|

(All MSCI index returns are shown net and in U.S. dollars unless otherwise noted.) Markets Review Past performance is not indicative of future results. Aristotle International Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Capital Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document. (Sources: CAPS CompositeHubTM, Bloomberg) |

Global equity markets ended the year slightly down, with the MSCI ACWI Index returning -0.99% in the fourth quarter. Concurrently, the Bloomberg Global Aggregate Bond Index fell by 5.10%. In terms of style, value stocks lagged their growth counterparts during the quarter, with the MSCI ACWI Value Index underperforming the MSCI ACWI Growth Index by 7.35%.

The MSCI EAFE Index fell 8.11% during the fourth quarter, while the MSCI ACWI ex USA Index dropped 7.60%. Within the MSCI EAFE Index, Europe & Middle East was the weakest performer, while Asia declined the least. On a sector basis, all eleven sectors within the MSCI EAFE Index posted negative returns, with Materials, Health Care and Real Estate generating the largest losses. Conversely, Financials, Consumer Discretionary and Communication Services fell the least.

Geopolitics continued to make headlines, as the conflicts in Ukraine and the Middle East escalated. For the first time during the war, Ukraine launched U.S.-made missiles deep into Russian territory, while Russia continued to bombard Ukraine’s power grid in the midst of winter. Russian President Vladimir Putin announced that aggression from a non-nuclear country – with the direct or indirect participation of a nuclear country – would be considered a joint attack on Russia, lowering the bar for the use of nuclear weapons.

In the Middle East, a tenuous ceasefire was made between Israel and Hezbollah, as well as seeming progress toward a ceasefire between Israel and Hamas. However, tensions also escalated as Israel, in response to an Iranian missile attack, conducted a precision strike on military targets in Iran. Concerns over a regional conflict have intensified, as the two countries have drawn closer to a potentially more forceful direct encounter. The Middle East also experienced a shock in politics, as the Islamist militant group Hayat Tahrir al-Sham overthrew the Iranian and Russian-backed dictator Bashar al-Assad in Syria. Europe and Asia were not immune to instability, as the French parliament passed a vote of no confidence against Prime Minister Michel Barnier, and the South Korean National Assembly voted to impeach President Yoon Suk Yeol after he declared martial law.

Even with the continued uncertainty stoked by geopolitical conflicts and political regime changes across the globe, the IMF projects global economic growth to hold steady at 3.2% for 2024 and 2025. Additionally, global inflation continues to decline, resulting in global headline inflation projections of 3.5% for 2025 – below the 2000-2019 average of 3.6%. As western countries continue to target a 2% annual rate of inflation, the Federal Reserve, European Central Bank and Bank of England all cut key interest rates during the period. In Asia, Japan’s index of service-sector inflation hit its highest level since 1995, as rising wages have caused companies to pass on higher costs. Though the Bank of Japan did not raise rates at its most recent meeting, Governor Kazuo Ueda has indicated that the central bank would continue to raise rates if inflation sustainably hit a 2% annual rate. Meanwhile, China announced a $1.4 trillion stimulus package to address local government debt issues and support its economy. The Chinese government hopes to repair municipal balance sheets rather than directly injecting money into the economy (which it has done in the past).

Annual Markets Review

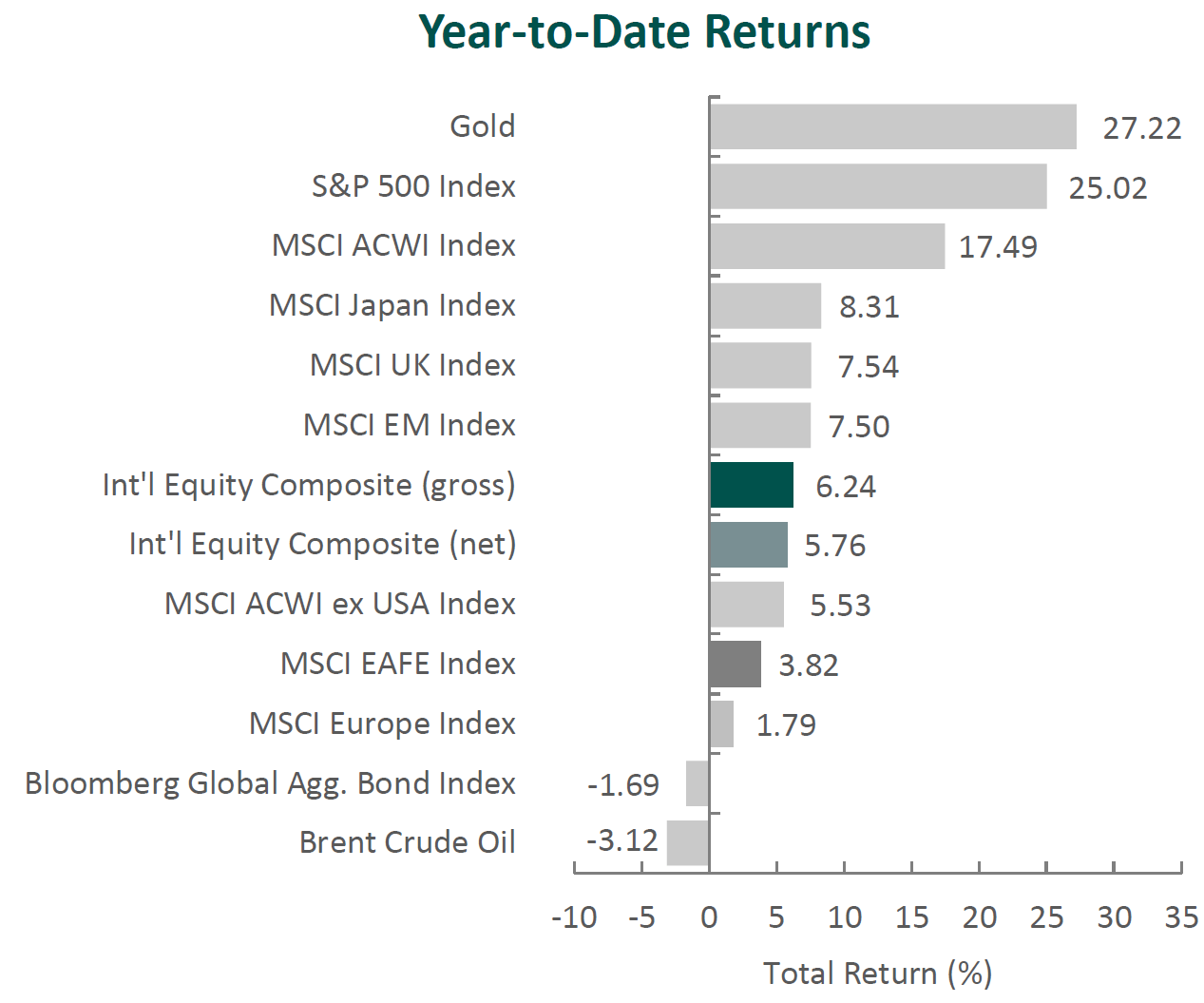

Global equity markets continued climbing in 2024 following a strong year in 2023, as the MSCI ACWI posted a full-year return of 17.49%. Additionally, growth outperformed value, as the MSCI ACWI Growth Index outperformed the MSCI ACWI Value Index by 13.46% in 2024. Meanwhile, fixed income markets lagged, as the Bloomberg Global Aggregate Bond Index fell by 1.69%.

Although the equity market remained strong in 2024 amid resilient global growth, uncertainty heading into 2025 is high, as geopolitical conflicts remain unsolved, central bank policy effects have yet to fully play out and countries’ governments are changing leadership.

Therefore, rather than trying to predict the unpredictable, we choose to focus on individual businesses and their long-term prospects. We believe by focusing on what is analyzable in the long run, we will be able to weather short-term volatility and provide attractive returns over the long term for our clients.

Performance and Attribution Summary

For the fourth quarter of 2024, Aristotle Capital’s International Equity Composite posted a total return of -6.91% gross of fees (-7.02% net of fees), outperforming the MSCI EAFE Index, which returned -8.11%, and the MSCI ACWI ex USA Index, which returned -7.60%. Please refer to the table below for detailed performance.

| Performance (%) | 4Q24 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

|---|---|---|---|---|---|---|

| International Equity Composite (gross) | -6.91 | 6.24 | 0.05 | 5.31 | 6.34 | 5.67 |

| International Equity Composite (net) | -7.02 | 5.76 | -0.42 | 4.82 | 5.83 | 5.17 |

| MSCI EAFE Index (net) | -8.11 | 3.82 | 1.65 | 4.73 | 5.20 | 2.83 |

| MSCI ACWI ex USA Index (net) | -7.60 | 5.53 | 0.82 | 4.10 | 4.80 | 2.53 |

|

|

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income. (Source: FactSet)

From a sector perspective, the portfolio’s outperformance relative to the MSCI EAFE Index can be attributed to both security selection and allocation effects. Security selection in Financials, Energy and Consumer Staples contributed the most to the portfolio’s relative performance. Conversely, security selection in Industrials and Materials, as well as an overweight in Consumer Staples, detracted from relative returns.

Regionally, allocation effects were responsible for the portfolio’s outperformance, while security selection had a negative impact. Exposure to Canada and security selection in Asia contributed the most to relative performance, while security selection in the U.K., as well as Europe & Middle East, detracted.

Contributors and Detractors for 4Q 2024

Cameco, one of the world’s largest uranium producers, was a major contributor during the period. With the continued focus on artificial intelligence and clean energy, the demand for nuclear energy remained robust. Some of the largest companies in the world, such as Amazon, Google and Meta, announced nuclear power agreements in the quarter. Given Cameco’s tier-one assets in reliable jurisdictions, proven operating experience and strong reputation, we believe the company is in a unique position to benefit as various industries and governments pursue clean, reliable and scalable sources of energy. Correspondingly, Cameco increased its production outlook, having already secured commitments that net an average of 29 million pounds per year over the next four years. We believe Cameco’s continued ability to efficiently increase production while securing long-term contracts will lead to sustainably higher levels of normalized FREE cash flow. While its Canada-based mines and Westinghouse unit are executing well, production was recently suspended at Cameco’s Inkai joint venture in Kazakhstan. We believe production will restart soon and note that Cameco’s share of Inkai’s production amounts to less than 10% of total Cameco volumes, a figure that can be offset with increased production at the company’s MacArthur River and Key Lake mines in Canada.

Sony, the global provider of videogames and consoles, image sensors, music, and movies, was a top contributor for the period. The company reported strong results driven by third-party gaming revenue and record PlayStation 5 console profitability. This was achieved despite lower console sales, which, in our view, exemplifies the strength of PlayStation’s network effects. PlayStation is the world’s largest gaming platform with 116 million monthly active users, making it an attractive market for game developers and allowing users to play the most advanced games at lower costs than PCs. In its Pictures segment, Crunchyroll (the anime business Sony acquired from AT&T in 2020) signed a distribution agreement with YouTube Primetime Channels, the market share leader in streaming services, which we believe will increase Crunchyroll’s subscriber base. Though a singular example, it illustrates management’s ability to better execute and further improve the segment’s profitability, a catalyst we previously identified. In addition, Sony reported improved sales of image sensors for mobile products as the global smartphone market continued its gradual recovery. Sony’s image sensor business has the largest global market share, and we believe, longer term, it is uniquely positioned to benefit from increasing demand for both autonomous driving technology in vehicles and improved image quality in smartphone cameras. As such, we continue to admire Sony’s capacity to build on its industry leadership and optimize its operations, which includes its plan for a partial spinoff of its Financial Services segment in October 2025.

Ashtead Group, a U.K.-headquartered equipment rental company, was the leading detractor for the quarter. Though rental revenues grew 2% year-over-year, shares declined as weaker local commercial construction markets weighed on growth and fleet utilization. In December, Ashtead also announced its intention to move to a U.S. primary listing (while retaining a U.K. listing), a reflection of the company’s large U.S. footprint. This process will take time, as management intends to first discuss the proposal with shareholders before putting forward a formal resolution. Despite the cyclical nature of the construction industry, which can impact short-term results, we believe Ashtead will continue to gain market share in North America as more customers choose to rent rather than purchase equipment. We estimate rental penetration in the U.S. (~90% of EBITDA) is roughly 55% compared to 75% in the U.K., which provides ample runway. During our nearly four years as shareholders, Ashtead has further consolidated the rental industry, which we believe should result in a more disciplined and attractive market. The company also continues to make progress on the catalyst of growing its higher-margin specialty business, which includes HVAC equipment and scaffolding. Moreover, we believe Ashtead will be able to further utilize its national footprint and procurement power to increase its market share and enhance its FREE cash flow (of which it plans to return up to $1.5 billion to shareholders via buybacks over the next 18 months).

DSM-Firmenich (DSM), the Dutch-Swiss nutrition, health and bioscience company, was one of the largest detractors. Despite a decline in share price, the company continued to increase its sales across segments following customer destocking in 2023. Within its largest segment – Perfumery & Beauty – we believe DSM will uniquely benefit, as customers look to differentiate their products and increase fragrance dosage levels. The company has also made progress on the integration of its 2023 merger with Firmenich, a catalyst we previously identified, which we expect to create further sales and product development synergies. With low leverage, the company is in a strong position to pursue additional bolt-on acquisitions and return cash to shareholders, all while it executes on shedding lower-margin segments. As such, during the quarter, the company completed the sale of its yeast extracts and marine lipid business and remains on track with plans to divest its Animal Nutrition & Health segment. We believe this should enhance overall profitability, as DSM’s global scale, close relationships with customers and ability to innovate allow the company to continue to gain global market share across the businesses it operates.

Recent Portfolio Activity

Consistent with our long-term horizon and low turnover, there were no new purchases or sales completed during the quarter.

Conclusion

While investment managers are typically judged by their performance, we often remind our clients and prospects that performance is an outcome of an investment process. Short-term performance, in particular, can be fleeting. We are proud to report that our strategy outperformed its benchmarks in 2024; however, we highlight that this is a result of our focus on the inputs of our time-tested investment process, not a focus on performance. Our process involves identifying what we believe to be high-quality businesses that are trading at a discount to their intrinsic value. While there are myriad variables – both micro and macro – that influence stock prices on a short-term basis, we believe the ultimate worth of a business is determined by company-specific fundamentals. As such, regardless of short-term market influences or performance outcomes, we will remain true to our investment process.

|

Disclosures The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to buy or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle International Equity strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s International Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information. Aristotle Capital Management, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACM-2501-38 Performance Disclosures

Index Disclosures The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The MSCI ACWI captures large and mid-cap representation across 23 developed market countries and 24 emerging markets countries. With approximately 2,700 constituents, the Index covers approximately 85% of the global investable equity opportunity set. The MSCI ACWI Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 developed markets countries (excluding the United States) and 24 emerging markets countries. With approximately 2,100 constituents, the Index covers approximately 85% of the global equity opportunity set outside the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 24 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Brent Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. The MSCI Japan Index is designed to measure the performance of the large and mid-cap segments of the Japanese market. With approximately 200 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in Japan. The Bloomberg Global Aggregate Bond Index is a flagship measure of global investment grade debt from 28 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The MSCI United Kingdom Index is designed to measure the performance of the large and mid-cap segments of the U.K. market. With nearly 100 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in the United Kingdom. The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe. With approximately 400 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization across the European developed markets equity universe. These indexes have been selected as the benchmarks and are used for comparison purposes only. The volatility (beta) of the Composite may be greater or less than the respective benchmarks. It is not possible to invest directly in these indexes.

|

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.