By Evan Bauman, Aram Green & Amanda Leithe

Recent Activity Begins to Bear Fruit

Market Overview

Signs of cooling inflation and an ambitious start to the Federal Reserve’s rate-cutting cycle drove equity markets to broad gains in the third quarter, led by smaller capitalization companies. The S&P 500 Index (SP500, SPX) rose 5.89%, the small cap Russell 2000 Index (RTY) jumped 9.27% while the Russell Midcap Index advanced 9.21%. Value shares outperformed for the period, with the Russell Midcap Value rising 10.08% compared to a gain of 6.54% for the benchmark Russell Midcap Growth Index.

Volatility spiked following a series of weak employment reports and an increase in the unemployment rate to 4.3%, its highest level since late 2021. In September, the Fed followed through on its concerns about labor market weakness by cutting interest rates by a half point, a move that sparked a stock rally through the end of the period. Combined with an increasing likelihood of an economic soft landing and more recent signs of a resilient labor market, these cuts create easier financial conditions for consumers and small and medium-size businesses in need of financing.

The ClearBridge Growth Strategy underperformed the Russell Midcap Growth Index through this period, giving back some of the strong outperformance seen in the prior quarter. Performance was weighed down by idiosyncratic headwinds across a handful of the Strategy’s holdings.

Shares of CrowdStrike (CRWD), a global cybersecurity leader, came under pressure following a software content update in July that caused widespread disruptions across its client base. Importantly, the outage was not caused by a security breach and we are encouraged that the company was swift and transparent in its response and support for customers. While some level of recompense will be required, after ongoing dialogue with company management, we are optimistic that thoughtful remediation efforts, such as offering flexibility around new module uptakes, will position the company well for future growth. Shares have since rebounded on the back of better than feared channel feedback, which suggests CrowdStrike remains a best-in-class provider in the eyes of customers.

e.l.f. Beauty (ELF), a disruptor in the beauty and skin care industry, also saw it shares sell off as intra-quarter channel data for the beauty category came in weaker than analysts expected. Though the company did not see the typical back to school lift in the U.S., strength in digital and international channels enabled ELF to reiterate its full-year guidance. The company remains a share gain story in the early stages of penetrating both international and skincare opportunities. While not immune from broader trends in the category, ELF is increasing the breadth of its offerings across more channels and regions, which should help to blunt the impact of current headwinds.

Social media platform and digital advertiser Pinterest (PINS) was also under pressure following last quarter’s results, which disappointed relative to expectations. In addition, the company’s outlook was impacted by weaker brand spending, particularly among food and beverage companies. However, management continues to make progress on driving strong user engagement, executing on product and sales and improving returns for lower-funnel campaigns, supporting our conviction in the name.

As long-term investors, we are well-positioned to take advantage of short-term volatility in our portfolio holdings. Shares of insulin pump maker Insulet (PODD), for example, went through a similar downdraft last year on fears that GLP-1 therapeutics would severely impact usage of its products. Our in-depth analysis, stress testing for a slowdown in growth of the diabetes patient population, convinced us that the market was giving little to no credit for the company’s Type 2 diabetes opportunity, giving us confidence to add to the position. The stock is impressively up more than 75% from 2023 lows as other investors have come to appreciate Insulet’s valuation had gotten overly penalized.

Portfolio Positioning

Improved diversification, risk management and sell discipline are a few of the key priorities we highlighted in refining our portfolio construction approach several years ago. We have continued to make progress on these efforts, diversifying our industry and sub-industry exposures and using both outsize and lower-conviction positions as sources of funds.

The Strategy has historically been underweight industrials and consumer discretionary sectors, but positioning moves over the last year have helped close these gaps and provided several new contributors this quarter. Builders FirstSource (BLDR), a supplier of building products, rose strongly in the quarter on optimism that rate cuts will improve demand for single family and eventually multifamily residential construction. Cintas (CTAS), a uniform rental and facilities services company, put up solid results as cross-selling and margin expansion efforts continue to bear fruit. Starbucks (SBUX) also provided a lift as the stock reacted positively to the naming of a new CEO, industry veteran Brian Niccol, who is expected to reinvigorate operations.

Performance during the quarter was also supported by larger cap durable compounders Broadcom (AVGO) and UnitedHealth Group (UNH), which continue to execute well as leaders in their respective markets. Both continue to serve as source of profits to reinvest in newer positions.

We exited long-time holding Wolfspeed (WOLF), a leading global supplier of silicon carbide substrate wafers and devices. After giving management ample time to ramp production at its new Mohawk Valley facility, we closed the position due to continued execution missteps and cyclical headwinds impacting electric vehicle, industrial and energy applications that have repeatedly pushed the company’s path to profitability further out.

“The Strategy has historically been underweight industrials and consumer discretionary stocks but recent positioning moves have helped close that gap.”

We also exited our position in ETSY, an ecommerce platform for artisan goods, due to our waning optimism in the company’s plans to reinvigorate post-pandemic growth. We similarly sold our position in Diageo (DEO), a global distiller and brewer, as the spirits category, excluding ready-to-drink, remains under pressure with no sign of a turn in volume, increased promotional expenses and continued destocking.

We took action in the quarter to shore up our financials exposure with two new buys in the sector. Ares Management (ARES) is an alternative asset manager and leading player in private credit, a large and growing market that continues to be supported by secular tailwinds such as increased bank regulation, rising retail penetration and the migration of insurance assets. With its scale, Ares should take outsize share of industry asset growth and drive fee-related earnings and margin expansion over time. The company’s high underwriting standards and performance in past downturns position it well to not only manage through a future credit cycle but also emerge stronger versus peers.

Our second financials buy was MSCI, an industry leader with defensible positions in the attractive index, ESG ratings and analytics markets. We believe the company can deliver sustained double-digit profit growth aided by strong demand for custom/specialized indexes, ongoing growth in passive assets and sustainability-focused products as well as robust pricing power. We are also attracted to MSCI’s largely recurring revenues, impressive retention rates, strong incremental margins and proven management team.

Outlook

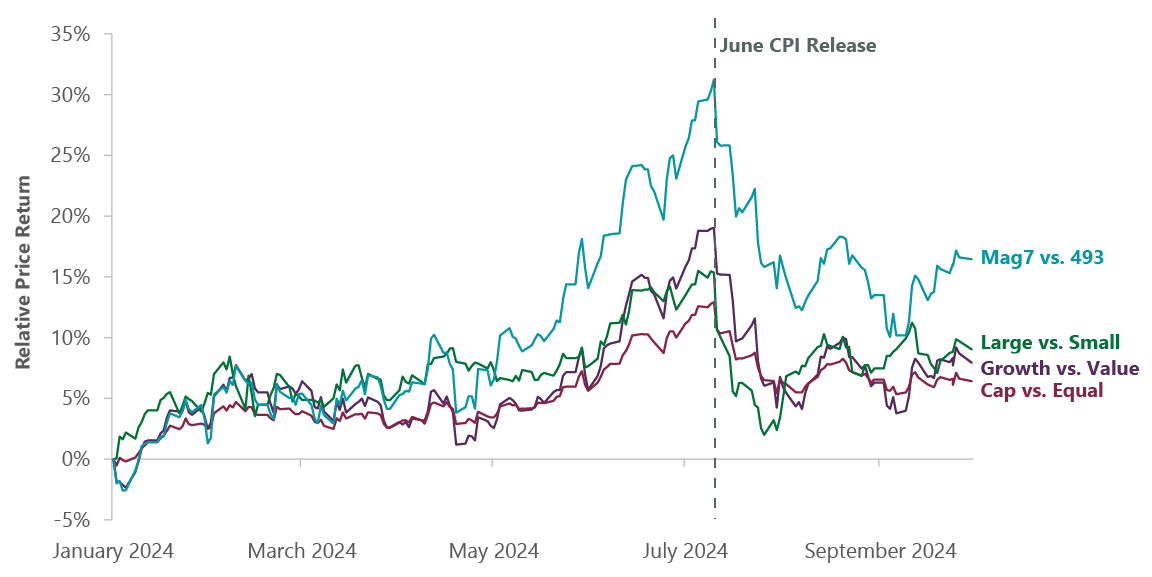

Large and mega cap stocks dominated market performance over the last 18 months through the second quarter, crowding out active strategies targeting companies down the market cap scale. We have seen green shoots of broadening leadership on several occasions over that span, only to have volatility or the latest positive AI-related news return the tech-heavy momentum names to favor. The latest rotation, however, could have more staying power as the Fed has communicated additional rate cuts are on the horizon and the chances of a soft landing for the economy continue to improve.

Exhibit 1: Rotation Has Begun

| Data as of Sept. 30, 2024. Sources: S&P, Russell, UBS, and Bloomberg. Note: Mag7 vs. 493 is the UBS Mag 7 relative price return vs. UBS S&P ex Mag 7; Cap vs. Equal is the S&P 500 relative price return vs. S&P 500 Equal Weight; Large vs. Small is the Russell 1000 relative price return vs. Russell 2000; Growth vs. Value is the Russell 1000 Growth relative price return vs. Russell 1000 Value. |

The companies we target in the $10 billion to $100 billion market cap range have historically seen more of a lift in a declining interest rate environment. Easing financial conditions also tend to lead to more M&A activity, with our smaller portfolio holdings becoming potentially attractive takeover targets. Mega cap dominance that has restrained valuations of small and mid cap stocks has also made share buybacks more attractive. We have seen tactical buyback announcements from several holdings, including Accenture and ELF, and we view this trend as positive for the portfolio.

Efforts to jumpstart the Chinese economy could also present catalysts as several portfolio holdings such as Johnson Controls (JCI), Freeport McMoRan (FCX) and Starbucks are poised to benefit from a rebound in the Chinese market.

Portfolio Highlights

The ClearBridge Growth Strategy underperformed its Russell Midcap Growth Index benchmark in the third quarter. On an absolute basis, the Strategy delivered gains across six of the eight sectors in which it was invested (out of 11 sectors total). The primary contributors to performance were the industrials and health care sectors while the information technology and consumer staples sectors were the detractors.

Relative to the benchmark, overall stock selection and sector allocation detracted from performance. In particular, stock selection in the IT, consumer staples, consumer discretionary and communication services sectors, an overweight to IT, an underweight to industrials and a lack of exposure to the utilities and real estate sectors weighed on results. On the positive side, stock selection in the health care, financials and industrials sectors contributed to performance.

On an individual stock basis, the leading absolute contributors to performance were Broadcom, Cohen & Steers (UTF), Autodesk (ADSK), UnitedHealth Group and Johnson Controls. The primary detractors were CrowdStrike, e.l.f. Beauty, Pinterest, Wolfspeed and HubSpot (HUBS).

Evan Bauman, Managing Director, Portfolio Manager

Aram Green, Managing Director, Portfolio Manager

Amanda Leithe, CFA, Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.