Dear Friends,

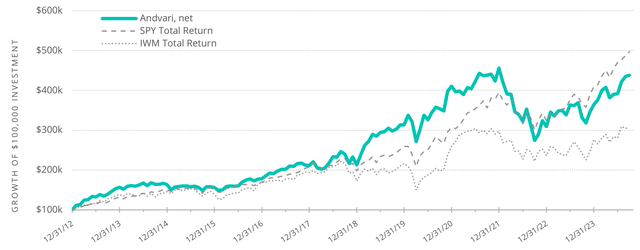

For the first nine months of 2024, Andvari is up 20.3% net of fees while the SPDR S&P 500 ETF (SPY) is up 21.9%.i Andvari clients, please refer to your reports for your specific performance and holdings. The table below shows Andvari’s composite performance while the chart shows the cumulative gains of a $100,000 investment.

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Annualized Since 12/31/12 |

|

|

Andvari, neti |

56.7% |

4.5% |

-4.6% |

14.2% |

18.4% |

0.7% |

47.2% |

31.1% |

11.0% |

-32.1% |

17.5% |

20.3% |

13.4% |

|

S&P 500 ETF (SPY) |

32.3% |

13.6% |

1.4% |

11.9% |

21.8% |

-4.4% |

31.5% |

18.4% |

28.7% |

-18.2% |

26.2% |

21.9% |

14.6% |

|

Russell 2000 ETF (IWM) |

38.7% |

5.0% |

-4.5% |

21.6% |

14.6% | -11.1% | 25.4% | 20.0% | 14.5% | -20.5% | 8.1% | 11.0% | 10.0% |

During the months of July and August, Andvari’s net performance began to catch up with the market. This was mostly due to investors rotating out of the largest and best performing stocks in the S&P and into many of our holdings that had been lagging the market.

This is an example of how quickly performance can change without much (or any) fundamental changes in the businesses we own. It reminds of the old Benjamin Graham quote: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” The quote is evergreen, but a bit overused, so I’d like to restate it in my own words. Perhaps a more accurate translation, and definitely less metaphorical, is this: “In the short term, markets reflect the perception of value, but in the long term it reflects actual value.”

This is why it is extremely important to judge Andvari’s performance over a long time frame, preferably a stretch of ten years where the market can more accurately judge the true growth in intrinsic value of the businesses we choose to own.

ANDVARI HOLDINGS

There is not much of significance to report about any individual holding over the past quarter. Most of the companies we own continue to perform in line with our expectations. However, we will give some brief reminders of why we own some of what we own.

Our three serial acquirers of vertical market software (VMS) companies are Constellation Software (OTCPK:CNSWF), Topicus.com (OTCPK:TOITF), and Lumine Group (OTCPK:LMGIF). This trio acquired another 22 software businesses in just the prior quarter. Given the decentralized nature of all three companies, and their many different business units and sub-business units, a few acquisitions may have flown under our radar. We continue to view this group as a semi-permanent holding still capable of outperforming the market over the long term.

Arthur J. Gallagher (AJG) and Rollins (ROL) are two other serial acquirers in Andvari’s client portfolios. Both are some of the largest, and best, businesses in their respective industries. AJG is a leading property and casualty insurance and reinsurance broker. Rollins is home to many of the top brands in the pest service industry in North America.

Importantly, while both AJG and Rollins have large market shares, their respective markets are still highly fragmented. There are thousands of small and medium-sized businesses left for AJG and Rollins to acquire. Gallagher currently has a pipeline of 100 potential acquisitions that represents about $1.4 billion of annualized revenue (compare this to $10.1 billion of revenues for 2023). Andvari believes the pace of acquisitions for both companies can continue for many years to come. Just see below the acquisition track records of both companies since 2014.

|

NUMBER OF BUSINESSES ACQUIRED |

|||||||||||

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2014 – 2023 |

|

|

Rollins |

21 |

12 |

34 |

23 |

38 |

30 |

31 |

39 |

31 |

23 |

282 |

|

Arthur J. Gallagher |

60 |

44 |

37 |

36 |

44 |

46 |

27 |

36 |

36 |

50 |

416 |

CREATING VALUE THROUGH M&A

Whether its our collection of VMS companies, Rollins with their pest service businesses, or AJG’s insurance brokerage business, they all have highly rational acquisition strategies and proven acquisition track records. Acquisitions have created enormous value for their respective shareholders over the years. There are several components to how they’ve created value through acquisition. First is the simple value arbitrage of the acquirer buying a business for a lower multiple than which the acquirer trades at in the market. For example, all else equal, if Company A that trades at 20 times earnings buys Company B at 10 times earnings, the acquired earnings of Company B will usually be valued by the market at somewhere near the multiple of Company A.

But the companies we own do not just play the value arbitrage game. Companies like Constellation, Rollins, or AJG position themselves as the “acquirers of choice” in their respective industries. They offer a fair price, but never top dollar. What they offer in exchange is a permanent home for the business and the employees of the seller. Thus, not only can they earn a potentially better return, they are also better able to select for business owners motivated by more than just money. They can select for business owners who care more about the continued growth and success of their business and employees.

Also, when Constellation, Rollins, or AJG acquire a company, the acquired company benefits by becoming part of a larger organization with greater resources. The acquired company has access to extraordinarily honed best practices.

The acquired company can offer more robust career opportunities for their own employees. Given all the above, it’s likely the acquired company can more easily grow its profit margins and revenues at a higher pace post acquisition.

Patrick Gallagher, Chairman and CEO of AJG, talks about the benefits a firm receives when they choose to sell to AJG:

“Most of these firms have less than $25 million of annual revenue and have terrific roots in their local communities. So when they sell and join Gallagher, we get revenue and profit. But more importantly, we get new talent and capabilities. Basically, we get their brains. And they get immediate access to our niche experts, our extensive data and analytics and our centers of excellence. And all of our tools and capabilities are on their desk overnight. That creates immediate value for their clients, gives them a terrific new story for prospects, and it offers enhanced career opportunities for their employees.” – September 19, 2024

Another benefit of M&A done correctly is that, in some cases, an acquired company can become an additional acquisition vehicle that can grow by making acquisitions of its own. There are several examples of this that have already happened at Constellation Software. It has also happened at Rollins. Jeff Dunn, Co-President of Northwest Exterminating, one of Rollins’ brands based in the South, speaks about the experience of being acquired by Rollins:

“When we were acquired back in 2017, we were very much a family-owned business. And the Phillips family sought out Rollins. And Jerry was the leader at that time, and Jerry said, “Trust us. We’ll give you autonomy. You guys can be Northwest, we’ll provide resources so that you can scale.” And 6.5 years later, we’ve more than tripled our revenue. We’ve got opportunities for our teammates that we would have never had before. We’ve done 15 acquisitions since becoming a part of Rollins. So it’s been an incredible experience.” – May 17, 2024

ANDVARI TAKEAWAY

When it comes to capital allocation, every business has only five choices. It can: (1) reinvest in its business; (2) pay dividends; (3) repurchase shares; (4) pay down debt; or (5) acquire other businesses. That’s it. The choices a company makes on each of these determines whether value is created or destroyed. In the case of M&A, when done correctly and in a programmatic way, the long term results can be incredibly additive. Think of a wintry landscape and the difference between someone rolling a snowball on flat ground and someone pushing a snowball down a long hill. One snowball will more quickly and easily gain in size and speed.

Finally, although we’re pleased our performance is catching up to the market, and that the market has recently recognized some of the latent value in our holdings, a year or even two years is not enough to judge Andvari’s skill in stock picking. It is the long term by which we should be judged, the next ten years and beyond.

As always, I love to hear from clients and anyone else. Please contact me with your thoughts, comments, or questions. Sincerely,

Douglas E. Ott, II

|

DISCLOSURES AND END NOTES iAndvari performance represents actual trading performance of all, actual clients beginning on 4/12/13. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees- assumed to be 1.25% per annum, paid quarterly, as currently advertised-net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results. The exchange traded funds (ETFs) are listed as benchmarks and are total return figures and assumes dividends are reinvested. The SPY ETF is based on the S&P 500 Index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The IWM ETF is based on the Russell 2000 Index, an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvari client portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage. One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari’s current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice. The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari. The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.