Board by offering them perspectives well beyond their experiences.

Our Chairman took the time to talk to this person back in June, but it pains me that nothing has been done. Just as they were blind to the problems they themselves caused by levering up with expensive debt to add revenue to a platform that didn’t work under the leadership of a CEO that I long complained was out over his skis (and is now gone), they seem blind to the opportunity of an upgrade. I would aggressively add to our position if our Board replaced one of its perpetual microcap Board members with this person, given his experience turning around companies in this industry and his successes in various others.

The good news is, this source told me that the changes the company has recently made should yield improvements in 12-to-18 months – again, everything he’s told me has proved accurate – offering a sense of hope that our new CEO and his cohort can succeed even as our Board underwhelms.

In Conclusion: For 8 Seconds You’re Flying

For stockpickers, there’s few things as exciting as the feeling of finding an “undiscovered stock”, ie one that has a terrific and legitimate business run by experienced managers trading at a cheap valuation relative to its expected growth and cash flow and that hasn’t been observed by the wider investment world. Owning such an asset can be a lonely experience but the loneliness is offset by the anticipation of something hopeful and positive in some undetermined future.

Though I like the prospects for the select few companies in our portfolio, especially our large holdings MTRX and RSSS, I’m feeling less hopeful about the economy. Even as the markets hit new highs, I have a hard time unseeing the likelihood of pending demand destruction. How aren’t we going to see near term demand destruction given we are …

Implementing non-free trade policies that raise the costs of inputs and dissuade trade; Dissuading overseas visitors, especially from Canada; Increasing policy uncertainty that disrupts long term investment decisions; Cancelling funded and in some cases nearly completed projects; Reducing the size of federal government employee base by 12%; Reducing the population by deporting 1,500 consumers per day; Overall increasing uncertainty, etc etc

… one can point to pockets of strength in recent earnings, but that could be a result of accelerating activity ahead of expected tariffs. And economic weakness may also be masked by data center spending, which is now contributing as much to the economy as consumer spending, one of the largest components of GDP and is softening. I have heard from people who are giddy with excitement about the current policies, and I wonder if they are simply experiencing the 8 seconds of soaring that follows a leap off a bridge. In short, I think it pays to be patient.

As always, I remain committed to building a durable and sustainable business based on a repeatable investment process and intelligent capital allocation. I remain grateful to have clients (by design) aligned with my long term, small company centric and research-intensive focus and I welcome the continued interest from individuals and institutions as I patiently grow the business.

Sincerely / Avi

Brooklyn, NY

August 2025

|

1 Performance data is based on Interactive Brokers “Portfolio Reports” function; shown net of management fees, expenses, and commissions; unaudited; and unless otherwise noted, since inception in Nov. 2015. Past performance is not a guarantee of future results. Individual account performance may vary. Any investment entails a risk of loss including the total loss of capital. ADV form available through Broker Check; CRD # 175005 |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.