Even brighter days are ahead for REITs.

That’s according to Brad Thomas, a Seeking Alpha analyst since 2010 who also helps lead the iREIT®+HOYA Capital service. He points to two key items that will propel REITs higher in 2025: Lower interest rates and the potential for a more accommodating policy environment from the Trump administration.

Today, most REITs are well-positioned to grow their businesses (and grow earnings and dividends). Scale and cost of capital advantages have set up the best-managed REITs for long-term success, Thomas says.

Thomas shares his bigger market outlook in this Q&A Outlook piece:

Seeking Alpha: 2024 has been a challenging year for REITs. What do you see for 2025?

Brad Thomas: On balance, 2024 has not been that bad for U.S. REITs as they have navigated higher interest rates while maintaining sound operational performance, strong balance sheets, and good access to capital.

When you compare the first three quarters of 2024 to the same period in 2023, aggregate net operating income (‘NOI’) and dividends paid are (“both”) more than 3% higher.

Also, through Nov. 30, 2024, total returns for the FTSE Nareit All Equity REIT Index were 14%, well above the 25-year average of nearly 10%. While REITs lagged the broader stock market, they did significantly outperform private real estate (by more than 17 percentage points, measured by the NCREIF ODCE index).

Recently, the Federal Reserve lowered its key interest rate by a quarter percentage point (from 4.5% to 4.25%), the third consecutive reduction, and this time the Fed was more cautionary regarding additional cuts in coming years.

CNBC

The Fed indicated that it will probably lower twice in 2025, according to the “dot plot” matrix of individual members’ future rate expectations. The main question now is whether inflation holds steady (above its target of 2%) and whether economic growth is solid.

Now that we know Donald Trump will be the president for the next four years, there are lingering questions regarding fiscal debt, tariffs, immigration, regulation, and corporate taxes.

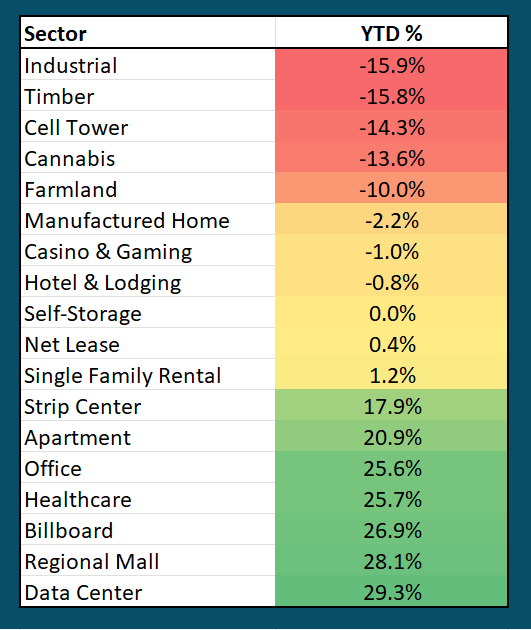

Just as we saw in 2024, certain property sectors will perform better than others, and getting the sectors right will be the key to success.

For example, in 2024 the top-performing sectors were data centers (+29%), malls (+28%), billboards (+27%), healthcare (+26%), office (26%), and apartments (21%).

iREIT + HOYA

Alternatively, other property sectors, such as industrial (-16%), timber (-16%), cell towers (-14%), cannabis (-13.5%), and farmland (-10%), underperformed.

I find it interesting to see that only one leg of the so-called “tech trifecta” stool (data centers) performed well in 2024. Had you been equal-weight data centers (+29%), cell towers (-14%) and industrial (-16%) you would have seen returns of -.33%.

Within the retail sector, if you had owned equal-weight malls (+28%), shopping centers (17.9%) and net lease (.4%) you would have seen returns of 15.5%.

The point is that it’s important to understand each sub-sector because each category has its unique growth drivers.

Broadly speaking, I like to own REITs with the most attractive earnings visibility and growth prospects – ones that offer realistic catalysts. I look for sectors that offer strong demand and higher occupancy levels with “wide moat” pricing power.

Seeking Alpha: As you pointed out, not all REITs are equal, as certain property sectors have performed better than others during the past year. What are the most attractive sectors for 2025?

Brad Thomas: First off, let me play the contrarian card, which is the net lease sector (.4% YTD).

As you know, I was a developer for many nationwide brands such as Advance Auto Parts (AAP), Dollar General (DG), and The Sherwin-Williams (SHW) for more than two decades, so I know this net lease business model extremely well.

When I was starting out in business (the 90s), there were just three net lease REITs: Realty Income (O), NNN REIT (NNN) and W. P. Carey (WPC). Today there are 21 net lease REITs in all shapes and sizes, representing a consolidated market capitalization of $140 billion.

iREIT + HOYA

During the last decade, the net lease sector has expanded beyond traditional fast food, casual dining, and car repair services into a wider range of categories such as casinos, hotels, amusement parks, farming, data centers, ground leases, and more.

What makes this sector so attractive, in my opinion, is the resilient and predictable income that these net lease REITs generate. Two REITs – Realty Income and NNN REIT are Dividend Aristocrats.

Picking winners from this list of 21 REITs can be overwhelming, but I believe the companies with scale and cost of capital advantages will come out ahead.

Clearly, concerns over higher rates are a risk in 2025 because of lower investment spreads, which weigh on external growth drivers.

However, acquisition volumes in 2024 generally exceeded expectations, and it appears there’s a healthy acquisition pipeline going into 2025 that could drive outperformance.

Consensus Growth (AFFO/Share) Estimates

iREIT + HOYA

I put together a chart above, highlighting consensus growth estimates for 2025 and 2026.

Don’t be fooled by Gladstone Commercial (GOOD), which cut the dividend by 20% in early 2023, and still has not returned to 2021 earnings of $1.60 per share ($.95 in 2024).

Removing that outlier, you can see that Essential Properties Realty Trust (EPRT) has the best growth prospects going into the new year (+9%) followed by Agree Realty (+5%).

Also, elevated rates may drive more sale-leasebacks, given high interest rates, as sale-leasebacks may look more attractive as a financing vehicle for companies, and as a result, this may drive more sale-leaseback volumes.

While valuations may appear compelling for GOOD and Global Net Lease (GNL), I would recommend buying shares in the consolidators such as Realty Income, Agree Realty (ADC), Essential Properties or VICI Properties (VICI). All four are in the Buy Zone and Realty Income remains the most discounted of the bunch (a Strong Buy).

Given the attractive valuations within the net lease sector, I recommend owning a few of these REITs, iREIT® + HOYA is overweight the sector.

Another promising category in 2025 is retail, specifically shopping centers.

Following Q3 2024 earnings, there’s strong earnings visibility for the retail sector given robust pipelines. Also, retail REIT balance sheets have continued to improve as several REITs have adequate capacity to lever up to fund growth opportunities.

Once again, as a shopping center developer in my prior career, I can attest to the opportunistic supply picture in which space is now highly constrained (due to increased rates associated with new construction). I favor sectors with enhanced pricing power (looking for “wide moats”) as tenants agree to more landlord-favorable lease terms.

iREIT + HOYA

As you can see, SITE Centers (SITC) and Acadia Realty (AKR) had a terrific year – both returning more than 45% year-to-date. Also, Retail Opportunity Investments Corp. (ROIC) is being acquired by Blackstone (BX) and is awaiting shareholder approval. As you can see below, consensus growth estimates for the shopping center sector are solid.

Consensus Growth (AFFO/Share) Estimates

iREIT + HOYA

Remember that Site Centers spun out its net lease properties to form Curbline Properties (CURB), a new net lease REIT, which is the reason AFFO is expected to decline.

Meanwhile, Whitestone REIT (WSR) is expected to grow earnings by 19% in 2025. However, shares are a bit rich today at over 19x P/AFFO. I like Kite Realty Group Trust (KRG) too, but I would also wait on a pullback.

Federal Realty Investment Trust (FRT) – a Dividend King – and Regency Centers (REG) are the most attractive to me, both trading at discounts to normal valuation levels.

It’s also worth noting that Tanger (SKT) has seen an incredible run over the last few years. I credit management for its disciplined capital markets execution and for having the foresight to enter the community center sector (from its core outlet center heritage).

I would most definitely wait for a pullback with Tanger as shares are trading at around 20x.

I recommend overweighting shopping centers.

I also like the healthcare sector that’s well-positioned to continue to ride the so-called “silver tsunami” (aka aging population).

Across the healthcare sector, acquisition volumes have been ahead of expectations (in 2024) and that momentum should continue in 2025. Within the healthcare subsectors, I like skilled nursing (tailwind given healthy investment spreads) and senior housing as well as life science.

Medical office building REITs have not performed as well, given the modest growth and less stellar pricing power.

iREIT + HOYA

Top performers in the healthcare REIT sector year-to-date include Strawberry Fields REIT (STRW), Welltower (WELL), Omega Healthcare (OHI), and Sabra Health Care REIT (SBRA).

Underperformers include Community Healthcare Trust (CHCT), Global Medical REIT (GMRE), Alexandria Real Estate Equities (ARE), and Medical Properties Trust (MPW).

Consensus Growth (AFFO/Share) Estimates

iREIT + HOYA

As you can see, Strawberry, Welltower, CareTrust REIT (CTRE), and Ventas (VTR) all screen strong based on their consensus growth estimates. However, they’re all relatively expensive today – although they’re moving closer to our buy zone.

Healthpeak Properties (DOC) is one of the most compelling healthcare buys in my opinion, given less lease rollover (compared with peers) and a strong balance sheet. I recommend overweight healthcare (excluding hospitals).

One final sector that I’m extremely bullish on is data centers.

I recently wrote an article on Digital Realty Trust (DLR) explaining how I decided to trim shares due to lofty valuations. However, as I mentioned in the article, I redeployed capital back into American Tower (AMT), Prologis (PLD) and Realty Income (O) – all REITs with data center exposure.

Also, Iron Mountain (IRM) has been a gem to own coming out of COVID-19, returning over 333% after my Strong Buy recommendation.

Seeking Alpha

It’s obvious there’s extraordinary demand for AI-related revenue, and I expect to see similar fundamental drivers to support data center fundamentals in 2025.

I don’t see any slowdown, as growth demand for both traditional data center applications and generative AI applications remains incredibly strong and is poised to accelerate.

I’ll also touch on towers, a sector that has slumped in 2024. As AT&T (T), T-Mobile US (TMUS), and Verizon Communications (VZ) accelerate 5G deployments, they will continue to supply the tower REITs with new supplies. Also, falling interest rates should ease refinancing risks and accelerate AFFO.

iREIT + HOYA

As I said, I’m more bullish on data centers and still hold a healthy stake in both Digital Realty and Iron Mountain (IRM). I also own America Tower (AMT) and a speculative stake in Crown Castle (CCI).

As you can see below, based on analyst consensus growth, data centers are mission-critical assets that should drive returns in 2025 and beyond. I’m maintaining an overweight allocation to Data Centers, and I’m equalweight on cell towers.

Consensus Growth (AFFO/Share) Estimates

iREIT + HOYA

Seeking Alpha: I see that you did not include Industrial REITs. Is there a reason?

Brad Thomas: I like (and own) industrial REITs and as I said earlier, I consider the sector part of the so-called “tech trifecta.” The reason I’m a bit more cautious going into 2025 is due to a leveling off in demand and uncertainty mainly because of potential tariff impacts.

That being said, I believe that demand will improve in 2025, and new leasing should pick up. I’m extremely bullish regarding President Trump’s “people and policies” and I view the prospect of corporate tax cuts and deregulation as jet fuel for the sector.

I suspect that onshoring/nearshoring will accelerate as Trump’s tariff policies will create more demand for space along trade routes near Mexico. In fact, I predict a manufacturing boom likely I’ve never seen in my lifetime.

And speaking of a boom in construction, I see The Department of Government Efficiency (‘DOGE’) as a catalyst that will unlock tremendous value across almost every property sector.

As I said, I was once a developer (for more than 20 years) and I know first-hand the inefficiencies related to zoning, permitting, and construction. I think Elon Musk and his team will speed up the timeline for new construction, which will make it much easier to open new projects and deliver a big boost to workers across all spectrums.

One of the first anticipated actions related to return-to-office (“RTO”) is five days a week for all civil servants. I see this being a huge boost for U.S. cities like D.C. This goes without saying, but I’m also bullish on certain Sunbelt office REITs like Highwoods Properties (HIW). I’m equalweight Industrial and Sunbelt Office.

iREIT + HOYA

Seeking Alpha: Are there any other property sectors you would like to discuss?

Brad Thomas: Yes, I like the apartment sector given the wide gap between the cost of homeownership vs. the cost of renting. The cost of homeownership has increased meaningfully over the last several years primarily because of rising mortgage rates. Also, insurance and tax costs have increased.

Being based in South Carolina and South Florida, I like the sunbelt markets and in Q3 2024 we saw the new deliveries have peaked, which is favorable for landlords like Mid-America Apartment Communities (MAA) and Camden Property Trust (CPT).

iREIT + HOYA

I’m not as bullish on the self-storage sector as fundamentals have slowed down. When and if the housing market picks up, I would be more interested in the sector. As demand picks up, so will my interest in the sector.

I’m equalweight Apartments and underweight self-storage.

Consensus Growth (AFFO/Share) Estimates

iREIT + HOYA

There are other niche sectors like cannabis, farming, timber, manufactured housing, hotels, and billboards. These can be exciting categories, but I prefer to maintain speculative exposure in these given their volatility.

Seeking Alpha: Brad, thank you for this overview. There’s tons of insight that you shared. Do you have any closing thoughts?

Brad Thomas:

For 2025 I’m recommending a barbell approach between quality and value. As I said earlier, I believe that sector performance is critical for designing the perfect REIT blueprint and I would overweight the following sectors:

- Net lease

- Shopping centers

- Healthcare

- Data centers

Then I would Equal Weight these sectors:

- Cell towers

- Industrial

- Sunbelt office

- Sunbelt apartments

Then Under Weight these categories:

- Self-storage

- Manufactured housing

I would also consider maintaining some exposure to preferred shares or perhaps a preferred-focused ETF like InfraCap REIT Preferred ETF (PFFR) which now yields 7.7%.

Given the opportunity set within the equity REIT sector, I would not recommend mortgage REITs unless you have the risk appetite for yield enhancement names like Ladder Capital (LADR) or Arbor Realty Trust (ABR).

Finally, given REIT valuations going into 2025 I believe REITs could deliver meaningful returns of 15% to 25%.

Needless to say, the biggest catalyst for REITs will be falling interest rates that will stimulate demand, especially the more rate-sensitive net lease sector. I recommend focusing on REITs with strong balance sheets.

For the large part, I expect President Trump’s policies to be very positive for REITs and I view the most sensitive sectors as those with the greatest exposure to tax cuts and deregulation, tariffs, labor-intensive workers and federal regulation.

I appreciate your allowing me to provide my 2025 forecast, and I wish all readers the very best.

Happy Holidays and Happy SWAN Investing!

IRET

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.