Frame of Reference

The DKCI Fund returned 102.75%1 in 2024. The fund has performed well since bottoming in October 2023 and we are now just over a year into what we believe is the next 5-7 year bull cycle for small/mid cap growth stocks. The Fund’s performance has continued in 2025, and the Fund was up 1.04% in January1.

The largest contributors to our performance in 2024 were investments in Zedcor (OTCPK:ZDCAF), VitalHub (OTCQX:VHIBF), Propel (PRL:CA), Cipher, Vertical Scope and Kraken (OTCQB:KRKNF). Our notable negative performers were Converge & Decisive Dividend (DE:CA). Another contributor in 2024 was that our long positions outperformed our shorts every single month.

The purpose of this newsletter has always been to keep our investors informed. We aim to answer the common questions we receive as well and try and proactively answer potential questions.

Our goal today is to apply context to the investment landscape. Watching the news or spending too much time on social media seems to lead to aggressive negativity. We’ve been traveling around North America and speaking with companies one on one, and the overall outlook is much more positive. There are always pockets of growth and as we’ll show with our projected growth and earnings, 2025 is shaping up well.

Interest Rates, Inflation & Tariffs

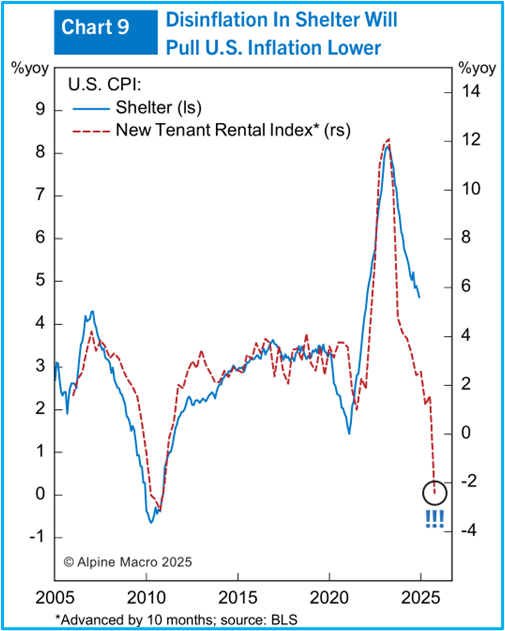

People have a “feeling” inflation will come back but it isn’t supported by the data. Importantly, in the U.S., both labour productivity growth and the dollar have been strong, which are historically anti-inflationary. As we discussed, the shelter component is the largest but also the most lagging input for inflation. This is the reason the Fed was behind the curve as inflation took off, but it is also the reason why core inflation should continue to converge with current core ex-shelter near 2%. In his January 29th press conference, where they kept rates in place, Chairman Powell stated that the current rate is meaningfully above the neutral rate, meaning it is restrictive and should be lowered as the rate of inflation declines.

Figure 1 – Shelter Disinflation

One of the gauges we follow is from Truflation, who track thousands of inputs in real-time. Back in 2021, the U.S. was reporting 4% CPI while Truflation was reporting closer to 8% real-time. While Truflation reported 8% inflation in Q2 2021 the US reported CPI didn’t get to 8% until Q1 2022. The reason for breaking down the delay between reported CPI and Truflation is so we can approximate where the reported CPI will be in the future based on where Truflation is today.

Figure 2- US Inflation Index

The most common inquiry and worry surrounds tariffs. Tariffs are paid by the company who is importing that item, and that tariff is paid to the government as a tax. The idea being imposing tariffs on a product from Canada should make that product more expensive and less appealing, and for companies and consumers to buy more from domestic suppliers (protect domestic industries). This can also be used politically as a bargaining tool or punishment. We’ll get into the macro impact of tariffs in a second, but investors should know that the first thing we did heading into this new administration was go through each of our investments one by one to assess the potential impact of tariffs. The fact that we focus on knowledge-based industries provides a lot of protection against tariff risk. Overall, the fund is very insulated from tariffs impacting the day-to-day operations of our investments.

The stock market however may react emotionally with a shoot first and ask questions later mentality. We’re writing this as the initial lists of goods to be taxed are starting to be released. Not knowing the specific details of products, timing of the rollout, and length in which they stay in place, make it impossible to gauge the overall impact. An interesting counter point to the initial negative reaction is that the weakness in the Canadian dollar improves the profitability of many of our investments which have significant revenue in USD, aren’t in tariffed industries, and who’s stocks trade in CAD. Another notable point is that Canadian interest rates are now forecasted to decline significantly faster than just a few weeks ago. Tariffs are economically inefficient, pretty much like any time the government inserts itself into economics, but declining rates and a declining CAD muddy the waters on how tariffs will actually impact stock prices. Remember, the stock market is not the economy.

Something to consider is that taxes suck money out of the economy, which leads to reduced consumption. We would urge anyone who wants to dive into this further to either reach out or read Ravi Batra’s Review of International Economics, Are Tariffs Inflationary?

To keep the frame of reference theme intact, below are four charts from four different time periods showing tariffs and inflation moving in opposite directions.

Figure 3 – Average Tariff and the CPI

Figure 4 – Chinese Tariffs

Figure 5 – Tariff Rate vs CPI

Figure 6 – Tariff Rate vs Trade

We’re only hitting on this point in order to provide some base facts for one to anchor to. Yes, tariffs have a direct impact on the products they are directly applied to, but from an inflation standpoint, an investor needs to take into account how these companies respond to the tariffs (pass it on or take less margin?) as well as how the consumer reacts, specifically higher prices usually lead to less consumption of that good, especially if there are close substitutes (Mexican beer vs. American beer), and labour’s ability to shift between industry and scale up and down also plays a role here (transfer of labour). In addition, how does the currency between the two countries behave because if a currency depreciates enough, it can offset a significant portion of the increase

in the buyer’s domestic price. Goldman Sachs economists estimate that the latest trade tariffs, if sustained, will reduce stock market earnings by 3% 2.

Why do we care? Tariffs probably don’t have the complete tit for tat impact on inflation that people are worried about. However, that doesn’t mean they should be ignored. The impact on specific businesses and trade is real and important. We care a lot about company-specific impacts and running a concentrated investment strategy allows us to stay on top of the impacts on each of our investments. We also care, because there will most likely be some overreactions in certain circumstances leading to long-term investment opportunities. An area of concern would be if our government decided to hand out free money “to help against the inflationary impacts of tariffs.”

During the time periods referenced, there was an industrial revolution and massive technological change. Fast forward to today, and we’re at the beginning of an AI shift change. Productivity has already started to make massive gains and factor in cultural shift changes like the mandated return to the office (ie. government worker productivity?), and increased productivity should continue to be a deflationary force. Overall, we care because the direction of interest rates impacts the valuation of assets. You’re probably tired of us stating that productivity and demographics are greater forces against inflation than almost everything else.

Trump

The second most common and more general question has been the potential impact of the new administration. We can look at his past actions, specifically his last presidency. He’s obviously a confrontational and ultimatum-based negotiator.

Threats from his first term include:

Threatened imposing escalating tariffs on Mexico in order to get new immigration measures. Threatened European car imports and agriculture products. Threatened to pull out of NAFTA if Mexico and Canada didn’t agree to his terms. Threatened North Korea with “fire and fury like the world has never seen.” Threatened to withdraw from NATO. Threatened to cut funding to sanctuary cities that did not comply with federal immigration enforcement.

Threatened cutting aid to Central American countries in order to address illegal immigration and drug trafficking. Threatened to keep the government closed indefinitely if Congress didn’t approve the funding for the U.S. – Mexico border wall. Stated he would make Mexico pay for the wall.

Under all of these headlines and distractions, the S&P 500 increased 70% during his first term. We are not defending his actions by any means. We’re framing the current headlines with similar past headlines. What we’re trying to illustrate is that there are more important factors to consider as investors, which leads us to our next topic.

Earnings Growth

We speak about tariffs, inflation, interest rates, politics, etc., but a frame of reference for someone’s investing outlook should always take into account is what the market is most tied too … earnings.

Markets don’t move in a straight line. The market is controlled by emotion in the short-term, and fundamentals over the long-term. Investor psychology is much more volatile than a company’s revenue and earnings. How an investor frames investing in the stock market is important. Headlines usually drive pessimism even if the underlying statistics and data show something else. The stock market is not the economy and can behave much differently than the overall economy.

We found the table below does a good job illustrating this point. If we focus on the earnings row in the table, the growth rate was anemic from Q2 2022 to Q2 2023 averaging less than 0%. This growth rate has now started to ramp considerably, with market earnings growth accelerating to more than 16% late in 2025 and into 2026. Considering where we’ve come from and where we’re going, we’re optimistic about the future of the market.

Figure 7 – Revenue and Earnings Growth

Spending too much time watching the news or scrolling social media has been proven to have a negative impact on one’s outlook and feelings. We express our opinions on certain topics but try not to get too far removed from what really matters, which is earnings. We like to reference the chart below which plots the stock market side by side with its respective earnings since 1945. There have been considerable known and unknown risks over this time period but as investors we view earnings as the North Star.

Figure 8 – S&P500 vs Earnings

DKAM Investments

Speaking of earnings growth, we now look at the Fund’s specific investments. We’re confident in our analysis and projections and believe we are invested in companies that can perform well in any political environment.

One of our first steps of investing is referencing our stock trackers. We rank hundreds of companies on an apples-to-apples basis in order to get a sense of which ones have the best growth and value relative to everyone else. Each company is modelled, given a score, and ranked. This is our starting point because we’re numbers first investors and our first pass on an investment is based on growth, earnings, and valuation. Framing investments this way keeps us away from focusing on “themes” or “great stories”. If it doesn’t rank well, we don’t own it. We are driven by a company’s return on equity, not its ability to tell a good story.

Below we list 10 investments in our fund with their corresponding revenue growth, earnings growth, and valuation projections for 2025. There are obviously risks associated with investing in smaller companies and many investors get comfort by owning the large caps or “blue chip stocks”. Considering large caps have never been this overvalued versus small caps, we have also included the respective fundamentals of the Mag 7 companies for reference. In our eyes, getting more than twice the earnings growth for almost one third the valuation is a great trade-off. This is one of the main reasons we have a positive outlook on this segment of the market for the next few years.

|

Company Market Cap |

2025 Revenue 2025 Earnings |

|||

|

Growth* |

Growth* |

2025 PE* |

||

|

Zedcor (OTCPK:ZDCAF) |

$340M |

85% |

107% |

28.1x |

|

Propel Holdings (OTCPK:PRLPF) |

$1,501M |

41% |

72% |

10.5x |

|

Cipher Pharmaceuticals (OTCQX:CPHRF) |

$350M |

54% |

66% |

8.9x |

|

VitalHub (OTCQX:VHIBF) |

$623M |

63% |

62% |

23.1x |

|

Enterprise Group (E:CA) |

$188M |

42% |

45% |

15.2x |

|

MDA Space (OTCPK:MDALF) |

$2,964M |

29% |

37% |

14.9x |

|

Atlas Engineering (OTCPK:APEUF) |

$84M |

24% |

29% |

15.1x |

|

VerticalScope (OTCQX:VFORF) |

$262M |

14% |

25% |

6.8x |

|

GoEasy (OTCPK:EHMEF) |

$3,174M |

22% |

23% |

8.6x |

|

SSC Security (OTCQX:SECUF) |

$47M |

12% |

15% |

15.0x |

|

Converge Technology (OTCQX:CTSDF) |

$668M |

6% |

12% |

5.9x |

|

Average |

$924m |

36% |

45% |

13.8x |

|

*DKAM Estimates |

||||

|

2025 Revenue |

2025 Earnings |

|||

|

Company |

Market Cap |

Growth* |

Growth* |

2025 PE* |

|

Nvidia (NVDA) |

$2,900B |

54% |

52% |

26x |

|

Tesla (TSLA) |

$1,275B |

17% |

32% |

112x |

|

Microsoft (MSFT) |

$3,231B |

14% |

15% |

29x |

|

Amazon (AMZN) |

$2,475B |

11% |

15% |

31x |

|

META |

$2,235B |

15% |

11% |

24x |

|

Alphabet (GOOG,GOOGL) |

$2,360B |

20% |

11% |

20x |

|

Apple (AAPL) |

$3,457B |

8% |

8% |

29x |

|

Average |

$2,562B |

20% |

21% |

3Gx |

|

*Bloomberg Estimates |

Zedcor (ZDC)

Zedcor had a phenomenal 2024 and the stock price performed extremely well. We just got back from Houston, where we met most of the Zedcor team and toured their new manufacturing facility as well as seeing their new monitoring center buildout. Their operational excellence was impressive, and we view them as being true operators where most competitors seem strictly focused on sales and lose sight of product and monitoring quality. Their footprint is now built out to be a much larger company with their eyes set on being +12,000 towers (they’re currently at ~1,400 towers). We believe they’ll get to +12,000 towers much faster than people think. From a financials perspective, their valuation in isolation may look expensive. For one, valuation in isolation is a blunt and fairly useless tool. Factoring in their growth, margins, and long-term runway, this valuation once again looks cheap based on 2026 projected earnings. We expect the stock will perform in-line with its earnings growth. A final note on Zedcor is how we view their reported financials. Their main cost is heavy duty powder coated steel. ZDC’s towers are the tanks of the industry when compared to competitors. The issue with the financials being that IFRS standards make them depreciate the cost of powder coated steel over 10 years when in reality this type of steel can last a lifetime. Some of the towers have already been through hurricanes and tornadoes and not only remained upright but were able to record and function providing valuable data to the customer for insurance purposes. Like most companies, we would urge investors to focus on Zedcor’s operating cashflow.

Propel Holdings (PRL)

Propel also had a great 2024 and we think they’re set-up for a great 2025. They recently acquired QuidMarket in the UK, which has higher growth and margins than PRL. This acquisition now diversifies them across the U.S., Canada, and the UK. Considering how fast they are growing earnings, we view the stock as being cheap.

Cipher Pharma (CPH)

After years of looking for an acquisition, Cipher pulled the trigger and acquired the rights and the U.S. sales force of Natroba (head lice and scabies). The acquisition not only doubles the size of the business but gives them the opportunity to bring the drugs which they were out licensing back in-house and distribute themselves. This would increase earnings as well as expand the efficiency of the sales force by giving them more to sell. In addition, they are in the process of getting approved to bring Natroba to Canada as well as licensing to the rest of the world. Add in potential tuck-in M&A in 2025 and we think Cipher’s growth and profitability will be well above what people expect.

VitalHub

VitalHub had a great 2024 and finished the year by announcing two more acquisitions. They currently have a relatively large amount of cash on the balance sheet, that when deployed should increase cash earnings by ~50%. We’re currently factoring in a partial deployment of this capital throughout 2025 so growth again should be impressive as they combine high organic growth, 2 deals done late in 2024, plus further M&A.

MDA Space (MDA)

MDA Space is set to grow at ~30% for the next few years while improving margins. The stock recently corrected on “news” of a client exploring opportunities with a competitor (Starlink). The initial reaction was overkill and we think the stock does well in 2025, especially considering the accelerated growth coming when they report Q1 earnings.

Enterprise Group

There is a lot of hype around AI which we’ve covered before ( HERE). A derivative play on AI where we’re finding real growth and profitable businesses is in power demand (power generation & power transmission). We’re extremely bullish on Enterprise Group specifically because they introduced a new technology in 2022 and have the exclusive access to a natural gas turbine which allows them to disrupt and replace legacy systems. Data centers are seeing an explosion in growth. The main cost to run a data center is electricity. Canada, specifically Western Canada, is at the forefront because they have the cheapest energy (Natural Gas) and cold weather, leading to massive advantages in power generation and naturally reduced costs for cooling. Alberta is currently home to 22 data centres, including 12 in Calgary and 9 in Edmonton. Given the massive power requirements, the Alberta government is encouraging developers to have their own off-grid infrastructure, which would speed up the approval process. Combined with a potential change in political climate plus multiple liquefied natural gas (LNG) pipelines coming online, the supply and demand dynamic is shifting. Enterprise will have the ability to offer 1-5 MW turbines for this market. Historically a single energy production site is powered by many diesel generators that use thousands of litres of diesel per day. These generators are loud, dirty, and require a 3rd party to regularly bring in fuel tanks. Enterprise Group launched their Evolution Power Projects division in 2022 which utilizes newly developed natural gas turbines to replace diesel generators, which allows the natural gas companies to tap into their nat gas onsite and power their entire site themselves. This eliminates their diesel costs as well as significantly reducing pollution and 3rd party costs and logistics. Enterprise has the exclusive ability to offer these turbines which are more reliable than diesel engines but also work in the frigid Canadian temperatures. In addition, they have recently been able to show that they can power sites by using the sites flaring gas, again eliminating expenses and pollution. Enterprise’s Evolution Power Products division is growing quickly and we think the business will triple earnings over the next couple of years.

Atlas Engineering (AEP)

Atlas provides roof and wall trusses to home builders in Canada. This is an extremely fragmented market. Atlas is starting to bring automation to this market, which should solve a lot of the labour and capacity issues. 2024 was a dismal year for home builders in Canada as they came out of 2023 where the number of new detached homes built fell by 20%. The number of residential building permits began to bounce back in 2024, a leading indicator for Altas’s business. Atlas remains profitable and we believe we’re investing at the trough in their market.

VerticalScope

VerticalScope owns +1,300 online forums and is returning to a growth mindset in 2025. With renewed organic growth plus a better balance sheet, we believe FORA is in a position of strength after the Covid boom then bust in ad spend. The business is extremely high margin and trades extremely cheaply, especially considering the upside to license data to LLMs which is not factoring into our projections.

GoEasy

GoEasy is a long-term compounder that continues to see the benefits of economies of scale as margins continue to improve and as they introduce more products. The stock can trade based on macro headlines, but we treat these pullbacks as buying opportunities.

SSC Security (SECU)

SSC continues to chug along and doesn’t get the credit it deserves. They have cash or near cash assets that cover more than half the market cap with zero debt. They currently have low single-digit organic growth with the goal of improving to 10%. The business is profitable, paying a dividend, buying back stock, and will most likely continue to rollout new product divisions.

Converge Technology

Converge was one of our investments that didn’t have a great 2024. Their services side of the business, which focuses on cyber, cloud, and AI, continued to grow but the boom then bust impact of Covid on hardware sales made the year over year comparisons tough. That being said, this part of the business should return to growth in 2025. In the meantime, they are buying back a lot of stock plus two of their Canadian competitors have already been acquired in 2025 at multiples that are 2x where CTS trades today.

Kraken Robotics

You’ll notice that we didn’t include Kraken in our list above. We sold our investment in Kraken at the beginning of this year. We bought most of our stock from $0.74-$1.20/share in 2024 and the stock recently got above $3.00/share. Selling this position was strictly a valuation call. On a relative basis, after factoring in projected growth versus valuation, we didn’t view the position as a great risk to reward tradeoff. Kraken does have considerable upside with their connection to Anduril and potential orders that would significantly boost earnings, but for now we are on the sidelines and may look to re-invest in the future.

Final Thoughts

Stock market volatility will remain high as political headlines both North and South of the border take front stage. Stocks aren’t as cheap as they were a year ago but the outlook for earnings growth is strong for large caps and even more so for small caps.

Jason and Jesse each made appearances on BNN Market Call in January. You can find the link to watch their shows HERE and HERE.

The original draft of this newsletter was over 20 pages long. We cut portions for brevity’s sake, but if there are any points made that you would like to discuss in greater detail, feel free to reach out.

Also, if you would like to discuss the Fund and specific investments please reach out.

Sincerely,

Jason & Jesse | info@donvillekent.com

|

DISCLAIMER Readers are advised that the material herein should be used solely for informational purposes. Donville Kent Asset Management Inc. (OTC:DKAM) does not purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers should always conduct their own research and due diligence and obtain professional advice before making any investment decision. DKAM will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our newsletters, presentations, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions. The information contained herein does not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters, presentations or on our website should be independently verified with the companies mentioned. The editor and publisher are not responsible for errors or omissions. Past performance does not guarantee future results. Unit value and investment returns will fluctuate and there is no assurance that a fund can maintain a specific net asset value. The fund is available to investors eligible to invest under a prospectus exemption, such as accredited investors. Prospective investors should rely solely on the Fund’s offering documentation, which outlines the risk factors in making a decision to invest. The S&P/TSX Composite Total Return Index, the S&P 500 Total Return Index, and the Russell 2000 Total Return Index (“the indexes”) are similar to the DKAM Capital Ideas Fund LP (“the fund”) in that all include publicly traded North American equities of various market capitalizations across several industries, and reflect both movements in the stock prices as well as reinvestment of dividend income. However, there are several differences between the fund and the indexes, as the fund can invest both long and short, can utilize leverage, can take concentrated positions in single equities, and may invest in companies that have smaller market capitalizations than those that are included in the indexes. In addition, the indexes do not include any fees or expenses whereas the fund data presented is net of all fees and expenses. The source of the indexes’ data is Bloomberg. DKAM receives no compensation of any kind from any companies that are mentioned in our newsletters or on our website. Any opinions expressed are subject to change without notice. The DKAM Capital Ideas Fund, employees, writers, and other related parties may hold positions in the securities that are discussed in our newsletters, presentations or on our website. 1 Class A, Leading Series, net of fees and expenses 2 Article at https://www.reuters.com/business/finance/goldman-sachs-flags-up-3-hit-its-sp-500-earnings-forecasts- trumps-tariffs-2025-02-03/ |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.