Investment Results (%)

|

As of 30 September 2024 |

QTD |

YTD |

1 Yr |

3 Yr |

5 Yr |

10 Yr |

Inception |

|

Investor Class: APFOX |

5.21 |

8.66 |

14.60 |

— |

— |

— |

11.38 |

|

Advisor Class: APDOX |

5.24 |

8.74 |

14.61 |

— |

— |

— |

11.45 |

|

Institutional Class: APHOX |

5.25 |

8.78 |

14.68 |

— |

— |

— |

11.58 |

|

J.P. Morgan EMB Hard Currency / Local Currency 50/50 |

7.14 |

6.77 |

14.99 |

— |

— |

— |

5.15 |

|

Source: Artisan Partners/J.P. Morgan. Returns for periods less than one year are not annualized. Class inception: Investor (7 April 2022); Advisor (7 April 2022); Institutional (7 April 2022). |

Performance Discussion

The portfolio trended higher for Q3 but trailed the J.P. Morgan EMB Hard Currency/Local Currency 50/50 Index for the period. The portfolio remains ahead of the index year to date.

Exhibit 1: Total Benchmark Returns

|

Q3 2024 |

YTD 2024 |

|

|

J.P. Morgan EMBI Global Diversified Index |

6.15% |

8.64% |

|

J.P. Morgan GBI-EM Global Diversified Index |

8.99% |

4.95% |

|

J.P. Morgan CEMBI Broad Diversified Index |

4.48% |

8.50% |

|

J.P. Morgan EMB Hard Currency/Local Currency 50/50 Index |

7.14% |

6.77% |

| Source: Artisan Partners/J.P. Morgan. As of 30 Sep 2024. Past performance does not guarantee and is not a reliable indicator of future results. |

Investing Environment

Emerging markets (‘EM’) debt rallied in Q3, primarily driven by movements in US interest rates. Continued cooling of US inflation and a sharper-than-expected slowdown in the labor market prompted the 10-year US Treasury yield (US10Y) to fall by approximately 80bps from early July through mid-September. This decline was driven by growing expectations of a soft landing, culminating in a 50bps rate cut by the Fed in September—its first rate cut in more than four years. In response, the US dollar weakened, the yield curve steepened, credit spreads tightened, and risk assets, particularly emerging markets debt, rallied. Local debt led the emerging markets rally in Q3, with emerging markets currencies mostly strengthening against a weakening US dollar. However, on a year-to-date basis, local debt continues to lag hard currency sovereign and corporate debt, which have benefited from favorable changes in US interest rates throughout the year.

The Fed’s September decision to cut interest rates marks a convergence among the developed world central banks. In Q3, the Fed, ECB, BOE, Bank of Canada and Swiss National Bank all implemented rate cuts, with several having done so in Q2 as well. In contrast, the Bank of Japan remains an outlier raising interest rates by 15bps during the quarter to 0.25%, setting off a global unwinding of the popular yen carry trade where investors short the yen and invest in higher yielding currencies.

Emerging markets central banks are increasingly aligning their monetary policies to developed market policy; however, notable differences in policies and rates remain and continue to present differentiated opportunities. Several central banks cut rates during Q3, such as Hungary, Czech Republic, Uzbekistan, Peru, Mexico, South Africa and Chile. Elsewhere, Nigeria raised its rates by 100bps to 27.25%, while Turkey maintained its interest rate at 50.00%.

Meanwhile, due to rising inflation and stronger-than-expected economic activity, Brazil reversed its monetary policy direction in September, raising rates by 0.25% after cutting them in the previous seven meetings.

Movements in sovereign spreads throughout the quarter were muted by changes in interest rates. Spreads for sovereign indices that include defaulted countries tightened, while those excluding defaulted countries and corporate credit spreads widened moderately. The high yield segment of the sovereign market experienced the most volatility, particularly in early August. A much sharper slowdown in hiring than expected revived fears of a hard landing, leading to wider credit spreads and declines in equities. This uncertainty was further intensified by the Bank of Japan’s raising rates, prompting investors to quickly unwind the yen carry trade. However, credit spreads tightened almost as quickly as they widened, and Fed Chair Powell’s dovish speech at Jackson Hole helped stabilize markets.

The US dollar weakened throughout Q3 due to expectations of a Fed rate cut, which ultimately materialized. This contributed to a broad strengthening of emerging markets currencies, lifting emerging markets local bonds. Several Asian currencies, including the Malaysian ringgit, Thai baht, Indonesian rupiah and Japanese yen, were among the top performers for the quarter, boosted by strong growth prospects and restrictive policies prompting the unwinding of carry trades. The Mexican peso was among one of the worst performers for the quarter, declining in response to controversial judicial reforms that were proposed by outgoing President Andrés Manuel López Obrador and supported by incoming President Claudia Sheinbaum.

While emerging markets debt remains at the mercy of an increasingly uncertain global macroeconomic backdrop, local events across the globe continue to shape idiosyncratic returns. Venezuelan sovereign bonds declined following the August presidential elections, where pre-election polls showed a significant discrepancy from the official results. The market interpreted this gap as a potential indication of fraudulent activity by the incumbent, President Maduro, leading to protests and increased political uncertainty. In contrast, Argentina’s fiscal consolidation, a key focus of President Milei’s administration, continued to boost the country’s sovereign bonds throughout Q3.

Meanwhile, Ukrainian sovereign bonds rallied after the country reached an agreement with creditors on its debt restructuring. This restructuring agreement involves two series of bonds, one of which includes a contingent feature. Sri Lanka also made progress on its debt restructuring toward the end of the quarter, overcoming several obstacles encountered in previous negotiations with creditors following its default in 2022. The country reached an agreement in principle with bondholders just two days before the presidential elections, where left-leaning politician Dissanayake emerged victorious. Additionally, the Ethiopian government floated its currency at the end of July, a policy shift aimed at alleviating foreign currency shortages, attracting foreign investment and securing funding from the International Monetary Fund and World Bank.

Portfolio Positioning

In our view, the portfolio remains conservatively positioned as geopolitical uncertainty persists. However, throughout Q3, the team capitalized on opportunities across various risk factors as they arose. The portfolio remains overweight duration in emerging markets and underweight duration in developed markets relative to the J.P. Morgan EMB Hard Currency/Local Currency 50/50 Index, translating to an overall underweight duration positioning relative to the index.

Throughout Q3, the team reduced the portfolio’s currency exposure but remains overweight relative to the index. The reduction mostly came from Eastern European currencies where carry has fallen below attractive levels and political uncertainty in certain countries is increasing. The team added to currency positions in Asia where strong growth prospects and restrictive monetary policies kept currency valuations attractive. Overall, sovereign credit positioning was flat during Q3 and remains overweight compared to the index. The team has adjusted its positioning within the sector to account for shifting risk profiles, valuations and outlooks based on on-the-ground research.

The EMsights Capital Group continues to search for countries with improving storylines where market prices are not fully reflecting fundamentals. The team continues to seek out idiosyncratic events in the corporate and sovereign space that shape the market landscape and drive divergence between the regions and countries. The global economy continues to face challenges, many of which are serving as tailwinds that keep the emerging markets debt outlook strong. With one of the busiest election cycles on record, growing geopolitical tensions and fiscal consolidation continue to present exploitable volatility events.

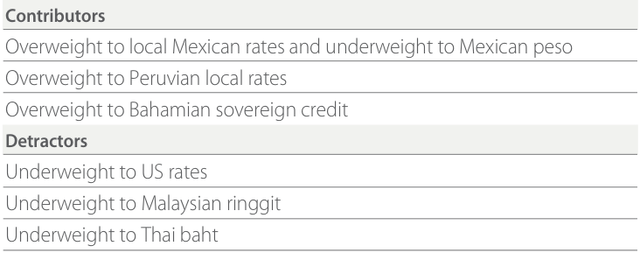

Exhibit 2: Q3 2024 Attribution—Relative to the J.P. Morgan EMB Hard Currency/Local Currency 50/50 Index